GCash Loan Review

Pros and Cons of GCash

Pros

- Perform transactions anytime, anywhere.

- Offers a wide range of services, such as money transfers, bill payments, and online shopping.

- Full integration with various merchants and businesses for cashless transactions.

Cons

- Some smaller providers may not accept this loan platform.

- To use the service effectively, you need a stable internet connection.

- Delays in loan repayments can result in additional fees and late payment charges, potentially increasing the overall loan cost.

Key Points

GCash is receiving positive reviews as a reliable and user-friendly loan platform for Filipinos. The company is secure and fast-growing, making it easy for customers to send and receive money, pay bills, and shop at local stores. The platform’s emphasis on security and reliability reassures users, while its versatility and expanding network of merchants make it attractive. Overall, this loan platform is considered a good choice for managing financial transactions in the Philippines.

| Features | Details |

| Interest rate | from 3% to 15% |

| Loan Amount | ₱5,000 to ₱25,000 |

| Loan Tenure | 15 to 90 days |

| Approval Time | 1 day |

| Processing fee | from 1.59% to 6.57% per month |

Full Review

In this loan review, our team of experts will take a look at the features and benefits of this online loan site, the leading mobile wallet service in the Philippines. With a secure and user-friendly platform, GCash Philippines has gained popularity among users who are looking for a reliable solution for their cash loan transactions. From money transfers to bill payments and online shopping, we’ll delve into GCash’s versatility and integration options. In addition, we will evaluate its convenience, reliability, and overall value to determine if this loan platform lives up to its reputation as the best choice for Philippine transactions.

What is GCash?

GCash Philippines is a mobile wallet and digital payment platform that has revolutionized the Philippine financial and loan market. This is a service offered by Mynt, a subsidiary of Globe Telecom, one of the largest telecommunications companies in the Philippines. The service allows users to store money in their digital wallets, which are accessed and managed through a mobile application. It can also be used to make money transfers, bill payments, online and in-store purchases, and cash-out options. You can link your bank accounts and your credit or debit cards to the loan accounts for a seamless transfer of funds.

GCash PH also introduced innovative features such as G-Invest, which allows users to conveniently invest in mutual funds from their loan account. In addition, this loan platform has expanded its services to include insurance, savings, and even loans, providing users with a comprehensive economic management platform.

Security is a top priority for GCash Philippines. The online loan platform uses several stages of security measures to protect user data and transactions. These include two-factor authentication, biometric verification, and encryption technologies to keep user information and funds safe.

| Company Name | GCASH AM’Z LENDING INVESTOR CORPORATION |

| Founder | Martha Sazon |

| Official Launch | 13-Feb-13 |

| License number | CS201302182 |

Loans Provided by GCash

GCash Philippines has a variety of loan options to meet the economic needs of its users. Here are some of the loan types provided by the loan platform:

- GCredit: GCredit is a digital loan line that allows users to borrow money for their immediate cash needs. It offers an initial credit limit based on the user’s transaction history, financial behavior, and other factors. Clients can borrow loan funds instantly and repay them within a specified period, typically ranging from 7 to 30 days.

- GScore: GScore is a credit-scoring feature that assesses the creditworthiness of loan users. Based on the user’s transaction history, bill payment patterns, and other data, it assigns a credit score.

- Personal Loans: This loan platform partners with various cash loan institutions to provide a personal loan to its users. These loans typically offer larger amounts and longer repayment terms compared to GCredit. Users can apply for personal loans directly through the loan application, and the loan approval and disbursement process is streamlined.

Best Online Loans Similar to GCash

Our upcoming table will reveal a variety of top-notch online loan platforms in the Philippines, each mirroring GCash’s services.

| Company | Loan Amount (PHP) | Interest Rate | Loan Term |

|---|---|---|---|

| Digido | 1,000 – 25,000 | From 0% to 11.9% | Up to 30 days |

| MoneyCat | 500 – 20,000 | Up to 11.9% per month | Up to 180 days |

| Kviku | 500 – 25,000 | 1.2% per month | Up to 180 days |

| Cashspace | 1000 – 25,000 | 1.3% per month | 2 – 4 months |

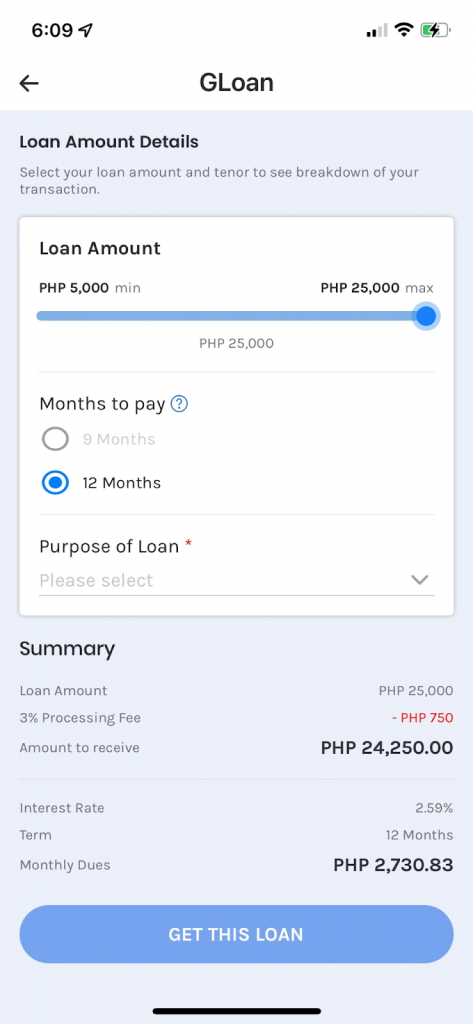

Interest Rate for GCash

GCash offers personal loans with interest rates ranging from 2.6% to 4%. These rates are dependent on factors such as the loan amount, repayment period, and the borrower’s creditworthiness. In addition to the interest charges, there is an online lending processing fee of 3% applied to the loan amount.

The specific interest rates and processing fees may vary based on the partnership agreements between this loan platform and the participating financial institutions. Users are advised to carefully review the loan details and terms within the loan app to obtain accurate and up-to-date information on the interest rates and associated fees before applying for a personal loan.

GCash Cash Loan Requirements

GCash has certain requirements that users must fulfill to be eligible for a loan. Here are some general loan requirements typically requested:

- Users need to have a verified loan account to access loan services. This includes providing personal information and completing the necessary verification process.

- Users must meet the minimum age requirement set by this loan platform, which is typically 18 years old or older.

- This loan platform evaluates the creditworthiness of users based on factors such as transaction history, bill payment behavior, and credit scores (if applicable). A good loan standing enhances the chances of loan approval and may result in better loan terms.

- Clients should demonstrate proof of ability to repay the loan by meeting the income requirements set by the loan platform or the partnering finance company.

- Clients are expected to adhere to the loan platform’s terms and conditions, including loan-specific policies and regulations.

ID`s accepted by GCash

| ID Type | Name |

| UMID | SSS |

| ID Code | driver’s license, passport |

| Valid government-issued ID | Professional Regulations Commission (PRC) |

| Pag-Ibig ID | Home Development Mutual Fund (HDMF) |

How Can You Repay a Loan in GCash?

We have explored various payment methods from GCash that are convenient for repaying loans. Here are some of the more common ones:

- GCash wallet: Borrowers can use the funds available in their GCash wallet to repay the loan. This method allows smooth and instant transactions directly from the application.

- Automatic debit facility: Some loan repayment options may allow borrowers to set up an automatic debit facility. This includes linking their loan account to their bank account or debit card, allowing loan payments to be automatically on time.

- Bank Transfer: Borrowers may initiate a bank transfer from their preferred bank account to a designated partner finance company account. This method may require you to provide a specific payment link or account details for accurate processing.

- OTC: Some loan repayment options may offer the ability to make payments without a prescription at physical branches or authorized payment centers. Borrowers can visit these locations and pay their loans with cash or other acceptable payment methods.

Exclusive Features of GCash

GCash Philippines has several unique features that set it apart from other mobile wallets and digital payment platforms. Here are some notable features that make GCash stand out:

- GScore and G-Invest: The company provides your credit scoring feature called GScore, which assesses creditworthiness based on commercial behavior.

- Additionally, GCash Philippines offers G-Invest, allowing users to invest in mutual funds conveniently from their accounts.

- Partner Ecosystem: GCash loan has built a vast network of partner merchants and establishments, enabling users to make cashless payments at a wide range of retail stores, restaurants, online platforms, and utility companies. This extensive partner ecosystem enhances the convenience and versatility of using the platform for various transactions.

- GCash Forest: It is an innovative feature that promotes environmental sustainability. Users earn “green energy” points by using GCash loan, and these points contribute to planting real trees in designated reforestation areas. It combines economic services with environmental consciousness, allowing users to make a positive impact while managing their finances.

- Insurance and Savings: The loan platform provides options for users to avail themselves of insurance coverage and savings products directly from their GCash accounts. This integration of economic services allows users to protect their assets and save for the future conveniently within the loan platform.

GCash Customer Support

This loan site offers customer support through various channels, including a dedicated customer service hotline (2882), email support ([email protected]), and social media platforms. Users can reach out to the GCash support team for assistance with account-related inquiries, transaction concerns, and other support-related issues.

GCash Mobile Аpp Review

GCash has a powerful and versatile mobile app that has changed the way Filipinos manage their financial transactions. It is available for iOS and Android operating systems. One of the standout features of the loan app is its extensive partner ecosystem, allowing users to make cashless payments across numerous retail stores, restaurants, online platforms, and utilities.

The app also provides a number of services besides the basic functions of a mobile wallet. Users can transfer money, pay bills, shop online, invest in mutual funds through G-Invest, and even access insurance and savings. These additional features make this loan app a comprehensive financial management tool.

How Does the GCash App Work?

The GCash PH app functions as a mobile wallet and digital payment platform, offering users a convenient and secure way to manage their finances. Here’s our overview of how the GCash app works:

- Users need to download the GCash app from the app store and register for an account. They will be required to provide personal information and undergo a verification process, which may involve submitting identification documents.

- Users can load funds into their GCash wallet through various methods such as bank transfers, partner outlets, or cash-in centers. Once the wallet is funded, users can access and utilize the funds within the app.

- Clients can send money to other GCash users or even to non-GCash users through the app’s Send Money feature. They can also pay bills, purchase goods and services from partner merchants, and shop online using their GCash PH wallet.

- This loan app prioritizes security measures to protect user information and funds. The loan app incorporates features like two-factor authentication, biometric verification (fingerprint or face recognition), and PIN code protection to ensure secure access and transactions.

How do I Create a GCash Account?

By following these steps, you can create a GCash account and begin enjoying the convenience and benefits of using the GCash mobile wallet and payment platform.

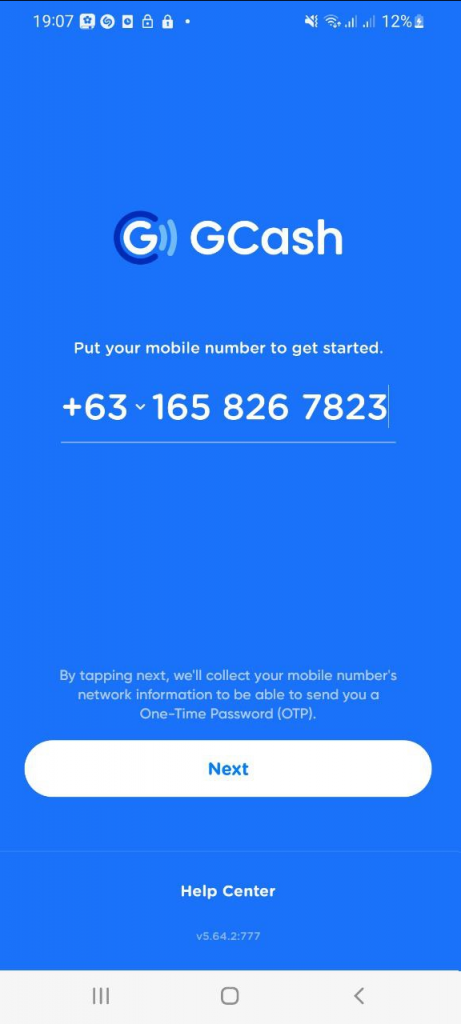

- Download the GCash App: Visit your device’s app store (Google Play Store or Apple App Store) and search for “GCash.” Download and install the app on your phone.

- Open the GCash App: Launch the GCash app by tapping on the icon.

- Sign Up: On the app’s home screen, tap on “Sign Up” to start the registration process.

- Provide Personal Information: Enter your personal details, such as your mobile number, email address, and create a secure password. Make sure the mobile number you provide is active and accessible.

- Verify Your Mobile Number: GCash will send a verification code to the mobile number you provided. Enter the code in the loan application to verify your contact number.

- Finish the Registration: Follow the cues on the screen to finish the registration. This may include providing additional information, such as your full name and birthdate.

- Set Up Your Security Features: Set up the security features for your GCash account, such as a 4-digit MPIN (Mobile Personal Identification Number) or enabling biometric verification (fingerprint or face recognition) if available on your device.

- Agree to Terms and Conditions: Read and agree to the terms and conditions governing the use of the platform.

- Start Using GCash: Once your account is successfully created, you can start using GCash to load funds, send money, pay bills, and access other features within the app.

Whom GCash suits better?

GCash suits a wide range of users, including students, small businesses, and individuals looking for a convenient and secure mobile wallet solution. The platform provides features like bill payments, fund transfers, loans, and cashless transactions, making it beneficial for those who seek seamless economic management on their smartphones.

FAQ

-

Is GCash legit in the Philippines?

Yes, GCash is legal in the Philippines. It is regulated by the BSP (Bangko Sentral ng Pilipinas) and operates under the necessary licenses and regulations.

-

Is it okay to pay in advance in GCash?

Yes, it is possible to make advance payments using GCash. Many bill payment options in the app allow users to pay in advance for services such as telecommunications, utilities, and insurance premiums.

-

How do I edit information on GCash?

To edit your information on GCash, open the GCash app, log in, go to the “Account” section, and select “Edit Profile.” From there, you can update and modify your personal information as needed.

-

How do you get approved for GCash?

To get approved for GCash, download the app, register for an account, provide the required personal information, undergo the verification process, and comply with the T&C.

-

What is the highest credit limit in GCash?

The highest credit limit is ₱25,000.

GCash Competitors

| Company | Loan Amount (PHP) | Interest Rate | Loan Term | Our Review |

|---|---|---|---|---|

| Digido | 1,000 – 25,000 | From 0% to 11.9% | Up to 30 days | Read Digido Review |

| MoneyCat | 500 – 20,000 | Up to 11.9% per month | Up to 180 days | Read MoneyCat Review |

| CashMart | 3,000 – 150,000 | From 0,8% to 3,5% | Up to 6 months for new loan | Read CashMart Review |

| EasyCash | 5,000 – 25,000 | 0,33%-1% | From 1 to 300 days | Read EasyCash Review |

| Crezu | 1,000 – 25,000 | From 1.5% per month to 30% per year | From 3 to 12 months | Read Crezu Review |

| CashMe | 2,000 – 20,000 | 0,08% per day | Up to 3 months | Read CashMe Review |

| Blend | 50000 – 2 million | From 1,5% to 3% monthly | Up to 36 months | Read Blend Review |

| Binixo | 2000 – 30000 | 1% per day | From 7 days to 30 days | Read Binixo Review |

| Asteria Lending Inc | 2000 – 50000 | 0.2% per day | From 30 days to 120 days | Read Asteria Review |

| Loanmoto | 1,000 – 12,000 | 4% – 6% per month | Read Loanmoto Review | |

| Finbro | 1,000 – 50,000 | 0.5% – 1.25% per day | Up to 12 months | Read Finbro Review |

| Kviku | 500 – 25,000 | 1.2% per month | Up to 180 days | Read Kviku Review |

| Binixo | 2000 – 30000 | 1% per day | From 7 days to 30 days | Read Binixo Review |

| PesoQ | 5,000 – 20,000 | 4% – 6% per month | 91 – 365 days | Read PesoQ Review |

| CashBee | 2,000 – 20,000 | 0,3% daily | From 30 to 120 days | Read CashBee Review |

| Revi Credit Philippines | 1000 – 250,000 | 1% – 5% | From 6 to 36 months | Read Revi Credit Review |

| Tala | 1,000 – 25,000 | 15% – 15.7% | From 15 to 61 days | Read Tala Review |

| OKPeso | Up to 24% | From 96 to 365 days | Read OKPeso Review | |

| Vamo | 1,000 – 30,000 | From 1,3% | From 10 to 3000 days | Read Vamo Review |

| Flexi Finance | Up to 25,000 | From 365 to 1460 days | Read Flexi Finance Review | |

| JuanHand | Up to 50,000 | 14.7% per month | From 14 to 90 days | Read JuanHand Review |

| Moca Moca | 2,000 – 35,000 | 0.83% per month | From 180 to 365 days | Read Moca Moca Review |

| RoboCash | 1,000 – 25,000 | From 0% to 11.9% | Up to 30 days | Read RoboCash Review |