Binixo Loans: A Critical Review Post-SEC Intervention

Binixo is a noteworthy contender in the Philippine digital lending space in an era where financial agility is paramount. To democratize access to credit, Binixo.ph promises financial empowerment through its innovative lending services. This Binixo review intends to delve deep into the service’s workings, scrutinizing its offerings’ nuances, its service’s efficiency, and its position within the competitive online lending market.

Get Started Now!

Apply for a fast, secure, and hassle-free loan through Binixo today!

As we embark on this analytical journey, we at TriceLoans.ph shall dissect the various facets of Binixo, from its user experience and loan processing mechanisms to its customer service efficacy and repayment structure. Our goal is to provide a comprehensive overview that informs potential borrowers and offers investors and industry observers a balanced perspective. Join us as we explore the intricacies of Binixo and what it signifies in the broader context of financial technology services in the Philippines.

Is Binixo Legit

Binixo is not a legitimate lending company. It was operating without the necessary Certificate of Authority from the Securities and Exchange Commission (SEC), which is required by law for lending companies in the Philippines. The SEC’s action to shut down Binixo and other similar online lending apps for privacy invasion and harassment issues further supports the claim that Binixo was engaging in unauthorized and potentially illegal activities at the time of the notice.

Anyone considering lending services should always verify that the provider is fully licensed and compliant with all regulatory requirements to ensure they engage in legal and secure transactions.

For those seeking financial solutions, we recommend exploring various lenders that are fully licensed and compliant with regulatory standards to ensure a secure and lawful transaction. It is always prudent to consider alternative options that offer transparency, security, and a strong track record of customer satisfaction. However, if you are considering Binixo despite its regulatory challenges, we provide a comprehensive review below, detailing our findings to help you make an informed decision. Before engaging with their services, please proceed cautiously and arm yourself with all the necessary information.

Best Online Loans Similar to Binixo

Our forthcoming table will feature a range of the best online loan providers in the Philippines, paralleling the services offered by Binixo.

| Company | Loan Amount (PHP) | Interest Rate | Loan Term |

|---|---|---|---|

| Digido | 1,000 – 25,000 | From 0% to 11.9% | Up to 30 days |

| MoneyCat | 500 – 20,000 | Up to 11.9% per month | Up to 180 days |

| Kviku | 500 – 25,000 | 1.2% per month | Up to 180 days |

| Cashspace | 1000 – 25,000 | 1.3% per month | 2 – 4 months |

Pros and Cons of Binixo

Are you considering applying for a loan with Binixo? Let’s discuss the pros and cons of this lending platform.

On the positive side, Binixo offers convenient online applications and quick approval processes. However, it is important to know that their interest rates may be higher than traditional banks.

Pros

One of the advantages of Binixo loans is how easy it is to repay them. You will find that the repayment process is straightforward and hassle-free. Binixo offers flexible payment options, allowing you to choose a repayment schedule that suits your financial situation. Whether you prefer weekly, bi-weekly, or monthly payments, Binixo covers you.

Another benefit is the convenience of making payments online. You can easily access their website or mobile app to make your loan repayments from the comfort of your own home. This saves you time and effort compared to traditional methods such as visiting a bank or mailing checks.

With Binixo loans, paying back what you owe quickly and conveniently ensures a stress-free borrowing experience.

Cons

However, the downside of Binixo loans is that the interest rates can be quite high, which may result in you paying back significantly more than you initially borrowed.

This means you must carefully consider whether the loan is worth it for your financial situation. Additionally, some borrowers have reported difficulties with the repayment process.

It is important to ensure that you fully understand the terms and conditions of the loan before agreeing to it, as there may be hidden fees or penalties for late payment.

Another potential drawback is that Binixo loans are only available in certain countries, so you won’t be able to access their services if you’re not located in one of these areas.

Key Points

| Features | Details |

| Interest rate | 1% per day |

| Loan Amount | 2000 PHP to 30000 PHP |

| Loan Tenure | 7 days to 30 days |

| Approval Time | 1-2 working days |

What is Binixo

To understand Binixo, imagine a user-friendly online platform that helps you obtain loans quickly and easily.

Binixo is an online lending service that connects borrowers with lenders, providing a simple and efficient way to access personal loans. With just a few clicks, you can apply for a loan without the hassle of lengthy paperwork or time-consuming visits to banks or financial institutions.

Binixo offers an extensive network of trusted lenders ready to provide the necessary funds.

With Binixo, the application process is straightforward. You only need to complete an online form with your personal information, employment details, and desired loan amount. Once submitted, your application will be reviewed by multiple lenders simultaneously, increasing your chances of approval. Within minutes, you will receive loan offers from different lenders tailored to your specific needs.

Binixo’s platform provides transparency in terms of interest rates and repayment options. You can choose the best offer that suits your requirements before finalizing the loan agreement. Repayment methods are flexible, too – you can choose between automatic deductions from your bank account or manual payments through various payment channels.

Binixo simplifies the loan application process by offering a user-friendly platform that connects borrowers with multiple trustworthy lenders. It saves time and effort while ensuring transparency and flexibility throughout the borrowing experience.

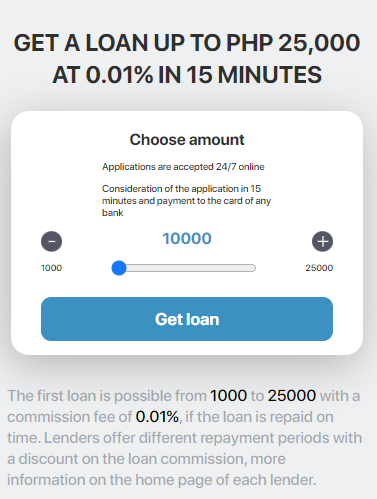

Offers provided by Binixo PH

Fast Cash Loan

Getting a fast cash loan from Binixo is like having a financial lifeline when needed. Whether it’s an unexpected medical expense, car repair, or any other urgent situation, Binixo understands the importance of getting quick access to funds.

With their fast cash loan option, you can apply online and receive a decision within minutes. The application process is simple and hassle-free, requiring only basic personal information and documentation. Once approved, the funds are deposited directly into your bank account, allowing you to use them immediately for your needs.

Repayment options are flexible, with various payment terms available to suit your financial situation. Binixo provides a reliable and convenient solution for those seeking instant cash assistance without the long wait times associated with traditional loans.

Personal Loans

If you need extra cash for a personal expense, a fast and hassle-free solution is applying for a personal loan. Getting a personal loan with Binixo Loans is quick and easy. Depending on your needs, you can borrow amounts ranging from $100 to $1,000.

The application process is simple – fill out an online form with your basic information and submit it. Binixo Loans will review your application and provide you with the best loan options. Once approved, the funds will be deposited directly into your bank account within 24 hours.

Repaying the loan is also convenient as you can choose from various payment methods such as bank transfer or debit card. So, if you need money for that unexpected personal expense, consider applying for a personal loan with Binixo Loans today!

Salary Loans

With salary loans, you can finally breathe a sigh of relief and tackle those unexpected expenses that have been weighing you down. Binixo understands that life can throw curveballs at any time, and sometimes, your paycheck doesn’t stretch far enough.

Their simple application process ensures quick approval, and the funds will be deposited into your account within 24 hours. Plus, flexible repayment options allow you to choose the best terms that suit your budget.

There is no need to worry about high-interest rates either – they offer competitive rates to ensure financial well-being.

Interest Rate for Binixo

The Binixo lending service extends financial assistance at a remarkably high-interest rate of 1% per day, which can rapidly accumulate but provides swift aid for those in urgent need. With loan amounts ranging from 2,000 to 30,000 PHP, Binixo caters to various financing needs, whether for unexpected emergencies or immediate cash-flow shortages.

The loan tenure is flexible, allowing borrowers to choose between a brief period of 7 days to a maximum of 30 days, accommodating short-term financial obligations without committing to a long-term repayment schedule. This short-term lending model is particularly advantageous for individuals anticipating the ability to repay the loan quickly, such as receiving an upcoming paycheck.

Binixo Loan Requirements

Ensure you carefully understand and gather all the necessary documents for your Binixo loan application. Having these requirements ready will help expedite the process and increase your chances of approval.

First, you must provide a valid government-issued ID, such as a passport or driver’s license. This is to verify your identity and ensure you meet the legal age requirement for borrowing money.

Additionally, you’ll be asked to submit proof of income, including recent pay stubs or bank statements. This helps demonstrate your ability to repay the loan.

It’s also important to have a working email address and active mobile number as part of the application process.

How Do You Get Approved for Binixo Loan

Getting approved for a Binixo loan feels like stepping into a brightly lit room where your financial worries begin to fade away. To increase your chances of approval, you should keep a few key things in mind.

- Age: Borrowers must be aged between 22 to 60 years old.

- Employment: Applicants must be currently employed or have a steady income.

- Residency: Applicants must have a valid home address within Metro Manila or other select areas in the Philippines.

- Bank Account: Borrowers need to have a bank account where the loan funds can be disbursed.

- Income: There is a minimum monthly gross income requirement, specified as $1,500 in most states; this likely refers to a minimum income threshold applicable in most areas where Binixo operates.

- Payment Method: Borrowers must receive their paychecks through direct deposit, suggesting that loan repayments may also be automated through the same channel.

These criteria are designed to ensure that applicants have the means to repay their loan and that Binixo operates within a framework that minimizes the risk of default.

Exclusive Features of Binixo

Discover the unique features that set Binixo apart from other lending platforms and enhance your borrowing experience. With Binixo, you’ll enjoy exclusive benefits that make the loan process hassle-free and convenient.

First and foremost, Binixo offers a simple online application process. Gone are the days of lengthy paperwork and endless queues at the bank. You can apply for a loan directly from the comfort of your own home, saving you time and effort.

Additionally, Binixo provides fast approval times. Once you submit your application, you won’t have to wait long to receive a decision. In most cases, approval is granted within minutes, allowing you to access funds quickly when needed.

Binixo also values transparency in its operations. They provide clear information regarding interest rates, fees, and repayment terms upfront, so there are no hidden surprises later. This ensures that borrowers can make informed decisions about their loans without confusion.

Whom Binixo Loan Suits Better?

Binixo loans are particularly suited for individuals who:

Need Quick Cash

Binixo loans cater to those in pressing need of funds, ensuring that financial relief is swiftly administered, typically within 1-2 working days from application.

Short-Term Borrowers

The service is tailored for individuals seeking a transient financial buffer who are confident in returning the borrowed sum within a brief window of 7 to 30 days.

Are Comfortable with High-Interest Rates

Borrowers who opt for Binixo must know the 1% daily interest rate and have a financial strategy to manage this high cost-efficiently.

Have Steady Incomes

A consistent income stream is requisite for Binixo’s loan approval, aligning with the lender’s need to ensure the borrower’s ability to fulfill repayment obligations.

Reside in Specified Locations

Potential borrowers must reside within the operational perimeters set by Binixo, which currently includes Metro Manila and other selected regions in the Philippines.

Prefer Online Transactions

Binixo’s digital-first approach is ideal for customers who favor the convenience and efficiency of online loan applications and electronic document handling.

Direct Deposit Recipients

The platform is designed for individuals who receive their salaries through direct deposit, suggesting a seamless integration with the company’s loan repayment mechanism.

Are Seeking Small to Medium Loan Amounts

Those needing modest financial assistance, ranging from 2,000 PHP to 30,000 PHP, will find Binixo’s offerings aligned with their requirements.

Frequently Asked Questions

Are There Any Penalties For Early Repayment of a Binixo Loan?

Yes, there are no penalties for early repayment of a Binixo loan. You can pay off your loan immediately without any additional charges or fees.

Can I Apply For a Binixo Loan With a Bad Credit Score?

Yes, you can apply for a Binixo loan even if you have a bad credit score. They consider other factors like income and employment history to determine eligibility.

Is There a Minimum Income Requirement to Qualify For a Binixo Loan?

There is no minimum income requirement to qualify for a Binixo loan. To determine eligibility, they consider various factors, such as credit score and employment stability. Focus on meeting their criteria rather than worrying about income alone.

How Long Does It Take to Receive the Funds Once My Binixo Loan is Approved?

Once your Binixo loan is approved, you will receive the funds within a short period of time. The exact duration may vary depending on various factors, but typically it takes a few business days to transfer the money into your account.

Are Any Additional Fees or Hidden Charges Associated with Taking Out a Binixo Loan?

There are no additional fees or hidden charges when taking out a Binixo loan. You can trust that you agree upon the exact amount you will receive and repay.

Binixo Competitors

Read OKPeso Review

| Company | Loan Amount (PHP) | Interest Rate | Loan Term | Our Review |

|---|---|---|---|---|

| Digido | 1,000 – 25,000 | From 0% to 11.9% | Up to 30 days | Read Digido Review |

| MoneyCat | 500 – 20,000 | Up to 11.9% per month | Up to 180 days | Read MoneyCat Review |

| CashMart | 3,000 – 150,000 | From 0,8% to 3,5% | Up to 6 months for new loan | Read CashMart Review |

| EasyCash | 5,000 – 25,000 | 0,33%-1% | From 1 to 300 days | Read EasyCash Review |

| Crezu | 1,000 – 25,000 | From 1.5% per month to 30% per year | From 3 to 12 months | Read Crezu Review |

| CashMe | 2,000 – 20,000 | 0,08% per day | Up to 3 months | Read CashMe Review |

| Blend | 50000 – 2 million | From 1,5% to 3% monthly | Up to 36 months | Read Blend Review |

| Asteria Lending Inc | 2000 – 50000 | 0.2% per day | From 30 days to 120 days | Read Asteria Review |

| Loanmoto | 1,000 – 12,000 | 4% – 6% per month | Read Loanmoto Review | |

| Finbro | 1,000 – 50,000 | 0.5% – 1.25% per day | Up to 12 months | Read Finbro Review |

| Kviku | 500 – 25,000 | 1.2% per month | Up to 180 days | Read Kviku Review |

| Binixo | 2000 – 30000 | 1% per day | From 7 days to 30 days | Read Binixo Review |

| PesoQ | 5,000 – 20,000 | 4% – 6% per month | 91 – 365 days | Read PesoQ Review |

| GCash | 5,000 – 25,000 | From 3% to 15% | From 15 to 90 days | Read GCash Review |

| CashBee | 2,000 – 20,000 | 0,3% daily | From 30 to 120 days | Read CashBee Review |

| Revi Credit Philippines | 1000 – 250,000 | 1% – 5% | From 6 to 36 months | Read Revi Credit Review |

| Tala | 1,000 – 25,000 | 15% – 15.7% | From 15 to 61 days | Read Tala Review |

| OKPeso | ||||

| Vamo | 1,000 – 30,000 | From 1,3% | From 10 to 3000 days | Read Vamo Review |

| Flexi Finance | Up to 25,000 | From 365 to 1460 days | Read Flexi Finance Review | |

| JuanHand | Up to 50,000 | 14.7% per month | From 14 to 90 days | Read JuanHand Review |

| Moca Moca | 2,000 – 35,000 | 0.83% per month | From 180 to 365 days | Read Moca Moca Review |

| RoboCash | 1,000 – 25,000 | From 0% to 11.9% | Up to 30 days | Read RoboCash Review |