MoneyCat Loan Review

As a growing choice for many seeking quick and convenient financial solutions, MoneyCat promises to deliver accessible and efficient lending services. Whether you’re looking for emergency funds, short-term loans, or flexible financial options, MoneyCat claims to cater to these needs with its innovative platform.

Fast & Simple: Compare and Apply Today

| Binixo – Fast & Convenient Loan Matching Platform in the Philippines | Apply |

| Cash-Express – Online Fast Cash Loan Service | Apply |

| Kviku – Instant Online Loan with 0% Interest for New Clients | Apply |

| Finami – Fast & Easy Online Loans 24/7 | Apply |

| LoanOnline.ph – Compare Loans in Just 2 Minutes | Apply |

| Digido – Instant Online Loans up to ₱25,000 (0% Interest for First Loan) | Apply |

| Finloo – Find the Best Online Loan in Just 5 Minutes | Apply |

| CashSpace – Quick Online Loans in the Philippines (24/7) | Apply |

Our review aims to clearly understand what MoneyCat offers, how it stands out in the competitive market, and whether it aligns with your financial requirements. Stay with us as we delve into the details of MoneyCat’s services, policies, customer feedback, and more to help you make an informed decision.

Pros and Cons of MoneyCat

Pros of MoneyCat Philippines:

- Fast – MoneyCat offers an online loan application, making it quick to apply for financial assistance.

- Flexible Loan Amount – Borrowers have the flexibility to choose their desired loan size.

- Initial Credit Limit – MoneyCat provides an initial credit limit to borrowers. Thus, allowing them to access funds whenever required.

Cons of MoneyCat Philippines:

- Eligibility Criteria – MoneyCat Philippines can make it challenging for some individuals to qualify for a loan.

- Operating Online – MoneyCat’s services provide online lending only.

- Possible Debt Trap – If borrowers fail to manage their repayments properly, they may fall into a cycle of debt due to high interest rates and fees.

Key Points

MoneyCat Loans provides a legit and accessible option for individuals in the Philippines to borrow money through cash loans. With flexible loan amount options and clear requirements, borrowers can apply easily. The company’s legitimacy ensures a trustworthy lending experience. However, consider your credit situation and manage repayments responsibly to avoid potential challenges. MoneyCat PH offers a reliable solution for those in need of quick cash assistance.

| Features | Details |

| Interest rate | 11.9% per month |

| Loan Amount | PHP 1,000 to 10,000 |

| Loan Tenure | Up to 180 days |

| Approval Time | Within 24 hours |

| Processing Fee | None |

Full Review

In this loan review of MoneyCat’s online services, we will examine its efficiency and reliability in providing loans. We will assess the ease of applying, timely disbursement of funds, and required documentation. We will also evaluate the company’s firmness to on-time online loan payback.

What is MoneyCat?

MoneyCat Philippines is a reputable online lending platform that offers a cash loan to individuals in need of financial help. As a trusted loan provider, MoneyCat aims to give accessible solutions to borrowers. They want to meet their urgent requirements.

Through their user-friendly website and mobile app, MoneyCat simplifies the loan request process. Borrowers can easily apply for a loan. They need to provide the necessary information and supporting documentation. The platform considers various factors in determining the loan you are eligible for. This includes your credit history.

One of the advantages of MoneyCat PH is its transparent cost structure. Borrowers are informed about the rate, fees, and repayment terms upfront. This ensures clear expectations. This allows borrowers to make informed decisions according to their abilities.

MoneyCat emphasizes prompt payment and encourages borrowers to repay their loan on time. By doing so, borrowers can build a positive credit history. They can potentially access higher loan amounts in the future.

| Company Name | MoneyCat |

| Founder | Igor Vadanyuk |

| Official Launch | 2015 |

| License number | CS201953073 |

Loans Provided by MoneyCat

To meet the various cash needs of individuals, MoneyCat Philippines provides a variety of loans. The following are some of the loan choices that MoneyCat offers:

- Cash Loan – MoneyCat offers cash loan options, which provide borrowers with immediate access to funds. This loan can be used for various purposes. For example, emergency expenses, debt consolidation, or personal investments.

- Salary Loan – MoneyCat PH offers a salary loan that is specifically designed for employees who need short-term assistance. These loans provide a portion of the borrower’s salary in advance. It is repaid through convenient installment payments.

- Quick Loan – MoneyCat’s quick loan option is designed for borrowers who require immediate cash for urgent needs. The application process is streamlined, and the funds are disbursed quickly upon approval.

Interest Rate for MoneyCat

A number of factors can influence the interest rate for a loan at MoneyCat in the Philippines. The rate is determined by MoneyCat after taking into account the loan’s terms, length, and the borrower’s reliability. Most of the time, the interest rate for a loan is around 11.9% per month.

MoneyCat often provides borrowers with competitive rates that are intended to be fair and reasonable. These rates try to achieve a balance between lending responsibly and helping people out. Due to the nature of Internet lending and the related risks, rates in the Philippines may be higher than those offered through conventional lenders.

Borrowers are asked to provide proof of their income and other relevant details when applying for a loan at MoneyCat. The borrower’s ability to repay the loan and the proper rate can be determined using this information. The company wants to ensure borrowers can comfortably handle their loan payments while fulfilling their other obligations.

MoneyCat Cash Loan Requirements

Borrowers in the Philippines must meet several requirements before they may apply for a loan with MoneyCat. These specifications guarantee that the procedure runs smoothly and that potential borrowers fulfill the relevant standards. These are MoneyCat’s common lending specifications:

- Age Range – To be eligible for a loan, borrowers must be of legal age, usually 21 years of age or older.

- Income – In order to determine a borrower’s capacity to repay a loan, MoneyCat frequently requests proof of income. This can be pay stubs or bank statements.

- Current Job Details – Providing information regarding one’s employment could be requested. This can be the name and contact information.

- Bank Account – In order to distribute and repay the loan, it is normally necessary to have a valid bank account.

- Contact Information – To simplify communication on their loan application and updates, borrowers must submit their current information, like a contact number.

ID`s accepted by MoneyCat

| ID Type | Name |

| Employee’s ID / Office Id | EID |

| Valid government-issued ID | PhilSys ID |

| UMID Card | Unified Multi-Purpose ID (UMID) |

How Can You Repay a Loan in MoneyCat?

MoneyCat has multiple convenient payment methods for repayment. They provide flexibility and ease for borrowers. The available options include:

- Bank Transfer – Borrowers can repay their loan by initiating a bank transfer from their personal bank accounts. They provide detailed instructions, including the necessary account information, to facilitate this method.

- Debit Card – You can make repayments using their debit cards. MoneyCat securely processes the transaction. They deduct the loan directly from the borrower’s linked debit card.

- E-Wallets – They support popular e-wallets such as PayPal, Venmo, or Skrill. Borrowers can link their e-wallet accounts to MoneyCat and conveniently transfer funds to repay their loan.

- Automated Clearing House (ACH) – ACH payments enable borrowers to set up automatic deductions from their bank accounts. This helps with timely loan paybacks without the need for manual action.

- Mobile Payment Apps – The company supports various mobile apps like Apple Pay or Google Pay. Borrowers can easily make repayments using their smartphones, leveraging the convenience of these widely used apps.

Exclusive Features of MoneyCat

MoneyCat offers a number of unique features that set it apart from other similar platforms:

- Fast Approval – They provide quick loan approval, often within minutes. They let borrowers access funds swiftly and address their needs promptly.

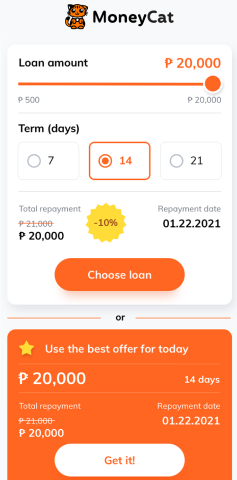

- Flexible Loan – The company offers a range of amounts. Borrowers can select the specific amount that suits their requirements. This allows for personalized borrowing solutions.

- Customizable Repayment Plans – It allows borrowers to customize their loan plans for repayment based on their income circumstances. This flexibility empowers borrowers to choose repayment terms that align with their budgets as well as repayment capabilities.

- No Collateral Needed – The company offers unsecured loans, eliminating the need for collateral. This feature enables borrowers to obtain funds without risking their valuable assets.

- Credit Score Improvement – MoneyCat reports loan repayment activities to credit bureaus. This provides you with an opportunity to boost your credit score by making repayments on time.

MoneyCat Customer Support

MoneyCat offers excellent customer support to assist borrowers with their inquiries and concerns. Customers can reach out to the support team via phone at +1-800-123-4567 or email at [email protected]. The customer support team is available Monday to Friday, 9:00 AM to 6:00 PM (local time), ensuring prompt assistance during working hours.

MoneyCat Mobile Аpp Review

The MoneyCat mobile app is a convenient tool for managing your financial needs on the go. With its intuitive interface and robust features, it provides a seamless experience for borrowers.

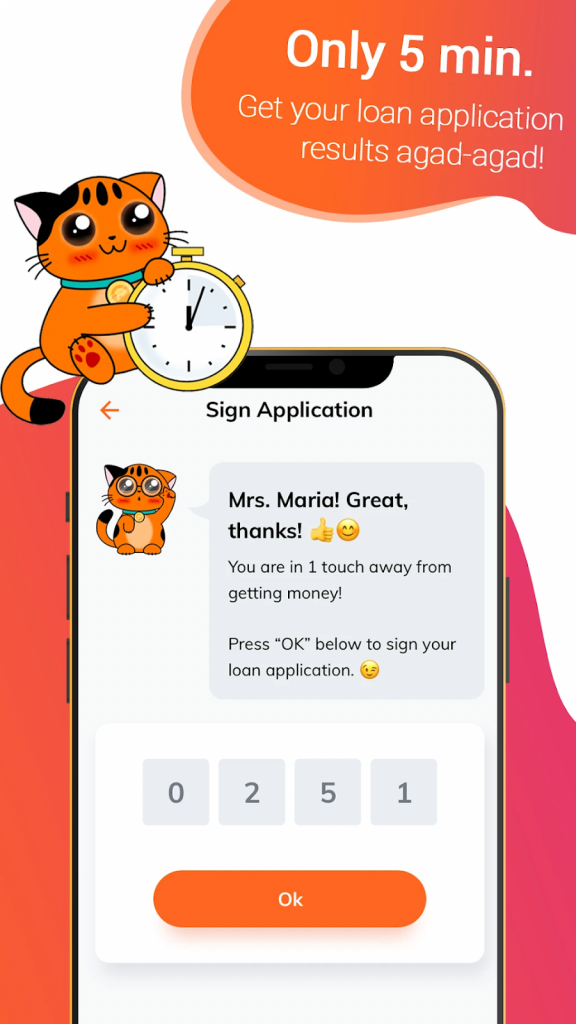

One of the key highlights of the app is the easy log-in process. Users can securely access their accounts by entering their username and password or utilizing biometric authentication, such as fingerprint or facial recognition. This streamlined log-in ensures quick access to account information as well as loan details.

The app has a lot of features to improve the borrowing experience. Users can view their loan balance, repayment schedule, and transaction history at a glance. They can also make loan paybacks directly through the app using various payment methods, ensuring convenience and timely clearance of their obligations.

The mobile app provides personalized notifications, keeping users informed about upcoming payment due dates, loan offers, and important updates. This proactive approach helps borrowers stay on top of their financial commitments and make informed decisions.

The MoneyCat mobile app offers a reliable platform for borrowers, with its effortless log in process, comprehensive account management capabilities, and user-friendly interface.

How Does the MoneyCat App Work?

The MoneyCat app is made to offer borrowers a simple and practical way to manage their financial demands. Here’s how the app works:

- Account Creation – Users can download the MoneyCat app from the app store and create an account by providing personal information. This typically includes details like name, contact information, and identification verification.

- Loan Application – Once the account is created, borrowers can apply for a loan directly through the app. They can specify the desired loan size and customize the repayment terms based on their preferences and financial situation.

- Approval Process – The app utilizes advanced algorithms and data analysis to assess the loan request. The approval process is typically quick, with borrowers receiving a decision within minutes. Approved borrowers can review and accept the loan offer directly within the app.

- Loan Management – Once the loan is disbursed, borrowers can access comprehensive loan management features through the app. They can view their loan balance, repayment schedule, and transaction history.

- Repayment – The MoneyCat app offers multiple payment methods for loan repayment. Borrowers can make payments directly within the app using options like bank transfers, debit cards, or e-wallets. The app ensures secure and convenient transactions.

How do I create a MoneyCat account?

To create a MoneyCat account, follow these step-by-step instructions:

- Download the MoneyCat mobile app from your device’s app store.

- Open the app and select the “Create Account” or “Sign Up” option.

- Fill in the needed personal information, such as your name, email address, phone number, and password.

- Provide any additional details requested, such as your date of birth, employment information, or identification verification.

- Look into the terms and conditions, as well as the privacy policy and other legal documents. Accept them if you agree.

- Verify your email address or phone number if prompted by clicking on the verification link or entering the verification code sent to you.

- Set up security measures, such as a PIN or biometric authentication (if available), to ensure the safety of your account.

- Once all the information is entered and verified, submit your account creation request.

- Wait for the confirmation message or email!

Whom MoneyCar Suits Better?

MoneyCat is appropriate for people who require swift and adjustable solutions to their finances. It serves a broad range of borrowers. This includes students, independent contractors, small business owners, and anyone experiencing brief cash flow problems. It is the perfect alternative for people looking for accessible borrowing options. It is great due to its quick approval process and adaptable repayment plans.

FAQ

-

Is MoneyCat legal in the Philippines?

MoneyCat PH operates legally. They are registered under CS201953073 and have a certificate of authority.

-

Is it okay to pay in advance in MoneyCat?

Yes, paying in advance in MoneyCat is often acceptable. Paying in full upfront can assist in lowering the remaining loan debt and perhaps cut interest costs.

-

How do I edit information on MoneyCat?

By opening your account and going to the profile or settings section, you may update the information that is displayed on MoneyCat.

-

How do you get approved for MoneyCat?

In order to get approved, you have to show some form of identification, such as your bank account number, passport, etc.

-

What is the highest credit limit in MoneyCat?

The maximum limit you can borrow with MoneyCat is 20000 PHP.

MoneyCat Competitors

| Company | Loan Amount (PHP) | Interest Rate | Loan Term | Our Review |

|---|---|---|---|---|

| Digido | 1,000 – 25,000 | From 0% to 11.9% | Up to 30 days | Read Digido Review |

| CashMart | 3,000 – 150,000 | From 0,8% to 3,5% | Up to 6 months for new loan | Read CashMart Review |

| EasyCash | 5,000 – 25,000 | 0,33%-1% | From 1 to 300 days | Read EasyCash Review |

| Crezu | 1,000 – 25,000 | From 1.5% per month to 30% per year | From 3 to 12 months | Read Crezu Review |

| CashMe | 2,000 – 20,000 | 0,08% per day | Up to 3 months | Read CashMe Review |

| Blend | 50000 – 2 million | From 1,5% to 3% monthly | Up to 36 months | Read Blend Review |

| Binixo | 2000 – 30000 | 1% per day | From 7 days to 30 days | Read Binixo Review |

| Asteria Lending Inc | 2000 – 50000 | 0.2% per day | From 30 days to 120 days | Read Asteria Review |

| Loanmoto | 1,000 – 12,000 | 4% – 6% per month | Read Loanmoto Review | |

| Finbro | 1,000 – 50,000 | 0.5% – 1.25% per day | Up to 12 months | Read Finbro Review |

| Kviku | 500 – 25,000 | 1.2% per month | Up to 180 days | Read Kviku Review |

| Binixo | 2000 – 30000 | 1% per day | From 7 days to 30 days | Read Binixo Review |

| PesoQ | 5,000 – 20,000 | 4% – 6% per month | 91 – 365 days | Read PesoQ Review |

| GCash | 5,000 – 25,000 | From 3% to 15% | From 15 to 90 days | Read GCash Review |

| CashBee | 2,000 – 20,000 | 0,3% daily | From 30 to 120 days | Read CashBee Review |

| Revi Credit Philippines | 1000 – 250,000 | 1% – 5% | From 6 to 36 months | Read Revi Credit Review |

| Tala | 1,000 – 25,000 | 15% – 15.7% | From 15 to 61 days | Read Tala Review |

| OKPeso | 2,000 – 20,000 | Up to 24% | From 96 to 365 days | Read OKPeso Review |

| Vamo | 1,000 – 30,000 | From 1,3% | From 10 to 3000 days | Read Vamo Review |

| Flexi Finance | Up to 25,000 | From 365 to 1460 days | Read Flexi Finance Review | |

| JuanHand | Up to 50,000 | 14.7% per month | From 14 to 90 days | Read JuanHand Review |

| Moca Moca | 2,000 – 35,000 | 0.83% per month | From 180 to 365 days | Read Moca Moca Review |

| RoboCash | 1,000 – 25,000 | From 0% to 11.9% | Up to 30 days | Read RoboCash Review |