Loan Apps For the Unemployed

The harsh reality of unemployment, especially for people looking for an easy loan in the Philippines, persists. Loss of steady income, which is a daunting reality for people who don’t have a regular job in the Philippines, leads to not only emotional distress but also financial constraints, making getting a loan for the unemployed more challenging.

Find a Loan & Take the Next Step

| Binixo – Fast & Convenient Loan Matching Platform in the Philippines | Apply |

| Cash-Express – Online Fast Cash Loan Service | Apply |

| Kviku – Instant Online Loan with 0% Interest for New Clients | Apply |

| Finami – Fast & Easy Online Loans 24/7 | Apply |

| LoanOnline.ph – Compare Loans in Just 2 Minutes | Apply |

| Digido – Instant Online Loans up to ₱25,000 (0% Interest for First Loan) | Apply |

| Finloo – Find the Best Online Loan in Just 5 Minutes | Apply |

| CashSpace – Quick Online Loans in the Philippines (24/7) | Apply |

Traditional financial systems often fail to support the unemployed, as most conventional loan options require proof of steady employment and income. This is where loan online specifically designed for the unemployed come into play, offering a glimmer of hope in tough times. These innovative loan solutions provide an alternative pathway to borrow money without the stringent requirements of traditional banking systems.

In this guide, we delve into the world of online loans for unemployed, exploring their nature, eligibility criteria, and the best available options. We aim to equip you with the knowledge and tools needed to navigate the landscape of these financial aids, helping you make informed decisions in your quest for financial stability amidst unemployment.

Top Loan Apps for the Unemployed in the Philippines

The Philippines has seen a surge in online loan platforms for unemployed people, catering to various financial needs. These online lending apps, offering the best loan for your needs, are not only accessible but also allow borrowers to get cash quickly. Below are some of the leading legit online loan for unemployed philippines.

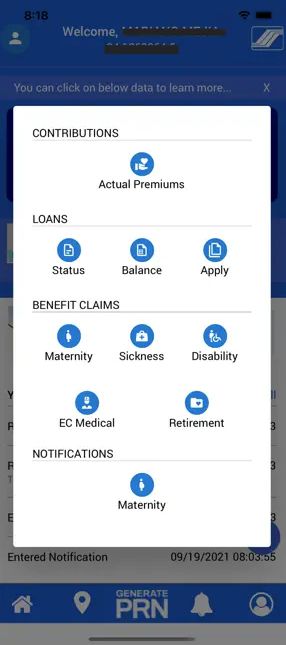

SSS Mobile App

The SSS Mobile App, developed by the Social Security System in the Philippines, offers a unique solution for unemployed people in the Philippines, particularly those who have been involuntarily separated from employment. This app is particularly significant for its role in providing access to unemployment benefits.

Key Features of the SSS Mobile App

The SSS Mobile App is not a typical loan app but rather a government-backed platform that provides financial assistance to qualified members who are currently unemployed. One standout feature of this app is its provision of an unemployment benefit, a key support mechanism for unemployed people trying to borrow money.

The benefit offered through the SSS Mobile App is essentially a cash benefit, equating to a certain percentage of the member’s average monthly salary credit. This benefit is designed as a one-time financial assistance to support the member during their period of unemployment.

Benefits of Using the SSS Mobile App

The most notable advantage of the SSS Mobile App is that it provides a safety net for unemployed individuals who are registered SSS members. This facility can be helpful during times of financial instability, offering an easy and quick loan for those who lost their jobs.

The app’s user-friendly interface allows for easy navigation and access to various services, including the application for unemployment benefits. Members can conveniently submit their applications and track the status of their claims through the app, reducing the need for physical visits to SSS offices.

Additionally, the app offers a range of other SSS-related services, making it a comprehensive tool for members to manage their contributions, loan applications, and other SSS benefits.

Finbro

Finbro is another notable instant loan for unemployed app in the Philippines. It offers a range of loan options that can be easily accessed through its user-friendly platform.

Key Features of Finbro

Finbro is recognized for its adaptable loan options for the unemployed individuals, providing them with financial assistance tailored to their specific needs. The app is designed for quick and straightforward loan applications, allowing users to access funds without the usual complexities associated with traditional lending institutions. Additionally, Finbro’s loan products come with flexible repayment terms, making it easier for borrowers to manage their financial obligations.

Benefits of Using Finbro

The primary benefit of using Finbro lies in its accessibility. People who are unemployed or have a poor credit history often find it challenging to get emergency loans for unemployed from conventional lenders. Finbro fills this gap by offering loans that require minimal documentation and no job verification. The quick disbursement of funds is a crucial feature, especially for those who need immediate financial assistance.

Cashspace

Cashspace is an online loan app that caters to the needs of the unemployed, offering financial solutions without stringent requirements for loans for unemployed. The app is designed to provide quick cash loans with a focus on accessibility and ease of use.

Key Features of Cashspace

Cashspace stands out for its rapid loan processing and disbursement, making it a viable option for urgent financial needs. The app’s user-friendly interface allows for a smooth application process, enabling users to apply for quick online loans with minimal hassle. Additionally, Cashspace offers a range of loan amounts, providing flexibility to borrowers to choose an amount that suits their immediate needs.

Benefits of Using Cashspace

One of the main advantages of Cashspace is its accessibility to individuals with bad credit or those who are unemployed. The app’s relaxed eligibility criteria make it a practical choice for those who might not qualify for traditional bank loans. Moreover, the quick approval process ensures that borrowers can access funds in a timely manner, which is crucial during emergencies. However, users should be mindful of the potentially higher interest rates compared to conventional lending sources.

Finami

Finami stands out as a reliable app for individuals who are unemployed in the Philippines. It focuses on offering accessible loan solutions to those who might not have a steady job but are in urgent need of financial assistance.

Key Features of Finami

Finami is particularly appreciated for its approachability and user-friendly interface, making the loan application process straightforward and accessible. The app offers a variety of options, catering to different financial needs of the unemployed. One of the significant advantages of Finami is its flexibility in terms of loan amounts and repayment terms, allowing users to tailor their borrowing according to their current financial situation.

Benefits of Using Finami

The main benefit of using Finami is its accessibility to a broader range of individuals, especially those who are unemployed and may not have access to traditional banking services. The app provides a practical solution for immediate financial needs, such as emergency expenses or urgent bills. The process of applying for a loan through Finami is designed to be quick and hassle-free, which is particularly beneficial for those who need funds urgently.

Creditify

Creditify emerges as a notable app for individuals in the Philippines who are unemployed and seeking convenient loan options without rigorous income verification processes.

Key Features of Creditify

Creditify is designed to cater to those who may not have traditional employment but still require financial assistance. The app offers personal loans that do not necessitate salary slips or bank statements, making it an accessible option for a wider audience, including those without formal employment. This feature is particularly useful for individuals who need a loan but lack the typical documentation required by more traditional lenders.

Benefits of Using Creditify

One of the primary advantages of using Creditify is the straightforward and fast loan application process. The app allows for quick decision-making, often providing loan approvals rapidly, which is essential for those in urgent need of funds. The flexibility in loan amounts and repayment terms makes Creditify a practical option for various borrowing needs.

Creditify’s platform operates around the clock, offering users the convenience and flexibility of applying for loans with no job anytime and anywhere. This accessibility is a significant benefit for those who may not have easy access to physical banking locations or standard office hours.

However, users should be aware of the potential for higher annual percentage rates (APRs) and additional fees associated with the loan. These aspects can make the loans more expensive over time. Despite these considerations, Creditify’s provision of loans without stringent income verification makes it an important option for unemployed individuals in the Philippines seeking financial solutions.

Understanding Loans for the Unemployed

Easy loans for the unemployed in the Philippines cater to individuals who find themselves without a job but in urgent need of financial support. These loans are structured to provide a safety net for those who, due to various circumstances, are currently not part of the workforce. Understanding these loans is crucial for anyone considering them as a financial solution.

| Target Audience | These loans are specifically designed for individuals who are currently without employment. This includes those who have been laid off, are in between jobs, or are unable to work due to various reasons. |

| Type of Loans | Typically, these loans come in the form of unsecured personal loans, microloans, or emergency loans. They are often short-term with relatively small loan amounts, intended to cover immediate financial needs. |

| Flexible Eligibility Criteria | Unlike traditional loans, these loans usually have more relaxed eligibility criteria. Employment history and a steady income stream, which are standard requirements for most loans, are not mandatory for these loan types. |

Key Features

- Being unsecured loans, they do not require collateral, making them accessible to a broader audience who may not have assets to pledge.

- Due to the higher risk associated with lending to individuals without a steady income, these loans often come with higher interest rates compared to traditional personal loans.

- Quick processing times and rapid disbursement are common features, as these loans are often sought in emergencies.

- Lenders usually offer flexible repayment terms, acknowledging the unique financial situations of the borrowers.

Risks and Considerations

- The ease of access and higher interest rates can lead to a cycle of debt if not managed properly.

- Failure to repay on time can adversely affect the borrower’s credit score, affecting future loan eligibility.

- Some lenders may engage in unfair lending practices, taking advantage of the borrower’s vulnerable situation.

Understanding these aspects is essential for anyone considering a loan. It’s not just about securing immediate funds; it’s about making an informed decision that won’t jeopardize financial stability in the long run.

Eligibility and Requirements for Loan Apps Targeting the Unemployed

When it comes to apps specifically designed for the unemployed in the Philippines, there are several common eligibility criteria that applicants usually need to meet. These criteria are crucial for lenders to assess the potential risk and the applicant’s ability to repay the loan.

| Age Requirement | Most apps require applicants to be of legal age, typically at least 18 years old. This ensures that the applicant is legally capable of entering into a binding financial loan agreement. |

| Residency | Applicants usually need to be residents of the Philippines. Proof of residency is often required to ensure the applicant is within the jurisdiction of the lender for legal and collection purposes. |

| Valid Identification | A valid government-issued ID is a standard requirement. This could include IDs such as a driver’s license, passport, or a Unified Multi-Purpose ID (UMID). This helps verify the identity of the borrower. |

| Contact Information | Lenders typically require a working mobile phone number and an email address. These are used for communication regarding the loan application, approval, disbursement, and repayment. |

| Bank Account or E-Wallet | While some lenders do not require a bank account, having one can be advantageous. For lenders that don’t require a bank account, an e-wallet account may be necessary for the disbursement and repayment of the loan. |

| Proof of Alternative Income | While traditional income proof like payslips may not be applicable, some lenders may require proof of alternative income sources. This could include evidence of remittances, pension, freelance work, or any regular income that demonstrates the ability to repay the loan. |

| No Adverse Credit History | Some lenders might check if the applicant is not listed in any credit bureaus for defaults. A clean credit history, even without a formal job, can be beneficial. |

Advantages and Disadvantages

Online loan applications have become a crucial support system for diverse segments of the population, particularly those facing job loss in the Philippines. These cutting-edge platforms offer the convenience of accessing easy cash loans without the need for conventional employment verification, serving as a vital financial lifeline during challenging times.

However, like any financial tool, it is crucial to carefully consider the merits and drawbacks before availing oneself of these services. This thoughtful approach ensures that individuals can make well-informed decisions that align with their financial well-being and future aspirations.

In the following sections, we will delve into the various pros and cons associated with utilizing lending apps for the unemployed, exploring factors such as accessibility, interest rates, privacy considerations, and the overall impact on one’s financial trajectory.

| Advantages | Disadvantages |

|---|---|

| Accessibility | Higher Interest Rates |

| Fast Approval Process | Privacy Concerns |

| Minimal Documentation | Short Repayment Terms |

| Flexible Eligibility Criteria | Risk of Debt Trap |

| Direct Disbursement and Repayment | Limited Loan Amounts |

| Small Loan Amounts | Impact on Credit Score |

| Potential for Hidden Fees | |

| Regulatory Concerns |

Pros of Using Loan Apps for the Unemployed

- One of the biggest advantages is their accessibility. These apps can be easily downloaded and used on smartphones, making them available to a wider audience, including those who might not have easy access to traditional banking services.

- Many apps offer rapid processing and approval of loan applications. This is particularly beneficial for those in urgent need of funds. In some cases, approval can be granted within minutes or hours.

- Unlike traditional bank loans, loan apps often require fewer documents. This streamlined process is especially helpful for those who may need to have standard proof of income.

- Lenders tend to have more relaxed eligibility criteria than traditional loans, making them more accessible to people with varied financial backgrounds, including those who are unemployed.

- Funds are usually disbursed directly to the borrower’s bank account or e-wallet, and repayments can also be made through these digital platforms, offering convenience.

- These apps often offer smaller loan amounts, which can be advantageous for covering short-term needs or emergencies without the burden of a large debt.

Cons and Risks Involved in Using Loan Apps for the Unemployed

- These apps often charge higher interest rates than traditional bank loans to offset the risk of lending to individuals without a stable income. This can make the loan more expensive over time.

- Applying for urgent cash loans for unemployed through apps involves sharing personal and financial information digitally, which raises concerns about data privacy and security. It’s crucial to use apps with robust security measures to protect user data.

- Many apps offer easy loan for unemployed with short repayment loan terms. This can result in higher monthly payments, which might be challenging for someone without a regular income.

- Due to the ease of access and fast approval, there’s a risk of falling into a debt trap, especially if borrowers rely on these loans for prolonged financial support or need to manage repayments effectively.

- The loan amounts offered are typically lower than those available through traditional banks in the Philippines, which may need to be increased for significant financial needs.

- Failure to pay your loan on time can adversely affect the borrower’s credit score. Some apps report repayment behavior to credit bureaus, and a bad credit score can hinder the ability to secure loans in the future.

- Some apps may include hidden fees such as processing fees, late payment fees, or prepayment penalties, which can increase the overall cost of borrowing.

- The regulatory framework for digital lending is still evolving. Depending on the lender’s adherence to financial regulations, this can mean varying degrees of protection for borrowers.

FAQs on Loans for the Unemployed

Can I Get a Loan If I’m Unemployed?

Yes, you can get a loan even if you’re unemployed, but the options may be limited. Online lending platforms and government benefits like the SSS in the Philippines are viable options.

What Kind of Loans Are Available for the Unemployed?

Unemployed individuals can access personal loans for unemployed, payday loans, and microloans from online lenders, as well as specific government benefits like the SSS unemployment insurance in the Philippines.

Do I Need a Bank Account for Loan with No Job?

Getting a salary or allottee loan while unemployed with no bank account Philippines is possible. Online loan offers provide benefits, enabling you to get money without a traditional bank account. Finding the best loan for the unemployed can be difficult, but these apps are a great solution for approving a loan without a bank account in the Philippines.

Are Loans for the Unemployed Safe?

Cash loans for the unemployed from reputable sources are generally safe, but always verify the lender’s legitimacy and read the terms carefully.

How Fast Can I Get a Loan If I’m Unemployed?

Online loans for the unemployed Philippines can be processed and disbursed within a day, depending on the lender.

What Are the Interest Rates for Unemployment Loans?

Interest rates for unemployment loans are usually higher than traditional loans due to the increased risk, typically ranging from 15% to 36%.

Do I Need Collateral for an Unemployment Loan?

Most loans for unemployed people are unsecured and don’t require collateral, except for pawnshop loans.

Can I Apply for a Loan If I Have a Bad Credit History?

Yes, some online lenders offer loans to those with bad credit, but terms might be less favorable. Numerous lenders grant you a loan, considering your situation. Explore the benefits of online applications, and some offer salary loans or extra cash.

What Is the Maximum Amount I Can Borrow?

The maximum loan amount varies by lender, but online loans for the unemployed typically range from PHP 1,000 to PHP 50,000.

Are There Government Programs for Unemployed Loans in the Philippines?

Yes, the Social Security System (SSS) loan program in the Philippines offers a specific unemployment benefit.

What Documents Do I Need to Apply for an Unemployment Loan?

You’ll usually need a valid ID, proof of residence, and possibly proof of alternative income sources.

How Do I Repay an Unemployment Loan?

Repayment can be done through direct debit, online payments, or at designated centers, depending on the lender.

Can Unemployment Loans Affect My Credit Score?

Yes, like any loan, timely or missed payments on unemployment loans can impact your credit score.

What Are the Risks of Taking a Loan While Unemployed?

Risks include higher interest rates and the possibility of falling into debt if you’re unable to pay back the loan.

Where Can I Apply for Unemployment Loans in the Philippines?

You can apply online through various lending platforms or visit pawnshops. The SSS also provides a specific loan for the unemployed.