Crezu Loan Review

Are you tired of traditional loan services requiring income and collateral proof? Look no further because Crezu is here to revolutionize the lending industry in the Philippines.

Key Points

| Features | Details |

| Application Process | Quick and easy online application |

| Approval Rate | High approval rate of up to 94% |

| Operating Hours | 24/7 availability, including holidays and Sundays |

| Accessibility | Welcomes all borrowers, including those with bad credit or past due debts |

Pros and Cons of CREZU

Let’s dive into a discussion on the pros and cons of CREZU, the game-changing loan service.

This review will highlight key points about the service, providing insights into its advantages and disadvantages.

Whether you’re considering using CREZU or just curious about its features, this discussion will give you a comprehensive overview of what to expect.

Pros

- Discover the incredible benefits of Crezu’s loan service that will revolutionize your borrowing experience! With Crezu, you can enjoy a hassle-free and convenient way to access the funds you need.

- Say goodbye to long waiting times and complicated application processes. Crezu offers a quick and easy online application that takes only minutes to complete. No more endless paperwork or unnecessary documentation.

- Plus, with Crezu’s high approval rate of up to 94%, you have a great chance of getting approved for a loan. Whether you have bad credit or past due debts, Crezu welcomes all borrowers.

- And the best part? Crezu operates 24/7, so you can apply for a loan anytime, even on holidays and Sundays.

- Experience the freedom and flexibility that Crezu brings to your borrowing journey!

Cons

However, it’s important to consider some potential drawbacks of using Crezu’s loan service.

- One possible drawback is that Crezu isn’t listed as a registered organization on the Securities and Exchange Commission (SEC) website. This means they may not have the same level of regulation and oversight as other lending institutions.

- Crezu offers a wide range of loan options, but their interest rates can vary greatly depending on the lender and your credit situation. This means you may have a higher interest rate than you anticipated.

- Finally, Crezu claims to be a transparent platform, but some customer reviews have mentioned hidden fees or unclear terms in their loan contracts. It’s important to carefully read all terms and conditions before accepting any loan offer from Crezu or its partners.

What is CREZU

Get ready to explore the game-changing Crezu loan service, where you can easily compare and find the best loan options for your needs. With Crezu, you can take control of your financial situation and liberate yourself from the stress of searching for a loan.

Crezu is not just another online money lending application; it’s a revolutionary platform that connects borrowers with trusted lending partners. You no longer have to spend hours researching lenders and comparing interest rates. Crezu does all the work for you, providing personalized loan offers based on your profile.

What sets Crezu apart is its commitment to transparency and convenience. Unlike traditional lenders, Crezu operates 24/7 and doesn’t require proof of income or collateral. Plus, with its easy-to-use website and mobile application, applying for a loan has never been easier.

So why wait? Take advantage of this game-changing service and unlock new possibilities today. Visit the Crezu website now and start your journey towards financial freedom!

Loans provided by CREZU

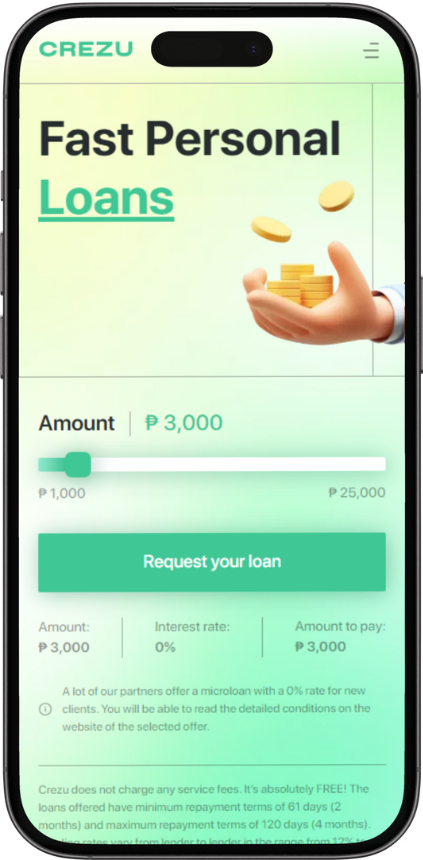

Looking for a mobile loan? CREZU offers convenient and accessible personal loans you can apply for on your phone.

Need some extra cash for medical expenses? CREZU also provides health loans to help you cover those unexpected medical bills.

Mobile Loan

Experience the convenience of applying for a mobile loan with Crezu, where you can easily search for trusted financial institutions and borrow up to 20,000 PHP in just 14 minutes, all from the palm of your hand.

Crezu’s mobile loan service allows you to access funds whenever and wherever you need them. You no longer have to worry about visiting physical branches or dealing with lengthy paperwork. Download the Crezu mobile app, fill in your personal information accurately, and select the best loan offer that suits your needs.

Once approved, the funds will be quickly disbursed to your provided account. Repayment is made directly to the partner lender registered with Crezu.

Experience liberation and take control of your financial situation with Crezu’s convenient mobile loan service.

Personal Loans

Discover the flexibility and freedom of personal loans with Crezu, where you can easily find the perfect loan solution tailored to your needs. Whether you dream of a luxurious vacation or need extra cash for unexpected expenses, Crezu is here to help you break free from financial constraints.

With Crezu’s user-friendly platform, you can compare multiple loan options and choose the one that suits you best. No longer do you have to worry about strict requirements or lengthy applications? Crezu offers a hassle-free experience, allowing you to apply for a loan in just minutes.

Say goodbye to traditional lending institutions that hold you back, and hello to the liberation of personal loans with Crezu. It’s time to take control of your finances and embrace a brighter future.

Health Loans

Need some extra cash to cover those unexpected medical bills? Crezu is here to help you with their flexible health loans tailored just for you. Crezu understands that your health should be a top priority, whether it’s a sudden illness or an accident, and they want to ensure you have the financial support you need.

With Crezu’s health loans, you can get the money quickly and easily without hassle or stress. The application process is simple and can be done online in just a few minutes. Crezu works with reputable lenders, offering competitive interest rates and flexible repayment terms.

So don’t let medical expenses keep you from getting the necessary care. Apply for a health loan with Crezu today and experience the freedom of having your medical expenses covered.

Interest Rate for CREZU

The interest rates for loans provided by Crezu range from 1.5% per month to a maximum of 30% per year, depending on the lender and the borrower’s credit situation. These rates may seem high at first glance, but it’s important to understand that they reflect the risks of lending money without requiring proof of income or collateral.

However, don’t let these interest rates discourage you from exploring the loan options through Crezu. Remember, Crezu is all about liberation and providing financial solutions to help you in need. They understand that traditional lending institutions may not always be accessible or willing to lend to individuals with low credit ratings or past-due debts.

Crezu aims to bridge this gap by connecting you with reputable financial partners willing to provide loans even in challenging circumstances. The transparency in disclosing interest rates and fees ensures you understand what you’re getting into before making any commitments.

So, if you need extra cash and traditional lenders have turned you away, don’t lose hope! Explore the loan options provided by Crezu and see if they can offer you a suitable solution. Remember to borrow responsibly and consider your ability to repay the loan within the agreed-upon terms. Liberation is possible, and Crezu is here to help!

Best Online Loans Similar to Crezu

We’ve prepared a table that spotlights top online loan platforms in the Philippines, each presenting services similar to Crezu.

| Company | Loan Amount (PHP) | Interest Rate | Loan Term |

|---|---|---|---|

| Digido | 1,000 – 25,000 | From 0% to 11.9% | Up to 30 days |

| MoneyCat | 500 – 20,000 | Up to 11.9% per month | Up to 180 days |

| Kviku | 500 – 25,000 | 1.2% per month | Up to 180 days |

| Cashspace | 1000 – 25,000 | 1.3% per month | 2 – 4 months |

CREZU Loan Requirements

Get ready to take control of your financial future with Crezu, where applying for a loan is as easy as 1-2-3!

At Crezu, they understand that you want the freedom to access funds quickly and conveniently. That’s why they have simplified the loan application process to make it hassle-free and accessible.

To qualify for a loan with Crezu, you only need to be a Filipino citizen aged 18 to 70. They value your time and convenience and only require basic information such as an active email address and phone number. For your first loan, they will also need personal identification verification.

The company believes in empowering customers by providing options that suit their needs. As a borrower, you can choose from various lending partners who offer different loan services.

Crezu has no strict requirements like proof of income or collateral.

How Do You Get Approved for CREZU Loan

Discover the simple steps to approval for a CREZU loan and take control of your financial future today!

Getting approved for a CREZU loan is quick and easy, allowing you to access the funds you need without any hassle.

To start, visit the CREZU website and complete the online application form. Provide accurate personal information, including your name, contact details, and identification documents.

Once you’ve completed the form, select the loan offer from our list of trusted lending partners that best suits your needs.

After submitting your application, the team will review it promptly. The company understands that time is of the essence when it comes to financial matters, so it strives to provide a fast approval process. In just 20 minutes or less, you’ll receive a decision on your loan application.

Once approved, the funds will be transferred directly to your bank account or made available for cash pick-up at a designated partner location. You can then use these funds to pay bills, cover unexpected expenses, or pursue personal goals.

CREZU Customer Support

Need assistance with your CREZU loan application? Their dedicated customer support team is here to help you every step of the way! They understand that applying for a loan can sometimes be overwhelming, but rest assured, they are committed to making the process as smooth and hassle-free as possible.

Whether you have questions about the application requirements, need guidance on choosing the right loan partner, or want clarification on any aspect of our service, our friendly and knowledgeable customer support representatives are ready to assist you.

Exclusive Features of CREZU

Experience the convenience and peace of mind with CREZU’s exclusive features that make applying for a loan a breeze! With CREZU, you can finally break free from the traditional hassles of loan applications. Say goodbye to long waiting times, endless paperwork, and complicated requirements.

CREZU understands your need for liberation and offers a streamlined process that saves you time and energy. One of the exclusive features of CREZU is its 100% online application process. You can apply for a loan anytime, anywhere, without the need to visit a physical branch or endure lengthy queues. Visit their website, accurately fill out the necessary information, and select the best loan offer that suits your needs.

Another remarkable feature of CREZU is its high approval rate of up to 94%. No more worrying about whether your application will be accepted or not. With CREZU, you have a higher chance of getting approved for a loan, even if you have past-due debts or low credit ratings.

Furthermore, CREZU offers flexible payment terms ranging from 3 to 12 months. This allows you to choose a repayment period that fits your financial situation and ensures comfortable monthly installments.

Whom CREZU Loan Suits Better?

For individuals seeking a loan application process that is convenient and hassle-free, CREZU’s exclusive features cater to their needs. If you value liberation and want a loan service that understands your time constraints and financial requirements, then CREZU is the perfect fit for you.

With its 24/7 availability, you can apply for a loan anytime, anywhere. No more waiting in long queues or dealing with complicated paperwork.

CREZU also recognizes the importance of speed when it comes to getting funds. That’s why they offer quick approval and disbursal of loans in as little as 14 minutes. So whether you have an emergency expense or need cash for a personal project, CREZU has got you covered.

Another great feature of CREZU is its flexible repayment terms. Depending on your financial situation, you can choose a payment term ranging from 3 to 12 months. This allows you to manage your repayments according to your schedule.

In addition, CREZU welcomes borrowers with past-due debts and low credit ratings. They understand that everyone faces financial challenges at some point and believe in giving second chances.

So if you’re looking for a loan service that offers convenience, speed, flexibility, and inclusivity, look no further than CREZU. Experience liberation from traditional lending processes and take control of your finances with ease through the game-changing CREZU loan service.

Frequently Asked Questions

How long does it take to receive the loan amount through CREZU?

You can receive the loan through Crezu in as little as 14 minutes. The quick and efficient online process ensures a high approval rate of up to 94%, allowing you to access funds when needed.

Can I apply for a loan with CREZU if I have a low credit rating or past-due debts?

Yes, you can apply for a loan with Crezu even with a low credit rating or past-due debts. They accept customer applications in these situations and have a high approval rate.

Are there any hidden fees associated with the loan service provided by CREZU?

No hidden fees are associated with the loan service provided by Crezu. They ensure transparency by disclosing interest rates and fees in the contract, allowing borrowers to make informed decisions.

What is the maximum loan amount that can be obtained through CREZU?

The maximum loan amount you can obtain through Crezu is 20,000 PHP. This allows you to access the funds you need for your financial goals, providing flexibility and convenience in managing your expenses.

How does CREZU select and compare loan offers to provide the most suitable financial solution?

Crezu selects and compares loan offers based on your personal information to provide the most suitable financial solution. They help you choose the partner that best suits your needs, ensuring a reasonable loan option.

Crezu Competitors

| Company | Loan Amount (PHP) | Interest Rate | Loan Term | Our Review |

|---|---|---|---|---|

| Digido | 1,000 – 25,000 | From 0% to 11.9% | Up to 30 days | Read Digido Review |

| MoneyCat | 500 – 20,000 | Up to 11.9% per month | Up to 180 days | Read MoneyCat Review |

| CashMart | 3,000 – 150,000 | From 0,8% to 3,5% | Up to 6 months for new loan | Read CashMart Review |

| EasyCash | 5,000 – 25,000 | 0,33%-1% | From 1 to 300 days | Read EasyCash Review |

| CashMe | 2,000 – 20,000 | 0,08% per day | Up to 3 months | Read CashMe Review |

| Blend | 50000 – 2 million | From 1,5% to 3% monthly | Up to 36 months | Read Blend Review |

| Binixo | 2000 – 30000 | 1% per day | From 7 days to 30 days | Read Binixo Review |

| Asteria Lending Inc | 2000 – 50000 | 0.2% per day | From 30 days to 120 days | Read Asteria Review |

| Loanmoto | 1,000 – 12,000 | 4% – 6% per month | Read Loanmoto Review | |

| Finbro | 1,000 – 50,000 | 0.5% – 1.25% per day | Up to 12 months | Read Finbro Review |

| Kviku | 500 – 25,000 | 1.2% per month | Up to 180 days | Read Kviku Review |

| Binixo | 2000 – 30000 | 1% per day | From 7 days to 30 days | Read Binixo Review |

| PesoQ | 5,000 – 20,000 | 4% – 6% per month | 91 – 365 days | Read PesoQ Review |

| GCash | 5,000 – 25,000 | From 3% to 15% | From 15 to 90 days | Read GCash Review |

| CashBee | 2,000 – 20,000 | 0,3% daily | From 30 to 120 days | Read CashBee Review |

| Revi Credit Philippines | 1000 – 250,000 | 1% – 5% | From 6 to 36 months | Read Revi Credit Review |

| Tala | 1,000 – 25,000 | 15% – 15.7% | From 15 to 61 days | Read Tala Review |

| OKPeso | Up to 24% | From 96 to 365 days | Read OKPeso Review | |

| Vamo | 1,000 – 30,000 | From 1,3% | From 10 to 3000 days | Read Vamo Review |

| Flexi Finance | Up to 25,000 | From 365 to 1460 days | Read Flexi Finance Review | |

| JuanHand | Up to 50,000 | 14.7% per month | From 14 to 90 days | Read JuanHand Review |

| Moca Moca | 2,000 – 35,000 | 0.83% per month | From 180 to 365 days | Read Moca Moca Review |

| RoboCash | 1,000 – 25,000 | From 0% to 11.9% | Up to 30 days | Read RoboCash Review |