Loanmoto App Review

Loanmoto stands out as a reputable financial institution in the Philippines, dedicated to providing hassle-free and accessible loan services. Catering to a wide range of financial needs, Loanmoto offers loan amounts from 1,000 PHP to 12,000 PHP, accommodating various customer requirements.

Loan Offers Tailored for You—Request Now

| Binixo – Fast & Convenient Loan Matching Platform in the Philippines | Apply |

| Cash-Express – Online Fast Cash Loan Service | Apply |

| Kviku – Instant Online Loan with 0% Interest for New Clients | Apply |

| Finami – Fast & Easy Online Loans 24/7 | Apply |

| LoanOnline.ph – Compare Loans in Just 2 Minutes | Apply |

| Digido – Instant Online Loans up to ₱25,000 (0% Interest for First Loan) | Apply |

| Finloo – Find the Best Online Loan in Just 5 Minutes | Apply |

| CashSpace – Quick Online Loans in the Philippines (24/7) | Apply |

What sets Loanmoto apart is its streamlined and user-friendly application process. Designed to be completed in a mere 5 minutes, this efficient system ensures swift approval, enabling customers to receive their funds within just 24 hours. This promptness in processing and disbursal makes Loanmoto a reliable option for urgent financial needs.

Recognizing the unpredictability of financial demands, Loanmoto operates round the clock, ensuring its services are available 24/7. This includes weekends and holidays, ensuring that you have access to financial assistance whenever the need arises. With Loanmoto, you can rest assured that fast, convenient, and reliable financial support is always within reach.

Pros and Cons Of Loanmoto

Loanmoto has established itself as a notable online loan service in the Philippines, offering significant advantages for those seeking financial solutions. Key benefits include rapid loan approvals, versatile repayment options, and an intuitive mobile application interface. These features make Loanmoto an appealing choice for individuals needing swift financial assistance.

Advantages of Loanmoto

- Loanmoto stands out for its efficiency. The application process is streamlined, taking approximately 5 minutes, which is ideal for busy individuals.

- Understanding the urgency of financial needs, Loanmoto ensures prompt decision-making, providing quick approvals.

- Offering loans ranging from 1,000 PHP to 12,000 PHP, Loanmoto caters to a variety of financial requirements, allowing borrowers to select an amount that aligns with their needs.

- Prioritizing customer confidentiality, Loanmoto guarantees a secure platform, ensuring the protection of borrower’s data.

Cons

- Borrowers may face challenges in altering bank account details for loan repayment, potentially causing inconvenience.

- Some users have reported lag in the reflection of loan repayments, leading to potential misunderstandings.

- There have been instances of inadequate response from Loanmoto’s customer support, which could be a significant drawback for those seeking prompt assistance.

- The absence of readily available hotline information might hinder immediate communication needs.

Key Points

Experience the convenience of Loanmoto’s quick loan approval process, allowing you to receive the money you need within 24 hours.

| Key Points | Details |

| Quick Loan Approval Process | Loanmoto offers swift approval, ensuring you receive funds within 24 hours of application. |

| Loan Amounts and Interest Rates | Ranges from 1000 PHP to 12000 PHP, with interest rates varying between 4.00% and 6.00% per month. |

| Minimal Documentation Process | Application takes less than 10 minutes with minimal documentation requirements, prioritizing quick and easy processing. |

| 24/7 Accessibility | Operates 24/7, including weekends and holidays, ensuring continuous access to loans when needed. |

| Data Security and Confidentiality | Guarantees strict data protection measures to ensure the security and confidentiality of personal information. |

| Flexible Repayment Options and Loan Extension | Allows changing bank card accounts for repayment, offers loan extension options post payment and renewal, enhancing repayment flexibility. |

| Reapplication Flexibility after Rejection | In case of rejection, reapplication is possible after 15 days, providing another chance for approval. |

| Regulatory Compliance and Reliability | Registered with the SEC, Loanmoto is a trusted lending company with a high approval rate, ensuring reliability and adherence to regulations. |

| Hassle-free Process and Financial Improvement | Offers a hassle-free loan process, aiming to contribute to improving financial well-being for its clients. |

What is Loanmoto?

Loanmoto is a mobile lending app that provides quick and hassle-free loans, allowing you to access the money you need within 24 hours. As an online loan provider operated by U-Peso.PH Lending Corporation, Loanmoto, offers short-term, unsecured loans with flexible repayment terms.

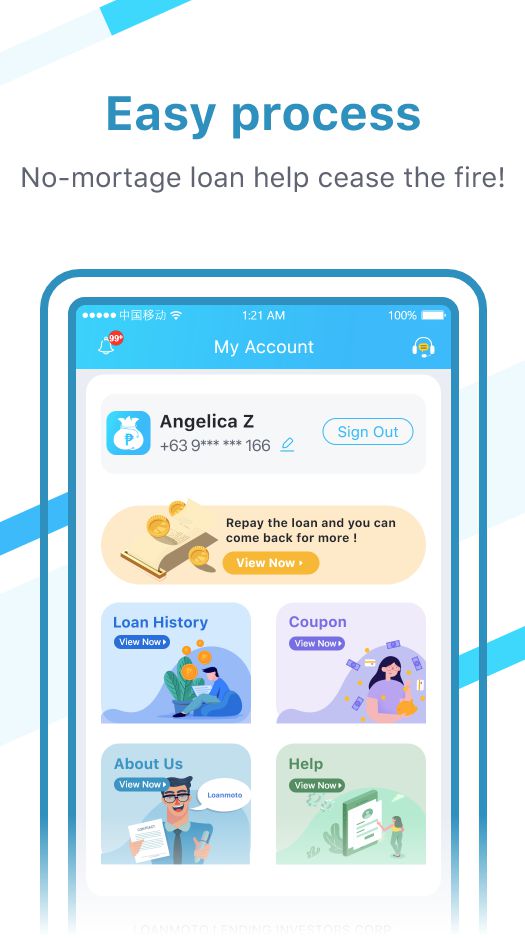

Through their intuitive mobile loan app, the loan application process takes less than 10 minutes, making it convenient for individuals who are in need of immediate funds. The app interface is user-friendly, ensuring a seamless experience for borrowers.

Loanmoto charges an interest rate of 4% to 6% per month, making it a viable option for those looking for affordable loan options. Moreover, Loanmoto is a legit lending app registered with the Securities and Exchange Commission (SEC), assuring customers that their financial transactions are safe and secure.

With minimal documentary requirements, Loanmoto aims to simplify the loan application process, allowing borrowers to easily register and select their desired loan amount and payment option. Loanmoto also provides a built-in loan calculator in their mobile app, helping borrowers determine the total loan amount and repayment terms.

Loanmoto accepts payments through the loan reference number or authorized payment partners to ensure convenient loan repayments. Additionally, Loanmoto can be contacted through email and has a physical address in Paranaque, Metro Manila.

However, it’s important to note that some customers have raised concerns about high service fees and aggressive collection methods by Loanmoto.

Loans Provided by Loanmoto

Loanmoto stands out in the Philippine lending landscape with its diverse loan offerings, tailored to accommodate a broad spectrum of financial requirements. Their portfolio encompasses Personal Loans, Salary Loans, and Business Loans, each uniquely designed to cater to specific financial scenarios.

Personal Loan Offering

Loanmoto’s Personal Loan is the epitome of convenience and efficiency. Catering to a range of financial needs, the loan amounts span from 1000 PHP to 12000 PHP. This flexibility makes it an ideal choice for various personal expenses. The application process is remarkably streamlined and can be completed swiftly, with approvals typically granted promptly. Funds are transferred within 24 hours, ensuring borrowers have quick access to the needed financial support. With Loanmoto, borrowers benefit from flexible repayment terms and a high approval rate, all within a secure and reliable service framework.

Salary Loan Service

The Salary Loan service by Loanmoto is a thoughtful financial solution for those requiring interim funds between paychecks. This loan option is particularly beneficial in addressing unforeseen expenses. Applicants can easily apply through Loanmoto’s mobile app, with the loan amount tailored to individual eligibility, usually within the 1000 PHP to 12000 PHP range. Interest rates are set between 4.00% to 6.00% per month, balancing affordability and accessibility. The prompt approval process and rapid fund disbursement within 24 hours make LoanMoTo’s Salary Loan a convenient choice for immediate financial relief.

Business Loan Provision:

For entrepreneurs and business owners, Loanmoto’s Business Loan emerges as a vital financial tool. This loan supports business-related financial needs, including expansion, equipment acquisition, and cash flow management. Loan amounts are versatile, ranging from 1,000 PHP to 12,000 PHP, catering to businesses of diverse scales. The interest rates for these loans are competitive, lying in the 4.00% to 6.00% per month bracket, ensuring manageable repayments. The online application process adds to the convenience, allowing entrepreneurs to apply digitally through Loanmoto’s app and receive immediate approval, reflecting Loanmoto’s commitment to facilitating business growth in the Philippines through efficient and supportive lending services.

Best Online Loans Similar to Loanmoto

We’re set to showcase a table that catalogs leading online loan platforms in the Philippines, each offering services similar to Loanmoto.

| Company | Loan Amount (PHP) | Interest Rate | Loan Term |

|---|---|---|---|

| Digido | 1,000 – 25,000 | From 0% to 11.9% | Up to 30 days |

| MoneyCat | 500 – 20,000 | Up to 11.9% per month | Up to 180 days |

| Kviku | 500 – 25,000 | 1.2% per month | Up to 180 days |

| Cashspace | 1000 – 25,000 | 1.3% per month | 2 – 4 months |

Interest Rate for Loanmoto

To fully understand the loan options available, it’s important to consider the interest rates offered by Loanmoto. These rates range from 4.00% to 6.00% per month and can vary depending on the loan amount and repayment term.

Loanmoto aims to provide affordable and flexible loan options to meet the diverse needs of its customers. The interest rate is an essential factor to consider when applying for a loan, as it determines the overall cost of borrowing. Loanmoto’s interest rates allow borrowers to access quick and convenient loans without worrying about exorbitant charges.

Whether you need a small loan for a short-term expense or a larger one for a more significant financial need, Loanmoto offers competitive rates designed to be affordable and manageable. It’s important to note that the interest rates offered by Loanmoto are subject to change and may vary based on prevailing market conditions.

However, the company strives to provide transparent and fair rates to its customers. By offering a range of interest rates, Loanmoto ensures that borrowers have options that suit their individual financial circumstances and repayment capabilities.

Overall, Loanmoto’s interest rates are competitive and make their loan options accessible to many borrowers. Whether you need a loan for an emergency or to fund a personal expense, Loanmoto provides a reliable and affordable solution.

Loanmoto Requirements

Loanmoto, a prominent financial entity in the Philippines, stipulates clear and straightforward requirements for loan applicants. Ensuring eligibility is key for prospective borrowers to access the financial solutions offered by Loanmoto.

Nationality and Age Criteria

At the forefront of the eligibility criteria is the stipulation that applicants must be Filipino citizens or permanent residents of the Philippines. This criterion underscores Loanmoto’s commitment to serving the financial needs of the local populace. Additionally, applicants must be at least 21 years old, aligning with the country’s legal age for financial accountability and independence.

Identification and Residency Proof

A pivotal requirement is the possession of a valid, government-issued identification document. This ID is a primary means of verifying the applicant’s identity and legal status. Alongside this, proof of residence is essential. This requirement ensures that Loanmoto can reliably establish the applicant’s current living situation and maintain contact throughout the loan process.

Credit History Consideration

A critical aspect of the eligibility process is assessing the applicant’s credit history. A good credit standing heightens the likelihood of loan approval and potentially increases the available loan limit. This emphasis on credit history reflects Loanmoto’s prudent risk management and endeavor to offer higher loan amounts to responsible borrowers.

How Do You Get Approved for Loanmoto

Looking to get approved for a Loanmoto loan? Wondering what you need to do? Well, let me tell you, it’s easier than you think!

Loanmoto has a simple and straightforward loan application process that can be completed in just a few minutes. You need to meet certain requirements to get approved for a Loanmoto loan.

You must be a Filipino citizen or a permanent resident of the Philippines, aged between 21 and 55 years old. You also need to have a valid government-issued ID and proof of residence.

Once you have all the necessary documents, you can download the Loanmoto mobile app, register with your personal information, select the loan amount and payment option, and submit your application.

Loanmoto will then review your application and if approved, you can expect to receive the money in your bank account within 24 hours. It’s that simple!

ID`s accepted by Loanmoto

When applying for a loan with Loanmoto, you can use your valid government-issued ID as one of the accepted forms of identification. Loanmoto understands the importance of verifying the borrower’s identity and ensuring the security of their services.

They accept various types of government-issued IDs, such as the Philippine Passport, Unified Multi-Purpose ID (UMID), Social Security System (SSS) ID, PhilHealth ID, Driver’s License, and Postal ID. These IDs serve as proof of your identity and citizenship, which are essential requirements for loan application approval.

By accepting a range of government-issued IDs, Loanmoto aims to make their loan services accessible to a wide range of individuals. It is important to note that the ID should be valid and not expired to be accepted by Loanmoto.

By providing a valid government-issued ID during the loan application process, borrowers can ensure a smooth and hassle-free experience with Loanmoto.

How Can You Repay a Loan in Loanmoto

Moving on to the next subtopic, let’s explore how to repay a loan in Loanmoto. Loanmoto provides various convenient options for loan repayment.

Once you have received your loan amount, it’s important to ensure timely repayment to avoid any penalties or late fees. Loanmoto offers multiple payment methods to cater to different preferences.

One option is to pay using the loan reference number provided. This can be done through authorized payment partners conveniently located in various branches across the Philippines. You can easily settle your loan amount by visiting one of these payment partners.

Additionally, Loanmoto allows customers to change their bank account for loan repayment. If you wish to update your bank card account, you can do so while there is no existing credit. This flexibility ensures you can use your preferred bank account for loan repayment.

It’s important to note that Loanmoto enforces strict collection methods if loan payments are not made on time. Therefore, adhering to the agreed-upon repayment schedule is crucial to avoid any complications.

Overall, Loanmoto provides customers with convenient options for loan repayment, allowing them to fulfill their financial obligations easily and efficiently.

Whom Loanmoto Loan Suits Better?

Loanmoto stands out as a versatile financial solution, adeptly tailored to cater to a diverse array of financial needs in the Philippines. It particularly resonates with specific groups of individuals, making it a preferred choice for many seeking convenient and flexible financial assistance.

Ideal for Urgent Financial Needs

Loanmoto’s expedited application process, which can be seamlessly completed within minutes via their mobile app, positions it as an ideal choice for individuals facing urgent financial needs. Whether it’s an unexpected medical emergency, sudden home repairs, or any unforeseen expenditure, Loanmoto offers a lifeline by providing rapid access to funds.

Flexible Repayment Framework

Those who value flexibility in financial commitments will find Loanmoto’s varied repayment options advantageous. Borrowers have the liberty to select a repayment plan that aligns with their financial status and income flow. This adaptability is particularly beneficial for individuals with fluctuating or irregular income patterns, as it allows them to manage repayments without undue stress.

Accessibility for a Broad Demographic

With minimal requirements such as a valid government-issued ID and proof of residence, Loanmoto extends its services to a broad spectrum of the population. Filipino citizens or permanent residents above the age of 21, regardless of their specific financial background, can easily access Loanmoto’s services. This inclusivity makes Loanmoto a practical option for a wide range of individuals, from young professionals to established adults, seeking reliable financial assistance.

Exclusive Features of Loanmoto

Moving on from discussing whom Loanmoto loans suit better, let’s now explore the exclusive features that Loanmoto offers. Loanmoto stands out from other lending platforms due to its innovative and customer-centric approach.

One notable feature is the loan calculator integrated into their mobile app, which allows borrowers to determine their repayment terms and interest rates before applying for a loan. This transparency empowers borrowers to make informed decisions about their financial obligations.

Loanmoto also offers a VIP program for frequent borrowers with good credit standing. This program provides additional benefits and perks, such as higher loan limits and lower interest rates. It rewards loyal customers and encourages responsible borrowing habits.

Furthermore, Loanmoto’s mobile app is designed to be user-friendly and intuitive, making the entire loan application process hassle-free and convenient.

In terms of customer support, Loanmoto has taken measures to address previous concerns. They can now be contacted through email, providing an avenue for customers to reach out for assistance or inquiries. Additionally, Loanmoto has a physical address in Paranaque, Metro Manila, further establishing their legitimacy and commitment to serving their customers.

With these exclusive features, Loanmoto continues to solidify its position as a trusted and reliable lending platform in the Philippines. They prioritize customer satisfaction, ensuring that their loan services cater to the diverse needs of their clientele.

Loanmoto Customer Support

Loanmoto’s commitment to providing excellent customer support is evident through their responsive email communication and their establishment of a physical address in Paranaque, Metro Manila. Customers can reach out to Loanmoto through email to address any concerns or inquiries they may have. The company strives to provide timely and helpful responses to ensure customer satisfaction.

The company has also made their presence known by establishing a physical address in Paranaque, Metro Manila. This allows customers to have a direct point of contact with the company if needed. Whether it’s for discussing loan repayment options, resolving any issues, or seeking general assistance, customers can visit the Loanmoto office and speak with a representative in person.

By offering both email communication and a physical address, Loanmoto demonstrates their dedication to providing accessible and reliable customer support. This ensures that customers can easily reach out to the company and receive the assistance they need. Loanmoto understands the importance of addressing customer concerns promptly and efficiently, and they strive to uphold their reputation for excellent customer service.

Frequently Asked Questions

Can I change my bank account for loan repayment in Loanmoto?

Yes, borrowers can change their bank account for loan repayment in Loanmoto. However, the specific process for changing the bank account is not mentioned in the provided information.

Is there a hotline number for Loanmoto’s customer service?

Yes, there is a hotline number available for Loanmoto’s customer service. Customers can contact the hotline for any inquiries or concerns regarding their loan application or repayment process.

How can I contact Loanmoto for support or inquiries?

Customers can contact Loanmoto for support or inquiries by emailing their provided email address. They can also visit their physical address in Paranaque, Metro Manila.

What are the available payment options for loan repayment in Loanmoto?

Loanmoto offers multiple payment options for loan repayment, including payment through the Loanmoto app using the loan reference number and through authorized payment partners.

What are the consequences of late loan payments in Loanmoto?

Late loan payments in Loanmoto can result in consequences such as late payment fees and collection methods being enforced. Making loan payments on time is important to avoid additional charges and potential negative impacts on credit history.

Conclusion

In conclusion, Loanmoto is a trusted and reliable option for individuals seeking quick and hassle-free loans in the Philippines. With a convenient mobile wallet service and a fast application process, customers can expect immediate approval and money received within 24 hours.

Loanmoto operates 24/7, ensuring accessibility even on weekends and holidays. While there have been concerns about the lengthiness of the application process and customer service response, Loanmoto offers exclusive features such as loan extensions and reapplication after rejection.

Overall, Loanmoto is a reputable financial company that provides loans for all your needs.

Loanmoto Competitors

Read OKPeso Review

| Company | Loan Amount (PHP) | Interest Rate | Loan Term | Our Review |

|---|---|---|---|---|

| Digido | 1,000 – 25,000 | From 0% to 11.9% | Up to 30 days | Read Digido Review |

| MoneyCat | 500 – 20,000 | Up to 11.9% per month | Up to 180 days | Read MoneyCat Review |

| CashMart | 3,000 – 150,000 | From 0,8% to 3,5% | Up to 6 months for new loan | Read CashMart Review |

| EasyCash | 5,000 – 25,000 | 0,33%-1% | From 1 to 300 days | Read EasyCash Review |

| Crezu | 1,000 – 25,000 | From 1.5% per month to 30% per year | From 3 to 12 months | Read Crezu Review |

| CashMe | 2,000 – 20,000 | 0,08% per day | Up to 3 months | Read CashMe Review |

| Blend | 50000 – 2 million | From 1,5% to 3% monthly | Up to 36 months | Read Blend Review |

| Binixo | 2000 – 30000 | 1% per day | From 7 days to 30 days | Read Binixo Review |

| Asteria Lending Inc | 2000 – 50000 | 0.2% per day | From 30 days to 120 days | Read Asteria Review |

| Finbro | 1,000 – 50,000 | 0.5% – 1.25% per day | Up to 12 months | Read Finbro Review |

| Kviku | 500 – 25,000 | 1.2% per month | Up to 180 days | Read Kviku Review |

| Binixo | 2000 – 30000 | 1% per day | From 7 days to 30 days | Read Binixo Review |

| PesoQ | 5,000 – 20,000 | 4% – 6% per month | 91 – 365 days | Read PesoQ Review |

| GCash | 5,000 – 25,000 | From 3% to 15% | From 15 to 90 days | Read GCash Review |

| CashBee | 2,000 – 20,000 | 0,3% daily | From 30 to 120 days | Read CashBee Review |

| Revi Credit Philippines | 1000 – 250,000 | 1% – 5% | From 6 to 36 months | Read Revi Credit Review |

| Tala | 1,000 – 25,000 | 15% – 15.7% | From 15 to 61 days | Read Tala Review |

| OKPeso | ||||

| Vamo | 1,000 – 30,000 | From 1,3% | From 10 to 3000 days | Read Vamo Review |

| Flexi Finance | Up to 25,000 | From 365 to 1460 days | Read Flexi Finance Review | |

| JuanHand | Up to 50,000 | 14.7% per month | From 14 to 90 days | Read JuanHand Review |

| Moca Moca | 2,000 – 35,000 | 0.83% per month | From 180 to 365 days | Read Moca Moca Review |

| RoboCash | 1,000 – 25,000 | From 0% to 11.9% | Up to 30 days | Read RoboCash Review |