Digido Review

Digido is a reputable Philippine online lending platform. It provides an easy-to-use interface with adjustable credit limits. There are also individualized loan amounts and practical repayment choices. The customer care staff is responsive. The app offers quick loan approvals and disbursals. In general, Digido is a trustworthy choice for borrowers looking for a speedy and practical online loan.

Pros and Cons of Digido

Pros:

- Convenience – Digido Philippines provides a convenient online platform for a loan application. It eliminates the need for physical visits to financial institutions.

- Accessibility – It offers online lending services in the Philippines, making it accessible to a wider range of individuals.

- Fast Approval – The loan application process is generally faster compared to traditional lending institutions.

Cons:

- High Interest Rate – Like other online lending platforms, they may charge a higher interest rate.

- Potential Debt Cycle – If borrowers do not manage their loan responsibly, they may fall into a debt cycle.

- Limited Payment Options – Digido’s payment options could be restricted.

Key Points

| Features | Details |

| Interest Rate | Anywhere from 0% to 11.9% |

| Loan Amount | PHP 1,000 – PHP 50,000 |

| Loan Tenure | Loan range from 3 to 12 months |

| Approval Time | Within 24 hours |

| Processing Fee | Absent |

Full Review

Digido Online is a legit lending platform offering a cash loan in the Philippines. Obtaining a loan is hassle-free, requiring minimal documents and proof of your credit history. They prioritize quick loan approvals and ensure transparent terms.

The platform encourages borrowers to finish loan repayment on time to avoid added costs. Digido PH provides a convenient and trustworthy solution. Especially for individuals seeking reliable and efficient cash loan services in the Philippines.

What is Digido?

Digido is a leading financial company in the Philippines, ideal for an online loan. It provides individuals with a convenient and accessible platform to apply for a loan. There is no need for physical visits to banks. Through Digido’s online portal, borrowers can easily access loan services from the comfort of their own homes.

A great feature of Digido is the concept of a credit limit. Borrowers are assigned an initial credit limit. This is based on their financial profile and creditworthiness. This limit determines the maximum amount that a borrower can apply for. Digido Philippines also offers flexible payment options. It allows borrowers to make convenient payments according to their capabilities.

The interest rate by Digido can vary based on factors such as the amount and repayment period. Borrowers should carefully review the rate associated with their specific offer before proceeding with the loan request.

| Company Name | Digido Finance Corp. |

| Founder | Andri Kristinsson |

| Official Launch | 2014 |

| License number | 202003056 |

Loan Types Provided by Digido

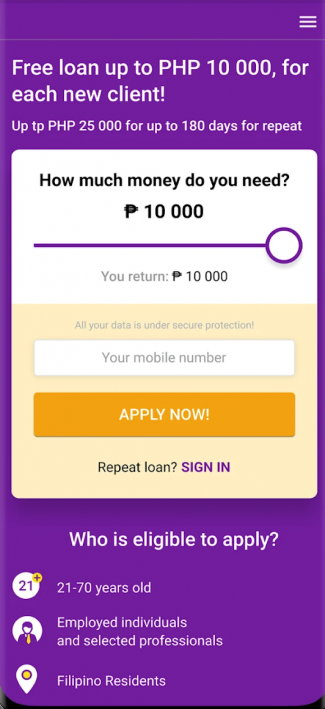

Digido, operating in the Philippines, has many online loan types to meet the diverse needs of borrowers. Each type is designed to provide access to funds without leaving your home. Here are some of the possibilities:

- Personal Loan – Digido PH provides a personal loan, allowing borrowers to get funds for different purposes. For example, emergencies, debt consolidation, or personal expenses. The amount available is based on the borrower’s eligibility and initial credit limit.

- Salary Loan – Borrowers can apply for a salary loan, which enables them to borrow money based on their monthly income. This loan is particularly suitable for individuals facing temporary cash flow challenges.

- Emergency Loan – You can get an emergency loan for unforeseen difficulties. This loan provides quick access to funds to address urgent expenses. For example, medical bills or car repairs.

Interest Rate for Digido

The interest rate for a loan at Digido Philippines varies based on several factors. This includes the borrower’s creditworthiness and repayment tenure. They determine the rate during the loan review process, taking into consideration these factors to assess the risk associated with lending.

To access the specific rate applicable to their loan, borrowers need to log in to their Digido account and review the loan offer provided. The interest rate will be clearly indicated in the loan terms and conditions. Generally, this can vary from 0% at the beginning up to 11.9%.

Maintaining a good credit history and making timely payments can positively impact the rate. Borrowers with a strong credit profile may be eligible for more favorable rates. Those with lower credit scores may face higher rates.

Digido Cash Loan Requirements

Digido Philippines has certain loan requirements for individuals looking to borrow money through their cash loan services. The specific requirements may include:

- Age – Borrowers must be of legal age, typically 21 years old and above, to apply for a loan.

- Proof of Identification – A valid identification document, like a Philippine National ID (PhilSys ID), passport, or driver’s license. There are other acceptable IDs required for verification as well.

- Proof of Income – Borrowers will be asked to provide evidence of income, such as payslips, bank statements, or employment certificates, to demonstrate their ability to repay the loan.

- Residence Verification – Documents to confirm the borrower’s current address, such as bills or other official correspondence, may be needed.

- Employment or Business Details – Providing information about employment, such as employer details, job position, or business details, are necessary.

ID`s accepted by Digido

| ID Type | Name |

| National ID | PhilSys ID |

| UMID Card | Unified Multi-Purpose ID (UMID) |

How Can You Repay a Loan in Digido?

Digido Philippines offers various methods for borrowers to repay their loan. These methods provide flexibility and convenience for borrowers. Some of the available options include:

- Online Financing – Borrowers can pay back the loan through online banking platforms by linking their Digido account to their bank account. This allows for easy and secure transfers.

- Debit Card – it accepts debit card payments, enabling borrowers to make loan repayments directly using their debit card details.

- Over-the-Counter Payments – Borrowers can also make payments through authorized centers or OTC channels. These centers may include selected banks, remittance centers, or other designated facilities.

- Mobile Apps – it may offer integration with popular mobile apps. This allows borrowers to make repayments through their mobile devices.

To ensure a smooth repayment process, borrowers should review the specific methods available and any requirements by Digido. This could include providing an accurate contact number or email address.

Exclusive Features of Digido

Digido stands out among online lending platforms with its unique and distinctive features. These exclusive offerings enhance the borrower’s journey, providing unparalleled convenience and adaptability. Here are some of the characteristics that set Digido apart:

- Dynamic Credit Boundary – Digido presents borrowers with a flexible and adjustable credit threshold. This means that borrowers can initiate with a limit. They have the opportunity to pay it back gradually by showing responsible repayment behavior.

- Personalized Loan Amount – Borrowers have the liberty to customize their desired loan size within the provided range by Digido. This grants borrowers the freedom to select a loan sum that precisely matches their specific financial requirements.

- Expedited Approval and Disbursement – Digido places significant emphasis on swift approval and disbursal of a loan. Borrowers can anticipate fast request processing. Upon approval, they can receive the funds within a remarkably short timeframe. Often within 24 hours.

- User-Friendly Digital Platform – it boasts a user-friendly digital interface. The intuitive platform empowers borrowers to effortlessly apply for a loan, monitor their loan status, and make payments online.

Digido Customer Support

For the benefit of borrowers, Digido offers dependable customer service to address their questions and problems. Concerns about loan applications and other credit-related issues are all handled by the customer service team. Digido’s customer service is available to borrowers by phone (02) 8876-84-84 from 8 AM to 5 PM daily or through their online form. They offer timely and helpful assistance for managing your credit.

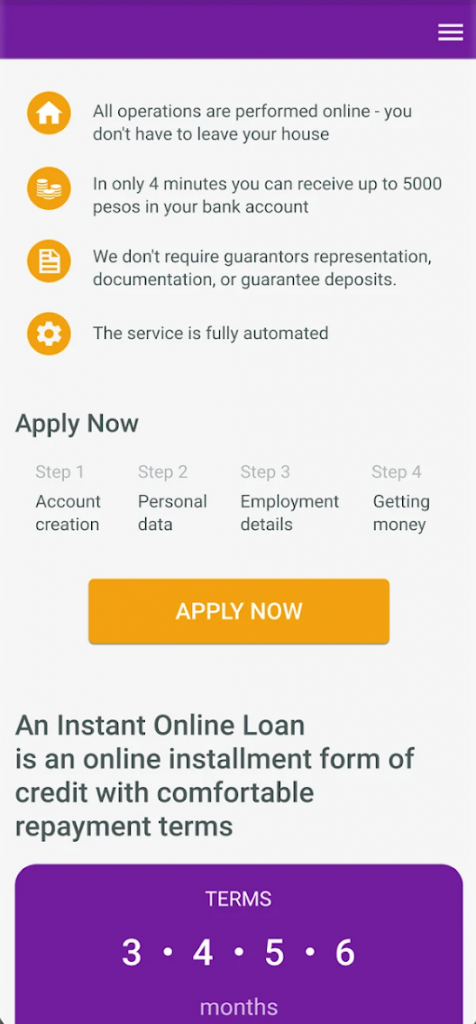

Digido Mobile Аpp Review

Borrowers looking for a loan can utilize the user-friendly and seamless Digido smartphone app. It is now simpler than ever to apply for and manage a loan while on the move, thanks to the app’s handy access to a variety of lending services.

Borrowers may conveniently complete the request procedure using the Digido mobile app. The app’s user-friendly layout leads users through the necessary steps to swiftly complete their requests. With only a few taps, borrowers may enter their personal and other details, upload the necessary papers, and submit their requests.

The app lets borrowers follow the progress of their request and receive notifications when it has been approved and disbursed. Once their request has been accepted, borrowers can easily monitor their repayment through the app. They may trace their history and view their payback schedule.

How Does the Digido App Work?

Digido mobile app provides a streamlined and user-centric experience for borrowers, simplifying the procedure of loan requests and management. Here is an overview of how its app operates:

- Download and Installation – Borrowers can acquire the Digido app from their respective app stores and install it on their smartphones or tablets. The app can be used on both Android and iOS devices.

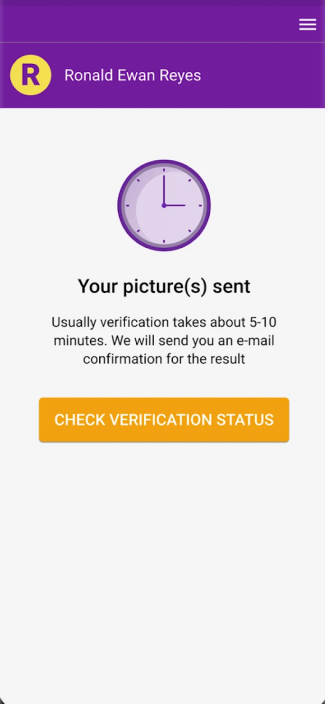

- Registration – Upon launching the app, borrowers can complete the registration process. Then, they can establish their Digido account. They will be prompted to provide essential information, such as personal details, contact particulars, and other documents for verification.

- Loan Request – Once the account setup is finalized, borrowers can proceed to submit their applications via the app. They will be guided through a structured request process, where they can input pertinent details like the desired loan, preferred repayment duration, and the purpose of the loan.

- Document Upload – The Digido app offers the convenience of directly uploading necessary documents from borrowers’ mobile devices. These documents typically include identification proofs, income verification documents, and proof of residence.

- Loan Approval – Following the submission of the request, borrowers can conveniently track the progress of their request within the app.

How do I Create a Digido Account?

Creating a Digido account is a simple and easy process. Follow these steps to set up your account:

- Download the Digido app – Visit your app store (iOS or Android) and search for “Digido.” Download and install the app on your mobile device.

- Launch the app – Open the Digido app by tapping on its icon on your device’s home screen.

- Registration – On the app’s main screen, you will find the option to register for a new account. Tap on the “Register” or “Sign Up” button.

- Provide necessary details – Enter the required information, such as your full name, email address, mobile number, and create a strong password. Review and accept the terms and conditions.

- Verification – Follow the verification process, which may include confirming your email or mobile number through a verification code sent to you.

- Personal Information – Fill in your personal details, including your date of birth, address, and any other required information as prompted.

Whom Digido Suits Better?

Digido is well-suited for individuals who require quick and convenient access to an online loan. It caters to a wide range of borrowers, including students, small business owners, and individuals needing immediate financial assistance. Digido’s user-friendly platform and flexible loan options make it accessible and beneficial for various financial needs.

FAQ

-

Is Digido legal in the Philippines?

Yes, Digido is a legal online lending platform. Digido Philippines is SEC-registered as well as certified.

-

Is it okay to pay in advance in Digido?

Yes, it is allowed to make advance payments on your loan with Digido. It can help reduce the outstanding balance and potentially save on interest charges.

-

How do I edit information on Digido?

To edit your information on Digido, you need to log in to your account and locate ‘Settings.’ There, you should find options to update and modify your personal details.

-

How do you get approved for Digido?

To get approved for a loan, you must complete the requesting process accurately and provide the necessary supporting documents, such as proof of income and employment, etc.

-

What is the highest credit limit in Digido?

The highest credit limit may vary depending on individual circumstances, including creditworthiness, income, and repayment history. It can be anywhere from 1.000 PHP to 25.000 PHP.

Digido Competitors

Read OKPeso Review

| Company | Loan Amount (PHP) | Interest Rate | Loan Term | Our Review |

|---|---|---|---|---|

| MoneyCat | 500 – 20,000 | Up to 11.9% per month | Up to 180 days | Read MoneyCat Review |

| CashMart | 3,000 – 150,000 | From 0,8% to 3,5% | Up to 6 months for new loan | Read CashMart Review |

| EasyCash | 5,000 – 25,000 | 0,33%-1% | From 1 to 300 days | Read EasyCash Review |

| Crezu | 1,000 – 25,000 | From 1.5% per month to 30% per year | From 3 to 12 months | Read Crezu Review |

| CashMe | 2,000 – 20,000 | 0,08% per day | Up to 3 months | Read CashMe Review |

| Blend | 50000 – 2 million | From 1,5% to 3% monthly | Up to 36 months | Read Blend Review |

| Binixo | 2000 – 30000 | 1% per day | From 7 days to 30 days | Read Binixo Review |

| Asteria Lending Inc | 2000 – 50000 | 0.2% per day | From 30 days to 120 days | Read Asteria Review |

| Loanmoto | 1,000 – 12,000 | 4% – 6% per month | Read Loanmoto Review | |

| Finbro | 1,000 – 50,000 | 0.5% – 1.25% per day | Up to 12 months | Read Finbro Review |

| Kviku | 500 – 25,000 | 1.2% per month | Up to 180 days | Read Kviku Review |

| Binixo | 2000 – 30000 | 1% per day | From 7 days to 30 days | Read Binixo Review |

| PesoQ | 5,000 – 20,000 | 4% – 6% per month | 91 – 365 days | Read PesoQ Review |

| GCash | 5,000 – 25,000 | From 3% to 15% | From 15 to 90 days | Read GCash Review |

| CashBee | 2,000 – 20,000 | 0,3% daily | From 30 to 120 days | Read CashBee Review |

| Revi Credit Philippines | 1000 – 250,000 | 1% – 5% | From 6 to 36 months | Read Revi Credit Review |

| Tala | 1,000 – 25,000 | 15% – 15.7% | From 15 to 61 days | Read Tala Review |

| OKPeso | ||||

| Vamo | 1,000 – 30,000 | From 1,3% | From 10 to 3000 days | Read Vamo Review |

| Flexi Finance | Up to 25,000 | From 365 to 1460 days | Read Flexi Finance Review | |

| JuanHand | Up to 50,000 | 14.7% per month | From 14 to 90 days | Read JuanHand Review |

| Moca Moca | 2,000 – 35,000 | 0.83% per month | From 180 to 365 days | Read Moca Moca Review |

| RoboCash | 1,000 – 25,000 | From 0% to 11.9% | Up to 30 days | Read RoboCash Review |