Cashbee Philippines Review

Whether looking for a reliable tool to streamline your financial transactions, seeking efficient ways to save, or exploring savvy investment options, Cashbee presents itself as a noteworthy contender in the financial technology space. Our in-depth analysis aims to provide you with a clear perspective on how Cashbee stands out, its potential benefits to your financial journey, and any considerations you should consider when using its services. Join us as we explore the functionalities, advantages, and user experiences associated with Cashbee, helping you decide to integrate this platform into your financial toolkit.

What is Cashbee?

CashBee stands as a distinguished money lending company based in the heart of the Philippines. Established with the vision of offering collateral-free personal loan services and efficient loan management through the user-friendly CashBee Philippines app, this financial institution has become a trusted ally for Filipinos seeking fast, secure, and reliable financial assistance.

Founded by fellow Filipinos, CashBee is driven by the commitment to provide accessible financial aid to its countrymen. But is CashBee loan legal? Let’s delve into the legalities to ensure a secure borrowing experience.

Is Cashbee legit?

In the realm of financial services, legitimacy is paramount. So, is CashBee a legitimate lending company in the Philippines? Let’s explore the regulatory landscape and certifications that affirm CashBee’s credibility.

According to Philippine law, any financial company operating in the country must obtain the approval of the Securities and Exchange Commission (SEC).

A visit to the official SEC website reveals a list of certified and trustworthy companies, including CashBee. The company’s registration number (CS201912321) and certificate of authority (3041) further solidify its standing as a lawful and regulated entity.

Key Features

| Features | Details |

| Loan Types | Collateral-free loans

Loan management services Personal loans |

| Establishment | Founded in the Philippines

Committed to providing fast, secure, and reliable financial services |

| Legal Compliance | Registered with the Securities and Exchange Commission (SEC)

Certificate of Authority: 3041 Registration No.: CS201912321 |

| Loan Parameters | Minimum Amount: Php2,000

Maximum Amount: Php20,000 Minimum Terms: 30 days Maximum Terms: 120 days Daily Interest Rate: 0.3% |

| Application Process | Swift loan approval within 24 hours

User-friendly CashBee Philippines app available on both Google Play Store and Apple App Store Clear application instructions with detailed documentation requirements |

| Repayment Options | Multiple avenues for loan repayment: RD pawnshop, M Lhuillier pawnshop, 7-eleven, other stores with EC pay, Gcash, bank account

Reminder to keep the contract number handy during repayment |

| Contact Infromation | Company Address: Unit 903-C 9th floor One Global Place, 5th avenue, Bonifacio Global City (BGC), Taguig City, Philippines

Hotline Number: (+632) 5310.2079 Facebook Username: CashBee PH Email Address: [email protected] |

Benefits and Drawbacks of Cashbee

Navigating the financial landscape requires a thorough understanding of your chosen lending institution’s advantages and potential challenges. In the case of CashBee, let’s explore the benefits and drawbacks to help you make an informed decision when considering their services.

Benefits

- Swift Loan Approval: CashBee boasts a streamlined application process, ensuring quick approvals within 24 hours, making it an ideal choice for those needing funds.

- Collateral-Free Loans: With CashBee, borrowers can access personal loans without the burden of providing collateral, simplifying the borrowing process for a wide range of individuals.

- Flexible Loan Terms: Offering a minimum loan amount of Php2,000 and a maximum of Php20,000, CashBee accommodates various financial needs. The loan term spans from 30 to 120 days, providing flexibility for repayment.

- Transparent Fee Structure: CashBee’s fee structure is clear and concise. With a one-time sign-up and service fee ranging from 15% to 20%, borrowers can easily understand the costs associated with their loans.

Drawbacks

- Minimum Monthly Income Requirement: Some potential borrowers may find it challenging to meet the minimum monthly income requirement of Php10,000, limiting accessibility for certain individuals.

- Interest Rate Consideration: While CashBee offers competitive interest rates at 0.3% per day, individuals comparing rates across lending companies may find other options with slightly lower rates.

- Overdue Fees: In the event of late repayment, CashBee applies an overdue fee, adding an extra cost to the total debt. Timely repayment is crucial to avoid incurring additional charges.

Understanding both the benefits and drawbacks of CashBee ensures a well-informed decision when considering this lending institution for your financial needs.

Loan provided by CashBee

CashBee positions itself as a versatile financial partner, catering to various monetary requirements of its clientele. Let’s explore the diverse range of loans provided by CashBee, ensuring you have a comprehensive understanding of the financial solutions available:

Collateral-Free Loans

One of the standout features of CashBee is its commitment to offering collateral-free loans. This means borrowers can access financial assistance without the burden of pledging valuable assets, making the borrowing process more accessible.

Loan Management Services

Beyond traditional lending, CashBee extends its services to include effective loan management. This implies a holistic approach to assisting borrowers not only in obtaining funds but also in efficiently handling their loans throughout the repayment period.

Personal Loans

CashBee recognizes the diverse financial needs of its customers. Whether it’s for urgent medical expenses, educational fees, or unexpected bills, CashBee’s personal loans provide a flexible and swift solution to address a range of individual requirements.

Understanding the array of loans CashBee offers ensures that potential borrowers can identify the financial product that best aligns with their needs. In the subsequent sections, we’ll delve into the application process, eligibility criteria, and the intricacies of the loan terms, empowering you with the knowledge to make an informed decision.

Best Online Loans Similar to CashBee

We are set to display a table highlighting the prime online loan platforms in the Philippines, each offering services akin to CashBee.

| Company | Loan Amount (PHP) | Interest Rate | Loan Term |

|---|---|---|---|

| Digido | 1,000 – 25,000 | From 0% to 11.9% | Up to 30 days |

| MoneyCat | 500 – 20,000 | Up to 11.9% per month | Up to 180 days |

| Kviku | 500 – 25,000 | 1.2% per month | Up to 180 days |

| Cashspace | 1000 – 25,000 | 1.3% per month | 2 – 4 months |

CashBee Requirements

Before embarking on the journey of securing a loan with CashBee, it’s crucial to familiarize yourself with the specific requirements. Meeting these criteria ensures a smooth and efficient application process. Let’s delve into the CashBee requirements, providing clarity on what potential borrowers need to prepare:

- Age Bracket: CashBee extends its financial assistance to individuals aged 18 to 65. This inclusive age range allows a broad spectrum of applicants to benefit from their services.

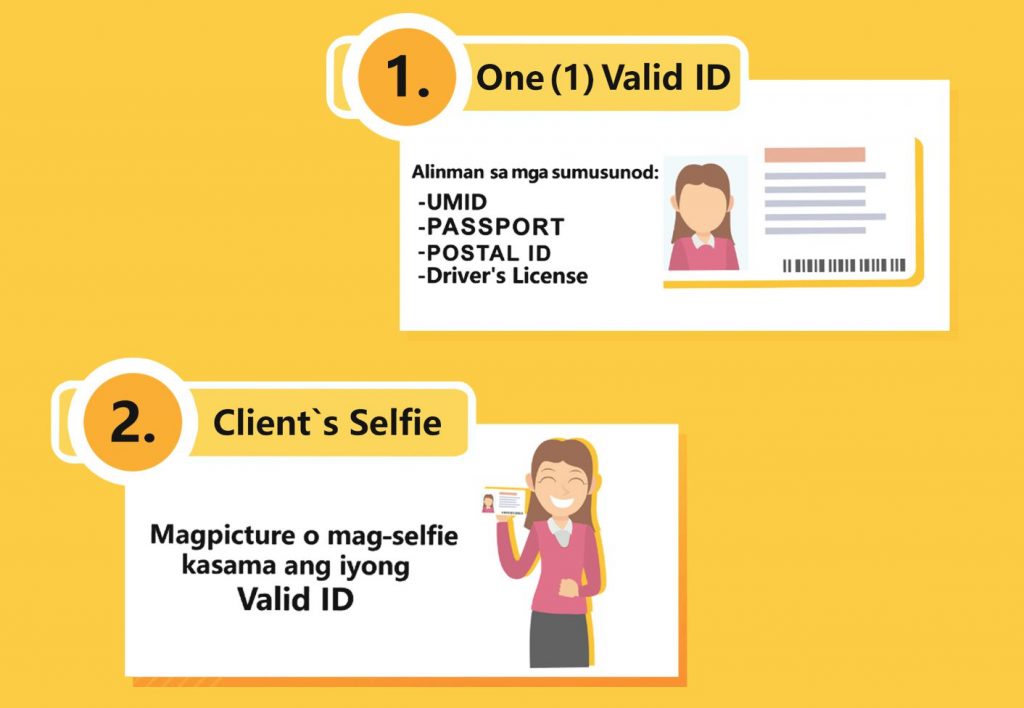

- Identification Documents:

- Updated postal ID

- Updated passport

- Driver’s license

- PRC ID

- UMID (old SSS is not accepted)

- A copy of the latest SSS/GSIS contribution

Meeting these identification criteria ensures that CashBee can verify your identity and process your loan application efficiently.

Understanding and preparing the necessary documentation aligns you with CashBee’s requirements, streamlining the application process.

How to Get a Loan From CashBee?

CashBee streamlines the loan application process, prioritizing user convenience and efficiency. If you’re considering securing a loan through CashBee, follow these straightforward steps to initiate the process and access the financial assistance you need:

Download the CashBee Application:

The CashBee Philippines app is available for download on both Google Play Store for Android users and the Apple App Store for iOS users. Search for “Cashbee Philippines” and install the free loan app on your smartphone.

Complete the Application Form:

Fill in all the required information accurately within the CashBee Philippines application. Review and verify the details before submitting to ensure accuracy.

Provide Necessary Documentation:

Take clear photos or scans of the required documentation, including identification and any additional documents requested during the application process.

Submission and Approval:

Submit your completed application and documentation through the app. Keep your communication channels open while awaiting approval. CashBee typically notifies applicants of their loan status within 24 hours.

Receive Control Number:

Upon approval, CashBee will send a control number via the mobile app.

Claim Your Funds:

Visit partnered remittance centers such as RD pawnshop and M Lhuillier pawnshop to claim your funds. Alternatively, funds can be claimed through Gcash, Coins.ph, or your bank account.

Note: When claiming through remittance centers, bring a valid ID and present it along with the control number.

Following these steps ensures a smooth and efficient experience in obtaining a loan from CashBee.

Custom Support

Navigating the financial landscape often involves queries, clarifications, and the need for responsive support. At CashBee, customer support is a cornerstone of their commitment to providing a seamless and trustworthy lending experience. Here’s a closer look at how you can connect with CashBee’s customer support team:

- Physical Location:

CashBee Lending Services Inc. is physically located at Unit 903-C, 9th floor, One Global Place, 5th Avenue, Bonifacio Global City (BGC), Taguig City, Philippines.

- Hotline Number:

Dial (+632) 5310.2079 to reach the CashBee hotline and speak directly with a customer support representative.

- Facebook Messenger:

Connect with CashBee through Facebook Messenger by searching for the username “CashBee PH.” This provides a quick and accessible channel for inquiries and assistance.

- Email Contact:

For formal communication, you can contact CashBee via email at [email protected].

CashBee’s commitment to transparent communication and responsive support ensures borrowers can seek assistance at every step of their loan journey.

Frequently Asked Questions About CashBee Loans

1. Is CashBee a legitimate lending company?

Yes, CashBee is a legitimate lending company registered with the Securities and Exchange Commission (SEC), ensuring compliance with Philippine financial regulations.

2. What types of loans does CashBee offer?

CashBee offers collateral-free loans, loan management services, and personal loans, providing a diverse range of financial solutions.

3. How do I apply for a loan with CashBee?

To apply for a CashBee loan, download the CashBee Philippines app, fill in the application form, provide necessary documentation, and await approval, typically within 24 hours.

4. What are the age requirements for CashBee loans?

CashBee extends its loan services to individuals aged 18 to 65, ensuring inclusivity.

5. How are loan repayments made?

Repayments can be made through various channels, including RD pawnshop, M Lhuillier pawnshop, 7-eleven, other stores with EC pay, Gcash, and bank account.

CashBee Competitors

| Company | Loan Amount (PHP) | Interest Rate | Loan Term | Our Review |

|---|---|---|---|---|

| Digido | 1,000 – 25,000 | From 0% to 11.9% | Up to 30 days | Read Digido Review |

| MoneyCat | 500 – 20,000 | Up to 11.9% per month | Up to 180 days | Read MoneyCat Review |

| CashMart | 3,000 – 150,000 | From 0,8% to 3,5% | Up to 6 months for new loan | Read CashMart Review |

| EasyCash | 5,000 – 25,000 | 0,33%-1% | From 1 to 300 days | Read EasyCash Review |

| Crezu | 1,000 – 25,000 | From 1.5% per month to 30% per year | From 3 to 12 months | Read Crezu Review |

| CashMe | 2,000 – 20,000 | 0,08% per day | Up to 3 months | Read CashMe Review |

| Blend | 50000 – 2 million | From 1,5% to 3% monthly | Up to 36 months | Read Blend Review |

| Binixo | 2000 – 30000 | 1% per day | From 7 days to 30 days | Read Binixo Review |

| Asteria Lending Inc | 2000 – 50000 | 0.2% per day | From 30 days to 120 days | Read Asteria Review |

| Loanmoto | 1,000 – 12,000 | 4% – 6% per month | Read Loanmoto Review | |

| Finbro | 1,000 – 50,000 | 0.5% – 1.25% per day | Up to 12 months | Read Finbro Review |

| Kviku | 500 – 25,000 | 1.2% per month | Up to 180 days | Read Kviku Review |

| Binixo | 2000 – 30000 | 1% per day | From 7 days to 30 days | Read Binixo Review |

| PesoQ | 5,000 – 20,000 | 4% – 6% per month | 91 – 365 days | Read PesoQ Review |

| GCash | 5,000 – 25,000 | From 3% to 15% | From 15 to 90 days | Read GCash Review |

| Revi Credit Philippines | 1000 – 250,000 | 1% – 5% | From 6 to 36 months | Read Revi Credit Review |

| Tala | 1,000 – 25,000 | 15% – 15.7% | From 15 to 61 days | Read Tala Review |

| OKPeso | Up to 24% | From 96 to 365 days | Read OKPeso Review | |

| Vamo | 1,000 – 30,000 | From 1,3% | From 10 to 3000 days | Read Vamo Review |

| Flexi Finance | Up to 25,000 | From 365 to 1460 days | Read Flexi Finance Review | |

| JuanHand | Up to 50,000 | 14.7% per month | From 14 to 90 days | Read JuanHand Review |

| Moca Moca | 2,000 – 35,000 | 0.83% per month | From 180 to 365 days | Read Moca Moca Review |

| RoboCash | 1,000 – 25,000 | From 0% to 11.9% | Up to 30 days | Read RoboCash Review |