Revi Credit Review

This innovative line of credit means individuals and businesses in the Philippines can find a cost-effective and convenient way to take out a loan, all without a credit check.

Get a Loan Fast!

Skip the hassle—Apply now in minutes!

While all this sounds good, consider these disadvantages too. This way, you’ll know if borrowing from Revi is best for you.

Pros:

- With Revi Credit Philippines, you can apply for a loan online and receive an approval within minutes. Plus, the funds are sent directly into your account

- A revolving line of credit means you don’t have to reapply for another loan

- There are no annual charges, and interest rates are 1% – 5% based on the number of days the loan is outstanding

- Customers can repay either the minimum monthly payment or the entire outstanding balance

Cons:

- While the rates are low compared to other loan types, they could add up over time, especially as they’re charged for each day you have an outstanding balance

- You’ll have to sign up for online lending with CIMB Bank, as they don’t lend to non-customers

- Borrowers will need to prove they have at least PHP 10,000 in income per month

Key Points

One of the key advantages of borrowing a loan from Revi is its convenience. The loan application process is simple and can be completed online or at any of their 1,080 branches. In addition, the bank makes sure you get your money quickly, often within 24 hours.

Revi Credit Philippines has also earned a reputation for providing outstanding assistance and customer service. Borrowers can expect professional assistance and guidance throughout the loan process. This makes the entire experience effortless and hassle-free.

| Features | Details |

| Interest rate | 1% – 5% |

| Loan Amount | PHP 1000 – PHP 250,000 |

| Loan Tenure | 6 to 36 months |

| Approval Time | Maximum of two days |

| Processing Fee | None |

Full Loan Review

Revi is a product offered by CIMB Bank, one of the leading banks in Southeast Asia. If you can access a financial tool that solves your money worries, you should use it, right? With a list of pros that seem too good to be true, Revi Credit Philippines continues to grow in popularity for people seeking reliable and hassle-free loans. Let’s take a look at their requirements as well as what they have on the menu.

What is Revi Credit?

This financial service is an all-in-one online loan product provided by CIMB Bank in the Philippines. It’s well known and trusted for its exceptional services and seamless banking experience.

This bank launched its revolving line of credit (Revi Credit) in 2021. The product allows customers to access a loan of up to PHP 250,000 with a rate as low as 1%. It’s designed to address the need for hassle-free access to formal credit in the Philippines, where many adults still rely on informal sources for their money needs.

| Company Name | CIMB Bank |

| Founder | CIMB Group Holdings Berhad |

| Official Launch | 2021 |

| License number | 549300HUCLV2DB1T8U76 |

Loan Types Provided by Revi Credit

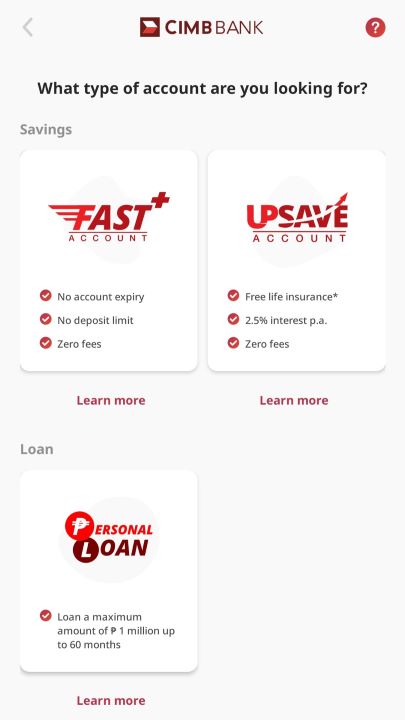

CIMB Bank offers a revolving line of credit through Revi. They also provide other loan types, which you can use with Revi. Although you can only have one of each at a time.

- GCredit (for groceries)

- Personal loan

- REvi Credit

The most popular is their unsecured personal advance of PHP 30,000 to PHP 1,000,000. This amount is much more than Revi Credit and is best for people who don’t mind committing to long-term repayments. With this, borrowers can take out a cash loan for 5 years, with a rate of around 6.88%.

Best Online Loans Similar to Revi Credit Philippines

The table will highlight a selection of outstanding online loan platforms in the Philippines, closely resembling ReviCredit’s services.

| Company | Loan Amount (PHP) | Interest Rate | Loan Term |

|---|---|---|---|

| Digido | 1,000 – 25,000 | From 0% to 11.9% | Up to 30 days |

| MoneyCat | 500 – 20,000 | Up to 11.9% per month | Up to 180 days |

| Kviku | 500 – 25,000 | 1.2% per month | Up to 180 days |

| Cashspace | 1000 – 25,000 | 1.3% per month | 2 – 4 months |

Interest Rate for Revi Credit

The loan rates offered by Revi Credit PH are reasonable and suitable for everyone. Their monthly interest rate is between 1% to 5% depending on your credit score. You’re charged based on how many days you used the loan.

Take a look at this example:

You borrowed a PHP 500 loan with a 3% rate and want to pay off the balance in 10 days. Here is how interest is calculated:

- PHP 500 x 3% x 10/30 = interest rate charge of PHP 5

- The full balance will be PHP 505.00

Revi Credit Cash Loan Requirements

To be eligible for REVI Credit Philippines, there are a few basic loan requirements you need to fulfill.

- A member of the CIMB Bank for at least one month

- A citizen of the Philippines with a valid government-issued ID

- Aged between 21-65 years old

- Have proof of a physical address and phone number that’s registered in the Philippines

- At least PHP 10,000 in income each month

IDs accepted by Revi Credit

Here is a list of the necessary documentation requirements you’ll need to present if you apply for a Revi Credit online loan. As long as you have at least one of these documents, you’ll be good to go.

| ID Type | Name |

| Electronic Identification | PhillD Card (printed and digital) |

| Personal/ employee ID | National Professional ID Card

Unified Multi-Purpose ID card |

| Legal documents | Drivers license

Passport Postal ID Voter’s (COMELEC) ID Card SSS ID |

How Can You Repay a Loan in Revi Credit?

There are many different methods customers can use to repay their loan:

CIMB mobile app:

- Click “Pay Now” and go into the savings account you have with the bank

- Decide how much you want to repay on the loan amount

- With your MPIN, confirm the transaction

- You should see the cash loan payment in your transaction history after the payment has been processed

In-store (7-eleven only) via the CIMB Bank app:

- In the mobile app, click on the “Pay Now” button and select the “Over the Counter” option

- Choose the store you want to pay at

- Enter the loan repayment amount

- You will be given a barcode to download

- Hand this barcode to an employee at the 7-Eleven store, and they will process the loan payment for you

From a bank account (using Dragonpay):

- Open your CIMB Bank app and select “Pay Now”, then “Over the Counter”

- A list of banks will come up – select the bank from which you want the money to be taken

- Enter how much of the loan amount you want to repay

- Follow the steps to process the payment

- Make sure you get a confirmation email from Dragonpay

Exclusive Features of Revi Credit

One of the most remarkable Revi features is its fully digital online loan application process. With just a few taps on your smartphone, you can apply for Revi Credit Philippines without having to visit a physical branch or submit tons of paperwork.

As opposed to a traditional loan that has excessive fees, Revi has some of the lowest interest rates in the market. It’s a really cost-effective financial solution for people in need.

In addition, Revi offers cash loan increases for people who repay on time. This means that as you continue to use and pay off your Revi loan, you’ll become eligible for a higher loan credit limit.

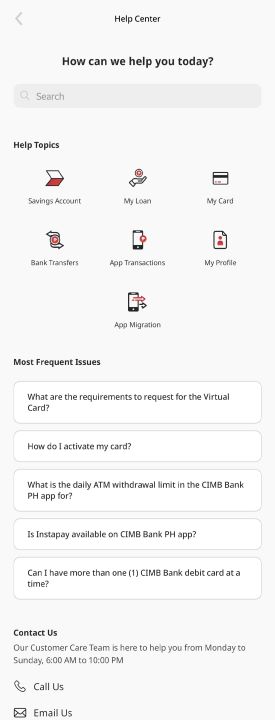

Revi Credit Customer Support

CIMB Bank’s loan customer support can be accessed both online and in-store. In terms of online support, the bank’s official website provides a comprehensive FAQ section that covers pretty much all you need to know.

For social media lovers, customers can also reach out to the bank through their official social media pages or call them on their contact number between 6 AM – 10 PM, Monday to Sunday.

Revi Credit Mobile Аpp Review

You can access the Revi Credit Philippines feature through the official CIMB Bank PH mobile app. Its primary function is to provide users with easy access to their CIMB loan, such as managing accounts and transactions or applying for a loan.

Jumio’s AI-driven identity verification technology is also integrated into the app. This means the loan customer onboarding takes under 5 minutes instead of 15.

Overall, the app’s user interface is intuitive and straightforward, with a modern and clean visual design. Their menus are well organized, and their icons are eye-catching without being distracting.

Additionally, the loan app’s enhanced security measures, like biometric login and real-time account notifications, guarantee that users’ sensitive information is protected.

How Does the Revi Credit App Work?

Before applying for a loan with Revi, it’s a good idea to familiarize yourself with what it has to offer. Here’s an in-depth explanation of how the app works:

- You can download the CIMB Bank PH app from Google Play or App Store. Then to create an account, complete the easy and all-digital sign-up process.

- You can apply for a loan of up to PHP 250,000 with zero early settlement fees and disbursement fees if you choose to deposit the loan to your CIMB savings accounts.

- Revi is a first-of-its-kind revolving credit line that can be accessed through the app, allowing you to pay bills and transfer balances.

- The app enables free instant transfers. With this, you can send money to other accounts.

- The app incorporates advanced security measures to ensure the safety of your loan transactions and personal information.

How Do I Create a Revi Credit Account?

Creating a Revi account on the CIMB Bank PH app can be done in just a few minutes. Follow this guide, and you’ll be on your way to enjoying the benefits of this loan app in no time.

- Download the CIMB Bank PH App. There are versions for iPhone and Android.

- Create an account with basic personal information such as name, email address, and mobile number.

- If you already have an account, log in with your CIMB account information.

- Navigate to the “Revi Credit” section within the app. This is where you’ll be able to apply for a Revi loan account.

- Fill out the required information, including your employment status, monthly income, and other relevant financial details.

- Once your verification is complete, CIMB Bank will review your loan application and determine if you’re eligible for a Revi Credit.

Who Does Revi Credit Suit Better?

A business can have unpredictable expenses and fluctuating cash flow. With a revolving line of credit, you don’t have to deal with the time-consuming paperwork that sometimes comes with a traditional loan. Instead, you can take out a loan to pay for unexpected costs, such as inventory purchases, equipment repairs, or payroll needs.

Additionally, a Revi loan is also an excellent option for freelancers and contractors. Due to the unpredictable nature of earnings, these careers have irregular income streams.

A revolving line of credit provides these people with the flexibility to borrow money when needed. In other words, if your income is low, you can cover your expenses without impacting your credit or taking out a long-term loan at high-interest rates.

FAQ

-

Is Revi Credit legal in the Philippines?

Revi operates under CIMB Bank, which follows the rules and regulations set by the Bangko Sentral ng Pilipinas (BSP). As a result, you can trust that a loan through Revi Credit is not only legal but also legit and reliable.

-

Is it okay to pay in advance in Revi Credit?

Revi appreciates it when you pay for your loan on time. More than this, they understand that their customers will also want to pay what they’ve borrowed before the due date. This is why they do not charge for advance payments when paying back a loan.

-

How do I edit information on Revi Credit PH?

Open the app and log in with your CIMB bank credentials. Once you’re in, navigate to the profile or settings section, where you’ll find options to edit your personal details. Save your changes, and your loan account information is now up-to-date.

-

How do you get approved for Revi Credit PH?

CIMB Bank doesn’t perform a credit check for a loan with Revi. All they ask is that their borrowers be over the age of 21, have a physical address in the Philippines, have a minimum monthly income of PHP 10,000, and be a member of CIMB Bank.

-

What is the highest credit limit in Revi Credit PH?

The maximum loan amount for Revi customers is PHP 250,000. It’s likely that first-time borrowers won’t be offered this much, though. If you make on-time payments and pay off the loan within the loan terms, Revi will more than likely increase the initial credit limit.

Revi Credit Competitors

Read OKPeso Review

| Company | Loan Amount (PHP) | Interest Rate | Loan Term | Our Review |

|---|---|---|---|---|

| Digido | 1,000 – 25,000 | From 0% to 11.9% | Up to 30 days | Read Digido Review |

| MoneyCat | 500 – 20,000 | Up to 11.9% per month | Up to 180 days | Read MoneyCat Review |

| CashMart | 3,000 – 150,000 | From 0,8% to 3,5% | Up to 6 months for new loan | Read CashMart Review |

| EasyCash | 5,000 – 25,000 | 0,33%-1% | From 1 to 300 days | Read EasyCash Review |

| Crezu | 1,000 – 25,000 | From 1.5% per month to 30% per year | From 3 to 12 months | Read Crezu Review |

| CashMe | 2,000 – 20,000 | 0,08% per day | Up to 3 months | Read CashMe Review |

| Blend | 50000 – 2 million | From 1,5% to 3% monthly | Up to 36 months | Read Blend Review |

| Binixo | 2000 – 30000 | 1% per day | From 7 days to 30 days | Read Binixo Review |

| Asteria Lending Inc | 2000 – 50000 | 0.2% per day | From 30 days to 120 days | Read Asteria Review |

| Loanmoto | 1,000 – 12,000 | 4% – 6% per month | Read Loanmoto Review | |

| Finbro | 1,000 – 50,000 | 0.5% – 1.25% per day | Up to 12 months | Read Finbro Review |

| Kviku | 500 – 25,000 | 1.2% per month | Up to 180 days | Read Kviku Review |

| Binixo | 2000 – 30000 | 1% per day | From 7 days to 30 days | Read Binixo Review |

| PesoQ | 5,000 – 20,000 | 4% – 6% per month | 91 – 365 days | Read PesoQ Review |

| GCash | 5,000 – 25,000 | From 3% to 15% | From 15 to 90 days | Read GCash Review |

| CashBee | 2,000 – 20,000 | 0,3% daily | From 30 to 120 days | Read CashBee Review |

| Tala | 1,000 – 25,000 | 15% – 15.7% | From 15 to 61 days | Read Tala Review |

| OKPeso | ||||

| Vamo | 1,000 – 30,000 | From 1,3% | From 10 to 3000 days | Read Vamo Review |

| Flexi Finance | Up to 25,000 | From 365 to 1460 days | Read Flexi Finance Review | |

| JuanHand | Up to 50,000 | 14.7% per month | From 14 to 90 days | Read JuanHand Review |

| Moca Moca | 2,000 – 35,000 | 0.83% per month | From 180 to 365 days | Read Moca Moca Review |

| RoboCash | 1,000 – 25,000 | From 0% to 11.9% | Up to 30 days | Read RoboCash Review |