Kviku Loan App Review

Looking for a reliable online lending platform in the Philippines? Look no further than Kviku! With its fully automated loan process, low interest rates, and quick approval and disbursement times, Kviku is a convenient solution for those needing fast funds.

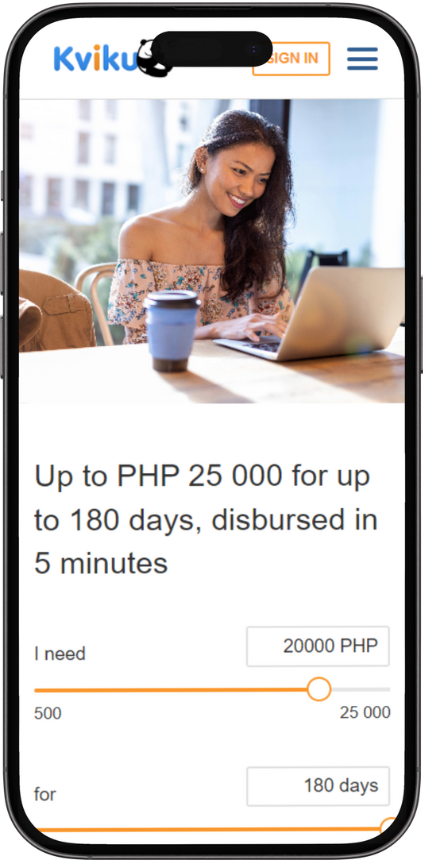

Borrowers can apply for loans ranging from P500 to P25,000, with flexible repayment options. Rest assured that Kviku operates within the regulations of the law to protect consumers from unscrupulous lenders.

While there have been some complaints about high interest rates and difficulty contacting customer support, Kviku aims to provide transparent and competitive services.

So if you’re looking for a hassle-free borrowing experience with competitive rates, Kviku may be the right choice. Read on to learn more about the pros and cons of Kviku and exclusive features that set it apart from other lenders.

Key Points

| Features | Details |

| Operating Hours | 24/7 availability |

| Approval and Disbursement | Quick approval and disbursement |

| Loan Limits | Flexible loan limits |

| Repayment Periods | Flexible repayment periods |

| Transparency | Transparent interest rates and fees |

| Application Process | Convenient online applications and fast processing |

Pros and Cons of Kviku

Kviku Philippines offers several advantages to borrowers, including a fully automated and convenient online application process, quick approval and disbursement of funds, and flexible loan limits and repayment periods.

However, there are also some drawbacks to consider. These include high interest rates compared to traditional bank loans and potential penalties for late payments.

Overall, it’s important for individuals to carefully evaluate the pros and cons before deciding to borrow from Kviku Philippines.

Pros

Imagine having access to a lending service that operates 24/7 and provides quick approval and disbursement. It also offers flexible loan limits and repayment periods, ensuring interest rate and fee transparency.

With Kviku Philippines, you can enjoy all of these advantages. Online applications’ convenience and fast processing allow borrowers to access funds when needed easily.

The transparent interest rates and fees provide peace of mind, allowing borrowers to make informed financial decisions. Kviku empowers individuals by providing a reliable and accessible lending solution.

Cons

Beware of the potential drawbacks when considering using this lending service. While Kviku offers convenient online loans, there are some downsides to be aware of.

Customers have complained about high interest rates, lack of customer service, and difficulty in contacting Kviku.

Negative reviews on Google My Business raise concerns about predatory lending practices and transparency issues during the loan application process.

It’s important to carefully evaluate these factors before borrowing from Kviku Philippines.

What is the Kviku Loan

To understand what Kviku Loan is, let me explain: it is an online lending service that offers fully automated loans with low interest rates and a simple application process. Borrowers can apply for loans ranging from P500 to a maximum of P25,000 through the Kviku website.

The loan application involves filling out an online form and waiting for approval. After approval, the funds are disbursed within 24-48 hours.

This convenient and user-friendly platform provides quick access to funds for those needing financial assistance.

Loans provided by Kviku

Kviku offers a variety of loans to cater to different financial needs. Whether it’s an online loan for quick access to funds, personal loans for more substantial expenses, or specialized loans designed specifically for veterans, Kviku has options.

With their user-friendly platform and transparent terms, Kviku aims to provide reliable lending solutions to its customers.

Online Loan

Online loans can provide a quick and hassle-free solution if you’re looking for a convenient way to borrow money. With Kviku’s online loan service, borrowers can easily apply for loans ranging from ₱1,000 to ₱25,000 through their website.

The application process is simple and requires filling out an online form with personal information. Once approved, the loan amount will be deposited into the borrower’s bank account within one hour. This allows borrowers to access funds quickly and conveniently without needing traditional paperwork or visits to a physical branch.

Personal Loans

When considering personal loans, it’s essential to carefully review the terms and conditions to ensure they align with your financial goals and circumstances.

Personal loans from Kviku Philippines offer quick and easy access to funds, competitive interest rates, and flexible loan terms.

With loan amounts ranging from P1,000 to P25,000 and repayment periods of 3 to 6 months, Kviku allows borrowers to meet their financial needs while maintaining control over their finances.

Loans For Veterans

Veterans can benefit from loans that cater specifically to their needs and provide them with the financial support they deserve. These loans offer special terms and conditions tailored to veterans, recognizing their service and sacrifice.

By providing accessible funding options, these loans aim to empower veterans in their post-military lives. Whether it’s for education, housing, or starting a business, these loans can help veterans achieve their goals and create a brighter future for themselves and their families.

Interest Rate for Kviku

The interest rate for Kviku loans in the Philippines may be higher than that of conventional bank loans, but it offers quick and easy access to funds with flexible loan terms.

While the exact interest rate may vary depending on factors such as creditworthiness and loan amount, Kviku aims to provide competitive rates to its customers.

It is important for borrowers to carefully consider their repayment capabilities before taking out a loan and ensure they can meet the financial obligations associated with it.

Kviku Loan Requirements

Moving on to the next important aspect, let’s discuss the Kviku loan requirements.

To avail of a loan from Kviku, individuals must meet certain criteria. Filipino citizens between 20 and 55 must possess a valid government ID, have an active mobile phone number, and maintain a bank account.

These requirements ensure that borrowers are eligible for the loans provided by Kviku.

How Do You Get Approved for a Kviku Loan

To successfully secure a Kviku loan, you must meet the eligibility criteria and complete the straightforward application process.

As long as you’re a Filipino citizen aged between 20 and 55, you’ll be eligible to apply if you have a valid government ID, an active mobile number, and a bank account.

Simply fill out the online application form with your personal information and await approval. It’s that easy to get approved for a Kviku loan!

Kviku Customer Support

If you ever need assistance with your Kviku loan or have any questions, their customer support team is available to help. They understand the importance of providing prompt and reliable support to their customers.

When you reach out to them through email, they aim to respond within 20 to 30 minutes. Their dedicated team is ready to address any concerns or inquiries, ensuring a smooth and satisfactory experience with Kviku.

Exclusive Features of Kviku

Moving on to the exclusive features of Kviku, customers can enjoy a range of benefits that set them apart from other lending platforms. With Kviku, borrowers can access quick and easy funds, competitive interest rates, and flexible loan terms.

The online application process is simple and convenient, allowing users to apply for loans anytime, anywhere. Additionally, Kviku offers transparency regarding interest rates and fees, ensuring that customers are fully informed throughout the borrowing process.

Whom Kviku Loan Suits Better?

For those needing quick and hassle-free access to funds, competitive interest rates, and flexible loan terms, Kviku is the perfect lending platform.

Whether you’re facing an unexpected financial emergency or need extra cash for personal expenses, Kviku offers a convenient solution.

With their simple application process and fast approval, borrowers can easily obtain the necessary funds without any unnecessary delays or complications.

Plus, with competitive interest rates and flexible repayment options, Kviku ensures that borrowers can manage their loans on their own terms.

Frequently Asked Questions

How long does it take to get approved for a Kviku loan?

Kviku loan approval typically takes 24-48 hours. Applicants need to fill out an online form and provide the necessary documents. Once approved, borrowers can receive their funds within 60 minutes.

What are the exclusive features offered by Kviku?

Kviku offers exclusive features such as fully automated loans, 24-hour approval, low interest rates, and transparent procedures. Borrowers can apply online, receive funds within 60 minutes, and repay through bank transfer or card.

What are the specific loan requirements for Kviku?

The specific loan requirements for Kviku include being a Filipino citizen aged between 20 and 55, having a valid government ID, an active mobile number, and a bank account.

What is the interest rate for Kviku loans?

The interest rate for Kviku loans is 0.16% per day. This rate is applied after the first two weeks, during which a 0% interest rate is offered to new customers.

Kviku Competitors

| Company | Loan Amount (PHP) | Interest Rate | Loan Term | Our Review |

|---|---|---|---|---|

| Digido | 1,000 – 25,000 | From 0% to 11.9% | Up to 30 days | Read Digido Review |

| MoneyCat | 500 – 20,000 | Up to 11.9% per month | Up to 180 days | Read MoneyCat Review |

| CashMart | 3,000 – 150,000 | From 0,8% to 3,5% | Up to 6 months for new loan | Read CashMart Review |

| EasyCash | 5,000 – 25,000 | 0,33%-1% | From 1 to 300 days | Read EasyCash Review |

| Crezu | 1,000 – 25,000 | From 1.5% per month to 30% per year | From 3 to 12 months | Read Crezu Review |

| CashMe | 2,000 – 20,000 | 0,08% per day | Up to 3 months | Read CashMe Review |

| Blend | 50000 – 2 million | From 1,5% to 3% monthly | Up to 36 months | Read Blend Review |

| Binixo | 2000 – 30000 | 1% per day | From 7 days to 30 days | Read Binixo Review |

| Asteria Lending Inc | 2000 – 50000 | 0.2% per day | From 30 days to 120 days | Read Asteria Review |

| Loanmoto | 1,000 – 12,000 | 4% – 6% per month | Read Loanmoto Review | |

| Finbro | 1,000 – 50,000 | 0.5% – 1.25% per day | Up to 12 months | Read Finbro Review |

| Binixo | 2000 – 30000 | 1% per day | From 7 days to 30 days | Read Binixo Review |

| PesoQ | 5,000 – 20,000 | 4% – 6% per month | 91 – 365 days | Read PesoQ Review |

| GCash | 5,000 – 25,000 | From 3% to 15% | From 15 to 90 days | Read GCash Review |

| CashBee | 2,000 – 20,000 | 0,3% daily | From 30 to 120 days | Read CashBee Review |

| Revi Credit Philippines | 1000 – 250,000 | 1% – 5% | From 6 to 36 months | Read Revi Credit Review |

| Tala | 1,000 – 25,000 | 15% – 15.7% | From 15 to 61 days | Read Tala Review |

| OKPeso | Up to 24% | From 96 to 365 days | Read OKPeso Review | |

| Vamo | 1,000 – 30,000 | From 1,3% | From 10 to 3000 days | Read Vamo Review |

| Flexi Finance | Up to 25,000 | From 365 to 1460 days | Read Flexi Finance Review | |

| JuanHand | Up to 50,000 | 14.7% per month | From 14 to 90 days | Read JuanHand Review |

| Moca Moca | 2,000 – 35,000 | 0.83% per month | From 180 to 365 days | Read Moca Moca Review |

| RoboCash | 1,000 – 25,000 | From 0% to 11.9% | Up to 30 days | Read RoboCash Review |