Cashme App Review

Cashme emerges as a groundbreaking solution in the personal finance sector. This review will explore the various facets of Cashme, from its loan offerings and application process to user experiences and security measures. By providing a comprehensive analysis of Cashme’s services, we aim to equip readers with valuable insights that can aid in making informed financial decisions in today’s fast-paced world.

What is Cashme?

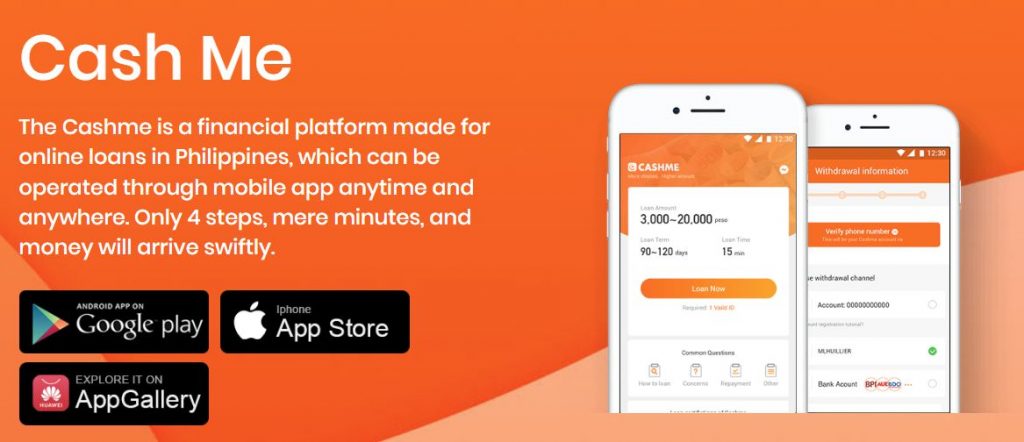

Cashme is a financial technology company that understands the urgency of financial needs. With a commitment to accessibility and convenience, Cashme connects those requiring swift financial assistance with a straightforward and efficient lending platform.

Unlike traditional lenders, Cashme has embraced technology to streamline the lending process, making it a go-to choice for individuals navigating unexpected expenses or financial challenges.

Whether it’s dealing with sudden medical expenses, unexpected home repairs, or bridging the gap until the next paycheck, Cashme positions itself as a reliable and accessible financial partner, offering solutions tailored to the modern borrower’s needs.

In the next sections, we’ll delve deeper into the legality of Cashme, explore key features, and provide insights into the interest rate calculation and benefits of choosing Cashme for your financial needs.

Is Cashme Legal?

Cashme proudly operates within the legal framework of the Philippines, providing financial services that are fully compliant with government regulations and the Securities and Exchange Commission (SEC). In a country with stringent requirements for financial institutions, Cashme has secured the necessary approvals and certifications, establishing itself as a legitimate and authorized lending platform.

Cashme has earned a spot in the List of Registered Online Lending Companies, a testament to its adherence to Philippine regulations and completion of government inspections. This listing underscores Cashme’s commitment to transparency, legality, and the provision of reliable financial services.

For borrowers, the legal standing of a lending platform is crucial for ensuring consumer protection. Cashme’s compliance with legal requirements establishes its legitimacy and provides borrowers with the assurance that their financial transactions are secure and protected by the relevant laws and regulations.

Key Features

| Feature | Details |

| Company Name | Hupan Lending Technology Inc. |

| Registration Number | CS201901197 |

| Regulatory Compliance | Fully compliant with government and SEC regulations |

| Loan Parameters | From PHP 2,000 to PHP 20,000 |

| Maximum Amount | PHP 20,000 |

| Terms | 91 to 120 days |

| Interest Rate | Fixed at 0.08% per day |

| Approval Time | Within minutes |

| Mobile App Availability | Accessible on Android phones & iPhones |

| Interest Rate Variability | Fixed interest rate throughout the loan duration |

| Security Features | Stringent measures to ensure the safety of personal information |

Example Of Interest Rate Calculation

Understanding how interest rates are calculated is crucial for borrowers to make informed financial decisions. Cashme employs a transparent and straightforward method to determine the interest on loans, providing borrowers with clarity on the cost of borrowing.

- Loan Amount: PHP 10,000

- Term: 20 days

- Interest Rate: 0.08% per day

Calculation:

Interest Amount:

- Daily Interest Rate = 0.08% (0.0008 in decimal)

- Interest Amount = Loan Amount × Daily Interest Rate × Number of Days

- Interest Amount = PHP 10,000 × 0.0008 × 20 = PHP 160

Fee:

- Fee Percentage = 0.08 (8% in decimal)

- Fee = Loan Amount × Fee Percentage

- Fee = PHP 10,000 × 0.08 = PHP 800

Total Repayment:

- Total Repayment = Loan Amount + Interest Amount + Fee

- Total Repayment = PHP 10,000 + PHP 160 + PHP 800 = PHP 10,960

In this example, for a loan amount of PHP 10,000 with a term of 20 days and an interest rate of 0.08% per day, the total repayment would be PHP 10,960. It’s important to note that this example illustrates the total amount to be repaid, including the principal loan amount, interest, and fees.

Benefits and Drawbacks of Cashme Loans

Cashme loans come with a set of advantages that make them a popular choice for individuals seeking quick and accessible financial solutions. However, like any financial product, it’s essential to weigh both the benefits and drawbacks before deciding to borrow.

Benefits

- Cashme excels in providing rapid access to funds, with loan approvals within minutes. This is particularly beneficial for individuals facing urgent financial needs.

- Cashme’s streamlined process requires minimal documentation, eliminating the cumbersome paperwork associated with traditional lenders. This simplifies the application process and accelerates approvals.

- Borrowers have the flexibility to choose loan amounts ranging from PHP 2,000 to PHP 20,000, with terms spanning from 91 to 120 days. This adaptability caters to a variety of financial needs.

- Cashme maintains a fixed interest rate of 0.08% per day, providing borrowers with transparency and predictability in their repayment calculations. There are no hidden fees, ensuring a clear understanding of the total repayment amount.

- Cashme’s mobile app availability on both Android and iOS platforms enhances accessibility, allowing borrowers to manage their loans and track transactions conveniently on the go.

- Cashme’s eligibility criteria are inclusive, making loans accessible to a wide range of individuals, including formally employed individuals, pensioners, and students.

Cons

- The convenience of quick loans comes with a trade-off, as the interest rates may be higher compared to traditional lending institutions. Borrowers should carefully assess their ability to repay within the stipulated time.

- The relatively short repayment period of 91 to 120 days may pose challenges for some borrowers. It’s crucial to assess whether the repayment timeline aligns with individual financial capabilities.

- While Cashme offers flexibility in loan amounts, the maximum cap of PHP 20,000 may be limiting for individuals with larger financial requirements.

- Cashme operates exclusively online, which might be a limitation for individuals who prefer or are accustomed to in-person interactions with lenders.

Cashme Requirements

Meeting these requirements is crucial for a successful loan application with Cashme. Borrowers should ensure that all documentation is accurate and up-to-date to facilitate a smooth and quick approval process.

Cashme’s commitment to transparency and security is reflected in its requirement criteria, providing borrowers with a reliable and accessible avenue for financial assistance.

| Requirement | Details |

| Identification Document | Any government-approved ID is accepted. This ensures that the borrower’s identity is verified and aligns with legal standards. |

| Contact Information | Valid phone number and email address for communication purposes. Cashme relies on these channels to update borrowers on the status of their applications and other relevant information. |

| Age | Applicants must be 18 years old or older to qualify for a Cashme loan. This age requirement ensures that borrowers are legally eligible for financial transactions. |

| Proof of Income | Documentation demonstrating a stable source of income. This could include pay stubs, bank statements, or other forms of proof to assess the borrower’s ability to repay the loan. |

| Philippine Credit Card | A credit card issued by a Philippine financial institution.This card serves as a means of transaction and is linked to the borrower’s Cashme account. |

| Residence Address | Verification of your current residence address. This ensures that the lender has accurate information for communication and legal purposes. |

How Do You Get Approved for Cashme?

Getting approved for a Cashme loan is a straightforward process designed for ease and efficiency. Here’s a step-by-step guide to help you navigate through the application and approval process:

Step 1: Download the Cashme Mobile App

- Access the Google Play Store or Apple App Store on your Android or iOS device.

- Search for “Cashme” and download the official mobile app.

- Install the app on your device.

Step 2: Create Your Account

- Open the Cashme app on your device.

- Click on the “Sign Up” or “Create Account” option.

- Provide the required information, including your phone number and email address.

Step 3: Choose Your Loan Amount and Term

- Once your account is set up, log in to the Cashme app.

- Use the loan calculator to select your desired loan amount and term.

- Review the interest and repayment details to ensure they align with your financial needs.

Step 4: Complete the Application Form

- Fill in the necessary details in the online application form.

- Ensure the accuracy of the information provided, as this will be crucial for the approval process.

Step 5: Connect Your Philippine Bank Card

- Link your Philippine bank card to your Cashme account.

- Follow the verification steps to confirm the ownership of the linked card.

Step 6: Submit Your Loan Application

- Review the completed application form for any errors or missing information.

- Click on the “Submit” or “Apply Now” button to send your loan application to Cashme for review.

Step 7: Wait for Approval Decision

- Cashme’s automated system will swiftly review your application.

- Approval decisions are typically provided within minutes.

- Keep an eye on your app notifications or email for the status of your loan application.

Step 8: Accept the Loan Terms

- If your loan is approved, carefully review the loan terms presented in the app.

- Accept the terms and conditions to proceed with the loan agreement.

Step 9: E-Signature and Confirmation

- Complete the e-signature process to confirm your agreement with the loan terms.

- Ensure that you thoroughly understand the details of the loan, including the repayment structure.

Step 10: Receive Funds in Your Bank Account

- Upon completing the e-signature, Cashme will initiate the transfer of approved funds to your linked bank account.

- Funds are usually disbursed within a short period, often within 24 hours.

By following these steps, you can navigate the Cashme loan application process efficiently and increase your chances of swift approval. Remember to provide accurate information, carefully review the terms, and ensure that you can comfortably meet the repayment obligations. Cashme’s commitment to a quick and hassle-free process makes it a reliable choice for those in need of immediate financial assistance.

Contacts Information of Cashme

If you need to get in touch with Cashme or have inquiries about their services, here are the contact details you can use:

Address: Petron Megaplaza 358 Sen. Gil J. Puyat Ave, Makati, 1227

Phone Numbers:

- Customer Support: 09453410327

- General Inquiries: 09066914908

- Loan Application Status: 09059152397

Email Address: [email protected]

Feel free to reach out to Cashme through the provided contact information for any questions, concerns, or assistance related to their loan services. Whether you prefer calling or emailing, their customer support is available to provide the necessary information and support you may need.

FAQ about Cashme

What age group is eligible for a Cashme loan?

Filipinos between the ages of 18 and 60 are eligible to apply for a Cashme loan. The minimum age requirement ensures that applicants are legally capable of entering into financial transactions.

Will Cashme protect my personal information?

Yes, Cashme prioritizes the security of your data. The transfer procedure is designed to be completely secure, with no third-party access or intervention. Cashme is committed to ensuring the confidentiality and safety of your personal information.

How can I get a loan from Cashme?

The process is simple. After pressing the “Apply now” button, the system sends your information to the Cashme team. They review the application and provide an acceptance or denial of loan terms. Once approved, instructions on the amount and the timeline for funds to arrive in your bank account are provided within 24 hours.