Tala Loan Review

Need quick cash without the hassle? Tala Loan Philippines offers a fast, convenient, and fully digital loan application process. Whether you’re facing an emergency expense or just need extra funds, Tala provides instant loan approvals with no credit check or collateral required. In this review, we’ll explore Tala’s key features, pros and cons, and why it’s becoming a popular choice for borrowers in the Philippines.

Instant Loan Options at Your Fingertips

| Binixo – Fast & Convenient Loan Matching Platform in the Philippines | Apply |

| Cash-Express – Online Fast Cash Loan Service | Apply |

| Kviku – Instant Online Loan with 0% Interest for New Clients | Apply |

| Finami – Fast & Easy Online Loans 24/7 | Apply |

| LoanOnline.ph – Compare Loans in Just 2 Minutes | Apply |

| Digido – Instant Online Loans up to ₱25,000 (0% Interest for First Loan) | Apply |

| Finloo – Find the Best Online Loan in Just 5 Minutes | Apply |

| CashSpace – Quick Online Loans in the Philippines (24/7) | Apply |

Pros and Cons of Tala Loan Philippines

Pros:

- All loan applications are done through the Tala Loan Philippines mobile app. This means fast approval and funding

- This instant loan can help users meet urgent money needs in minutes

- It doesn’t cost much to borrow money with competitive interest rates

- Without a credit check or collateral, borrowers can get up to PHP 25,000

Cons:

- Tala’s loan amounts may not be enough for some borrowers, especially those with bigger debts

- Easy access to money could cause people to rely too much on credit, causing financial problems and excessive costs in the long run

- People without smartphones or internet access won’t be able to use this online lending service, so its reach will be limited

Key Points

These days, a fast and reliable online lending service can make all the difference. One such service that has been making waves in the Philippines is Tala. This innovative platform has attracted much attention for its unique approach to online lending. And after delving into the key points of Tala Loan Philippines, it is clear that this service has much to offer.

| Features | Details |

| Interest rate | 15% – 15.7% |

| Loan Amount | Maximum PHP 25,000 |

| Loan Tenure | 15 – 61 days |

| Approval Time | Instant |

| Processing fee | Instant – 24 hours |

Full Review

Choosing the perfect online lending platform is so important for your financial well-being. Luckily, this comprehensive loan review of Tala Loan PH will explore its unique features, benefits, and eligibility requirements. This way, you’ll have a better idea if this one’s for you or not.

What is Tala?

The Tala Loan Philippines app is a modern mobile application that offers affordable and easy-to-get loan options to millions of people in the Philippines. The company used to be known as InVenture and is funded by Collaborative Fund, Lowercase Capital, IVP, and other leading investors.

It’s designed for anyone struggling to get a loan through traditional banking channels because of low credit scores or not owning any collateral. Through its user-friendly interface and advanced technology, the app applies advanced algorithms to analyze your reliability based on personal information rather than your credit score.

| Company Name | Tala Financing Philippines |

| Founder | Shivani Siroya |

| Official Launch | 2011 |

| License number | CS201710582 |

Loans Provided by Tala Loan

Tala Loan Philippines offers just one unsecured online loan option. This means you’re not required to provide proof of income, bank account, credit card, or collateral.

The loan amounts range from PHP 1,000 for first-time borrowers but goes up to PHP 25,000 for second and third loan. As long as you pay off your first one on time, your initial credit limit will increase.

This lender’s cash loan is ideal for people who lack supporting documents, as this lender asks for only one form of ID documentation.

Best Online Loans Similar to Tala

In our table, you’ll find a handpicked selection of top-tier online loan platforms in the Philippines, mirroring the services similar to those of Tala.

| Company | Loan Amount (PHP) | Interest Rate | Loan Term |

|---|---|---|---|

| Digido | 1,000 – 25,000 | From 0% to 11.9% | Up to 30 days |

| MoneyCat | 500 – 20,000 | Up to 11.9% per month | Up to 180 days |

| Kviku | 500 – 25,000 | 1.2% per month | Up to 180 days |

| Cashspace | 1000 – 25,000 | 1.3% per month | 2 – 4 months |

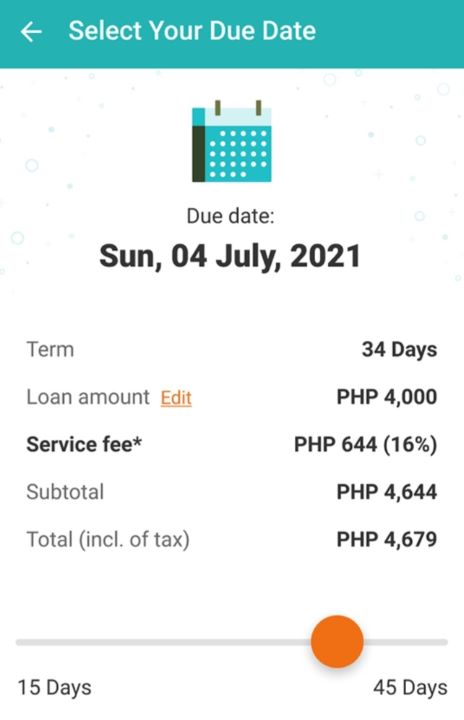

Interest Rate for Tala Loan

The interest rate for credit lines from this lender ranges from 15% to 15.7%. The amount you pay depends on how long you take out the online loan. For example, if you have an outstanding balance for 5 days, you’ll be charged interest only for those 5 days.

Compared to other lenders, their interest rates are a little higher for a loan of this type. But, because they aren’t very strict, they appeal to people who need urgent funding or have a limited credit history. However, borrowers should also consider other available products in the market to find the best interest rates and terms suitable for their needs

Tala Cash Loan Requirements

Before you apply for an online loan with Tala, you’ll need to make sure you satisfy the online loan requirements:

- You must be a citizen of the Philippines

- Aged 18 years or older. This is a non-negotiable requirement to make sure you’re of legal age

- You’ll also need to have a valid government-issued ID. This could be your passport, driver’s license, or any other identification card recognized by the government. The ID serves as proof of your identity and helps the company verify your personal information

- Another vital requirement is owning a compatible Android smartphone. Tala’s services are primarily delivered through their mobile app. So you’ll need to have a device that supports the app. A good internet connection will also be useful

Once you’ve met these basic requirements, you can begin with the registration process. It’s really simple.

- Just get the app from Google Play or Apple.

- During registration, you’ll need to provide your name, date of birth, address, and employment information.

- The lender will also ask to access certain data on your smartphone, which will help them evaluate your ability to repay the amount you borrow.

IDs accepted by Tala Loan

As long as you have at least one of these IDs, Tala will accept your cash loan application.

| ID Type | Name |

| Legal documents | SSS ID

Drivers license Voter’s (COMELEC) ID Card Passport Postal ID |

| Electronic Identification | National/ PhillD ID

Unified Multi-Purpose ID card |

How Can You Repay a Loan With Tala Loan?

A loan from Tala can be repaid in two ways. The first is in-store. And the second method is via their app. There are multiple methods with which you can pay through the app: via an e-wallet or through a digital bank.

The e-wallets compatible with Tala are:

- Lazada

- BPI Quickpay

- GCash

- Coins.ph

- Cebuana Lhuillier

- ShopeePay

- ECPay

- Maya

- 7-Eleven CLiQQ

- MLhuillier

In-store methods include:

- MLhuillier

- 7-Eleven CLiQQ Machine

- Cebuana Lhuillier

Repay with an e-wallet via the Tala loan app:

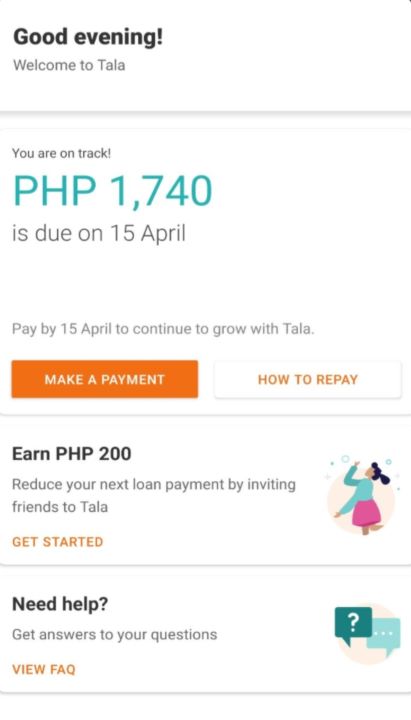

- Log into the app and select “Make a Payment”

- Enter how much you want to pay

- You will be offered a selection of payment methods to choose from

- From there, you will receive a text message containing either a payment link or a confirmation number

- If you select the method to repay through a banking app, you’ll receive a payment link

- If you wish to repay in-store, you’ll be given a reference number, which you’ll need to present to employee

- Make sure that you receive a confirmation text message from Tala once the loan payment has been processed

Exclusive Features of Tala Loan

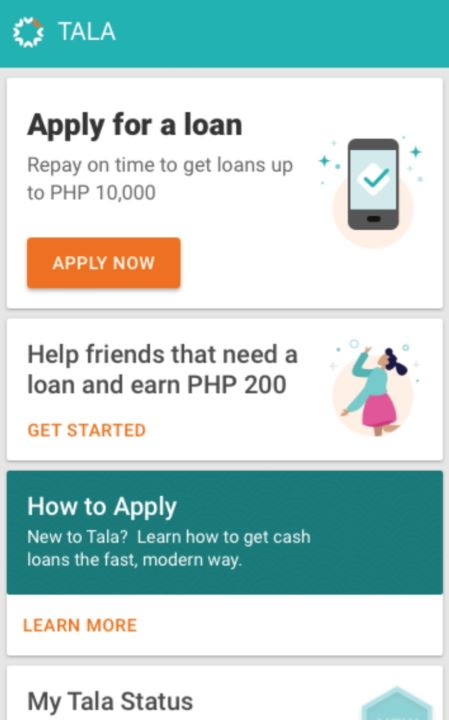

One of the exclusive features of Tala is its streamlined mobile app that makes loan applications simple. Applying for an online loan on your smartphone is as easy as tapping a few buttons on your phone. All of this without having to visit a physical branch or fill out tons of paperwork.

This accessibility means it’s more inclusive, especially for people who can’t qualify for a loan through conventional means.

Another standout feature is Tala’s flexibility when it comes to loan repayment. Essentially, you take out a cash loan and only pay for the days you borrow money. This really helps with making sure you can repay the money comfortably without being burdened by unrealistic repayment terms.

Tala Loan Customer Support

One of the most notable aspects of Tala’s customer support is its accessibility. With numerous communication channels available, clients can easily reach out to the team via their contact number for any questions. Whether through phone, email, or social media platforms, Tala’s customer support representatives are always ready to help and provide information about their services.

Tala Loan Mobile Аpp Review

Both Android and iOS versions of the Tala app are available, making it widely available in the Philippines. It’s easy to navigate, even if you’re not tech-savvy, thanks to its user-friendly interface and straightforward navigation.

The app’s design is clean and visually appealing, with a minimalist layout and intuitive icons. Another noteworthy aspect of Tala Loan PH is its top-notch security measures. To protect your personal information from potential threats, the app uses robust data encryption techniques.

How Does the Tala Loan App Work?

The Tala fast cash mobile app works by providing instant credit and personalized financial education to users in Kenya, the Philippines, and Mexico. To get started:

- Download the app, create an account, and then log in. You’ll need to provide personal information, including a valid ID and mobile number, as well as data from your smartphones. Tala uses this information to determine your creditworthiness using data science and mobile technology.

- Once approved, you can apply for a loan of up to PHP 25,000 without needing income proof or collateral.

- The loan application process takes only five minutes, and upon approval, you can choose how long you want to keep the loan.

- Your money will be transferred to whatever e-wallet you use, your bank account, or the nearest Padala center.

- You can repay your loan through various payment methods, such as GCash, 7-Eleven, and Cebuana Lhuillier.

With on-time loan repayments, you can potentially double your initial credit limit in just a few months.

How Do I Create a Tala Loan Account?

To create an account on the Tala fast cash mobile app, you’ll first need to download the app from your country’s app store. Once installed, open it and go through these steps:

- Provide your mobile number: Tala accepts Philippine resident citizens who are 18 years and older with a mobile number.

- Verify your mobile number: You’ll get an SMS verification code. Enter this code in the app to confirm your number.

- Complete the registration process: Fill in the information requirements, including your name, date of birth, and at least one valid ID.

- Grant the necessary permissions: Before you log in, the app might request access to your smartphone data to determine your creditworthiness.

Who Does Tala Loan Suit Better?

If you don’t have good credit and prefer a small and short-term loan, a loan from Tala may well be your best option. This includes entrepreneurs or small business owners, freelancers, and low-income earners.

Since the approval process is primarily based on your potential to repay the loan rather than your credit history, it opens up the chance to get financial assistance without the hassle of a bank loan request.

They’re also ideal if you need to pay urgent bills, do home repairs or fund a small business venture. With its user-friendly mobile app and fast loan funding, Tala will help you get peace of mind in a matter of minutes.

FAQ

-

Is Tala legal in the Philippines?

Tala is a fully licensed and regulated financial institution that operates under the guidelines set by the Securities and Exchange Commission (SEC). This means that Tala is legit with fair, transparent, and secure financial services.

-

Is it okay to pay in advance in Tala?

Tala lets its customers repay their loan early. In fact, early repayment can be an excellent strategy. If you pay in advance and on time, Tala will increase your initial credit limit.

-

How do I edit information on Tala?

To start, open the Tala PH app. Then find the profile menu in the top-left corner of the screen. From there, you can update your personal information, such as address or contact number, by tapping the respective fields. Don’t forget to save your changes before exiting.

-

How do you get approved for Tala?

Even people with no credit history can easily access a loan through Tala. All you need is a valid government ID and a smartphone to download their app. After providing your personal information and completing the quick online form, Tala PH’s advanced technology assesses your creditworthiness. Make sure to be honest and accurate when filling in your details, as this will increase your chances of approval.

-

What is the highest credit limit in Tala?

Tala has a very decent loan limit considering their relaxed approval process. The most they offer is PHP 25,000. Bear in mind that first-time borrowers are unlikely to receive this much for their first loan. Tala will likely increase the loan amount if you make your payments on time.

Tala Competitors

Read OKPeso Review

| Company | Loan Amount (PHP) | Interest Rate | Loan Term | Our Review |

|---|---|---|---|---|

| Digido | 1,000 – 25,000 | From 0% to 11.9% | Up to 30 days | Read Digido Review |

| MoneyCat | 500 – 20,000 | Up to 11.9% per month | Up to 180 days | Read MoneyCat Review |

| CashMart | 3,000 – 150,000 | From 0,8% to 3,5% | Up to 6 months for new loan | Read CashMart Review |

| EasyCash | 5,000 – 25,000 | 0,33%-1% | From 1 to 300 days | Read EasyCash Review |

| Crezu | 1,000 – 25,000 | From 1.5% per month to 30% per year | From 3 to 12 months | Read Crezu Review |

| CashMe | 2,000 – 20,000 | 0,08% per day | Up to 3 months | Read CashMe Review |

| Blend | 50000 – 2 million | From 1,5% to 3% monthly | Up to 36 months | Read Blend Review |

| Binixo | 2000 – 30000 | 1% per day | From 7 days to 30 days | Read Binixo Review |

| Asteria Lending Inc | 2000 – 50000 | 0.2% per day | From 30 days to 120 days | Read Asteria Review |

| Loanmoto | 1,000 – 12,000 | 4% – 6% per month | Read Loanmoto Review | |

| Finbro | 1,000 – 50,000 | 0.5% – 1.25% per day | Up to 12 months | Read Finbro Review |

| Kviku | 500 – 25,000 | 1.2% per month | Up to 180 days | Read Kviku Review |

| Binixo | 2000 – 30000 | 1% per day | From 7 days to 30 days | Read Binixo Review |

| PesoQ | 5,000 – 20,000 | 4% – 6% per month | 91 – 365 days | Read PesoQ Review |

| GCash | 5,000 – 25,000 | From 3% to 15% | From 15 to 90 days | Read GCash Review |

| CashBee | 2,000 – 20,000 | 0,3% daily | From 30 to 120 days | Read CashBee Review |

| Revi Credit Philippines | 1000 – 250,000 | 1% – 5% | From 6 to 36 months | Read Revi Credit Review |

| OKPeso | ||||

| Vamo | 1,000 – 30,000 | From 1,3% | From 10 to 3000 days | Read Vamo Review |

| Flexi Finance | Up to 25,000 | From 365 to 1460 days | Read Flexi Finance Review | |

| JuanHand | Up to 50,000 | 14.7% per month | From 14 to 90 days | Read JuanHand Review |

| Moca Moca | 2,000 – 35,000 | 0.83% per month | From 180 to 365 days | Read Moca Moca Review |

| RoboCash | 1,000 – 25,000 | From 0% to 11.9% | Up to 30 days | Read RoboCash Review |