UnaCash Review

Need quick financial assistance? UnaCash offers a seamless loan experience through its user-friendly mobile app, providing fast approvals and flexible repayment options. Whether you’re covering unexpected expenses or managing short-term cash needs, UnaCash delivers reasonable interest rates and multiple loan types to suit different borrowers. In this review, we’ll explore the key features, pros and cons, and what makes UnaCash a convenient choice for Filipinos looking for hassle-free loans.

Ready to Borrow? Find the Best Offer Here

| Binixo – Fast & Convenient Loan Matching Platform in the Philippines | Apply |

| Cash-Express – Online Fast Cash Loan Service | Apply |

| Kviku – Instant Online Loan with 0% Interest for New Clients | Apply |

| Finami – Fast & Easy Online Loans 24/7 | Apply |

| LoanOnline.ph – Compare Loans in Just 2 Minutes | Apply |

| Digido – Instant Online Loans up to ₱25,000 (0% Interest for First Loan) | Apply |

| Finloo – Find the Best Online Loan in Just 5 Minutes | Apply |

| CashSpace – Quick Online Loans in the Philippines (24/7) | Apply |

Pros and Cons of UnaCash Loan

Pros

- Swift and convenient loan offers.

- User-friendly app to access services.

- Reasonable interest rates.

- Flexible loan repayment schedule.

- Multiple loan types.

Cons

- Limited loan amount for borrowers.

- Borrowers will pay fees for late payments.

- Stringent eligibility requirements.

Key Points

UnaCash is one of those few online lenders offering a fast and convenient solution for Filipinos needing urgent funds. It has an intuitive and user-friendly app with competitive interest rates. Hence, it provides flexibility and diverse loan options. However, potential limitations such as eligibility criteria and app dependency should be considered. But overall, UnaCash Loan is a reliable choice for Filipinos seeking immediate financial assistance.

| Features | Details |

| Interest rate | 0-16% nominal interest rate, 194% APR |

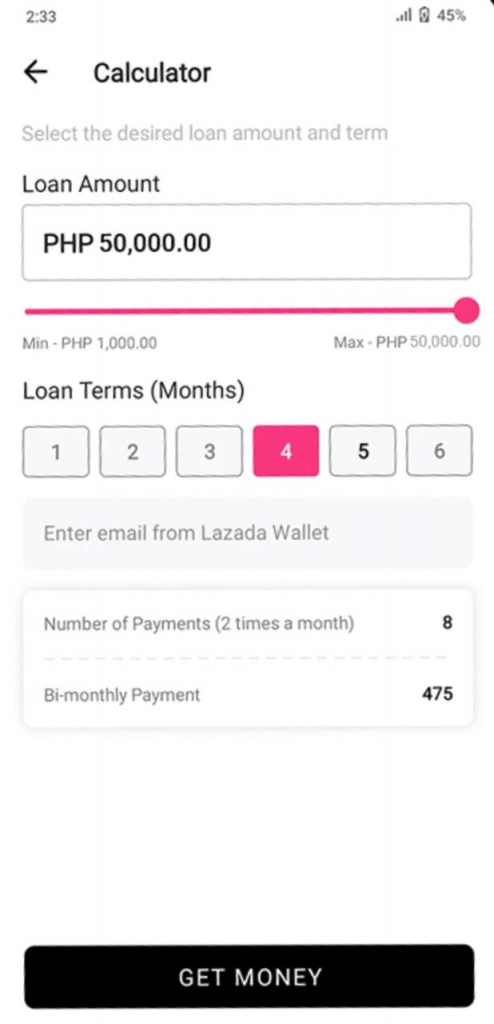

| Loan Amount | PHP 1,000 – PHP 50,000 |

| Loan Tenure | 2-6 months |

| Approval Time | 24 hours |

| Processing Fee | None |

Full Loan Review

UnaCash Philippines is a digital loan financing company that offers short-term loans to interested borrowers. The company is known to provide convenient and timely access to a loan and credit during emergencies. However, compared to some online lending services, UnaCash has pretty high-interest rates, though it’s fair enough considering the ease of access and low barrier of application. This creditor is available to Filipinos online without affiliating with any banks, so you won’t need a bank visit to request or process your loan.

What is UnaCash?

It’s an online loan provider that offers credit with no hidden charges, zero bank visits, and no hassles. UnaCash allows its users access to extra funds during emergencies, as the funds are available within 24 hours of the request. It also offers reasonable interest rates and no additional fees, which makes it ideal for borrowers who seek urgent cash and would love to incur fewer costs and expenses in the process. The loan offers here have short repayment terms of 2 to 6 months, so you might want to opt for something else if you plan to pay for longer periods.

The company came into existence in 2021 and has gained much reputation since then. Although it shares similar features with some local lenders, its services are pretty unique. You can get your credit needs here or request a personal credit line to fund your online installment shopping. UnaCash Loan is a legit establishment that’s registered and licensed under the Digido Finance Corporation, which is a subsidiary of Robocash, a group of financial companies based in Singapore.

| Company Name | Digido Finance Corporation |

| Founder | Robocash Group |

| Official Launch | 2021 |

| License number | CS202003056 |

Loans provided by UnaCash

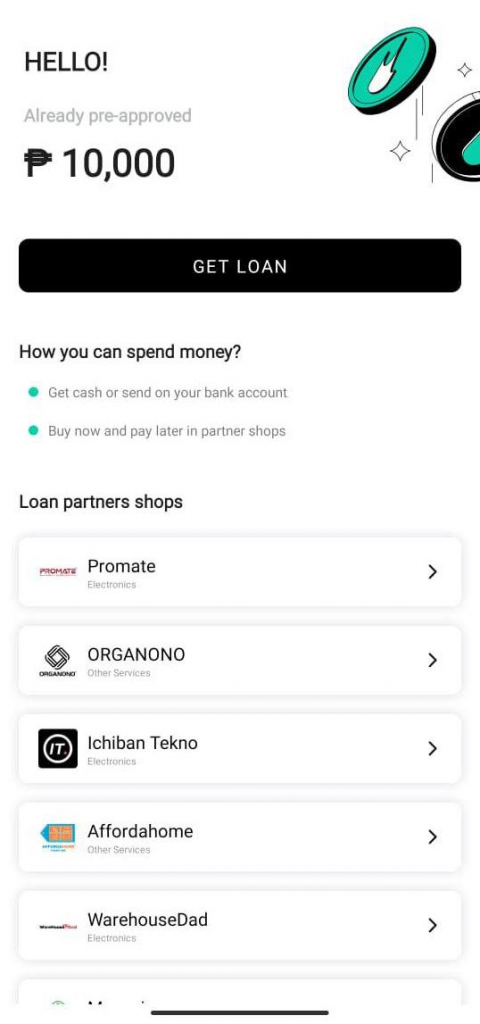

UnaCash Philippines offers various types of loans to cater to the diverse monetary needs of Filipino users. Here are the types of loan offers you can secure by applying here:

- Cash Loans: One of the most popular financing options on UnaCash is a cash loan. It provides borrowers with instant access to borrow money. These loans are usually smaller and have shorter repayment terms. A cash loan is most suitable for individuals seeking quick cash for immediate needs.

- Personal Loans: This loan is designed to cover personal expenses, e.g., medical bills, home repairs, or travel expenses. Personal loans from UnaCash Loan provide borrowers with a lump sum amount that can be repaid in fixed installments over their 6-monthly repayment period.

- Salary Loans: This online loan allows you to access extra funds based on your monthly income. It’s suitable for those facing temporary cash flow issues or unexpected expenses before their next payday. Repayment is typically set up to coincide with the borrower’s salary disbursement.

- Emergency Loans: UnaCash PH provides emergency loans to individuals who require immediate assistance during unforeseen circumstances in the Philippines. The loan offers quick approval and disbursal, ensuring borrowers can access funds promptly during emergencies like medical emergencies or natural disasters.

Interest Rate for UnaCash

The interest rate here depends on different factors. The nominal interest rate can vary, but there is a fixed APR of 194%. When compared to some lenders, the figure is quite high but still fair, considering the exceptional service UnaCash Philippines is known for. Depending on how long you wish to repay your loan, your interest may be higher or lower. For example, if you decide to go for a loan of PHP 2,000 and choose to repay it in more than 6 months. They’d have to pay a semi-monthly payment of 266.67 semi-month, then their total interest will be PHP 100 semi-monthly (at the APR of 194%).

UnaCash Cash Loan Requirements

Since this is more like a personal loan, you won’t face stringent requirements to qualify. UnaCash allows you to provide basic information and documents for verification and approval. If you have an existing loan with UnaCash Loan, you can still request a new one as long as you have a reputable history of repaying your loan. Although, we advise settling your current debt before applying for a new loan.

Unlike some Filipino lenders, it does check your creditworthiness depending on the amount you wish to borrow. Below is a list of the basic requirements:

- Be a Filipino citizen with a verifiable document to back up your claim.

- You must be between 21 to 60 years old, nothing below or above.

- Your email address must be active and valid, as well as your mobile number.

- You must have a valid government-issued ID.

- You must be gainfully employed or have a steady source of income.

ID`s accepted by UnaCash

| ID Type | Name |

| e-Card | UMID |

| SSS | SSS ID |

| Driver’s License | Philippine Driver’s License |

| Philippine Regulatory Commission | PRC |

| Postal ID | Improved Postal ID |

| Philippine Passport | Passport |

How Can You Repay a Loan in UnaCash?

There are various methods approved for repaying your loans. You can choose between the list of available ones based on the most convenient one for you. The three major options to repay your UnaCash loans are listed and discussed below:

- Bank Transfer: Borrowers can repay their debt via simple bank transfers. Once you input the bank details of UnaCash Philippines partners, such as name, account name, and account number. Share the proof of payment with the accounting team ([email protected]), and you’re good to go.

- E-wallets: Another method is through online banks. Choose your preferred bank, such as BPI, Metrobank, PNB, etc. You can access this option on your account by selecting “Cash In Via Bank Account”.

- Over-the-counter Payments: You can also sort your payment with UnaCash partners. These include 7-11, Cebuana Lhuillier, SM Store, etc. Once you visit the store and provide your reference code or lifetime ID, the payment will be made directly into your UnaCash PH account.

Exclusive Features of UnaCash Loan

With more than one million downloads on Google Playstore, it’s evident that UnaCash Loan is a reliable lender. It owes this remarkable success to its unique features that keep more users trooping in. Below are some special features:

- Loan Flexibility: The company offers a wide range of options to select from. You can borrow between PHP 1,000 to PHP 50,000, which leaves a huge gap for borrowers. Likewise, the terms can extend over 6 months, which is a pretty long time to repay.

- Convenient Process: Since its services are available online, you can sign up and get extra funds from the comfort of your home. The approval process takes around 24 hours, which eases the hassle for borrowers.

- Easy Repayment Processes: Its wide range of repayment options make it easy for anyone to find a suitable method of settling their loan.

- No Hidden Fees: This online lender doesn’t charge hidden fees such as initiation, disbursement, and processing fees on your loan. So, you can rest assured of getting the exact loan you request for.

UnaCash Customer Support

In terms of responsiveness, UnaCash Philippines does have a good reputation. Its customer support team is resourceful and helpful to customers. However, you can only reach out to them via email ([email protected]) to get complaints and inquiries attended to on time.

They also have no FAQ section on their website, which is one of the best support customers seek. Though they did replace this with a Blog page that provides useful information and updates for users. There are links to steps for applying for and repaying loans on the homepage.

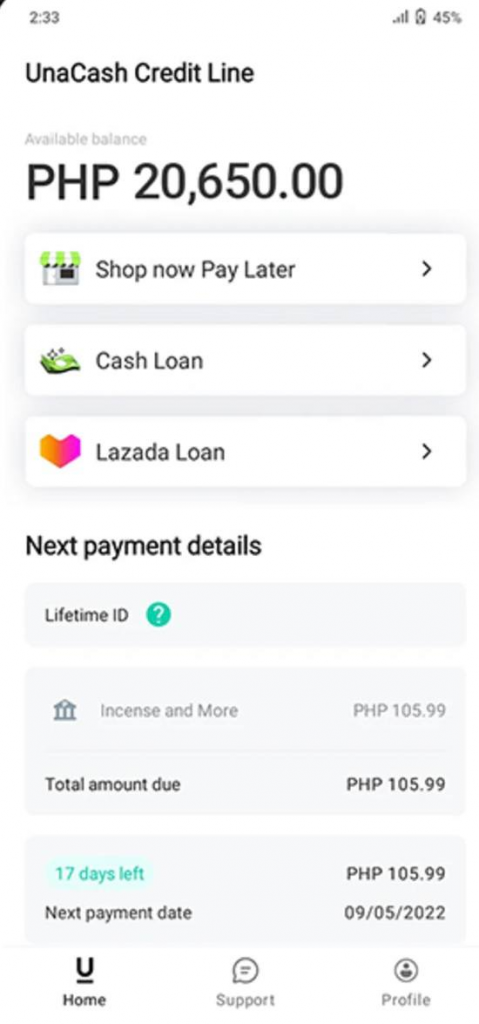

UnaCash Mobile Аpp Review

The UnaCash App is a highly convenient and user-friendly mobile app for managing your loan and transactions in the Philippines. The app boasts an intuitive user interface that makes navigation and accessing features a breeze. Its features, such as borrowing, sending, repaying the money, etc., are well-implemented and help provide a seamless experience for borrowers.

The app’s usability is also quite commendable, with clear instructions and simple processes for account creation and transactions. It has security measures, like PIN code protection and identity verification, to inspire confidence in using the app for sensitive activities.

How Does the UnaCash App Work?

The UnaCash loan app works by providing users with a simple and convenient platform to apply for and manage loans. Here’s how it generally works:

- Registration: You need to get the UnaCash mobile app via your app store and register by providing your personal information and creating an account.

- Loan Application: Once registered, users can proceed to apply for a loan within the app. They will be required to provide necessary details, such as loan amount, desired repayment term, and supporting documents like proof of income and identification.

- Loan Approval: UnaCash PH evaluates the loan request based on the provided information and performs your credit assessment. If it meets the eligibility criteria and is approved, you will receive a loan offer indicating the approved loan, interest rate, and repayment terms.

- Acceptance and Disbursement: If users are satisfied with the loan offer, they can accept it through the app. Upon acceptance, the loan amount will be disbursed directly to the borrower’s UnaCash account or linked bank account.

- Repayment: UnaCash Loan provides flexible repayment options, allowing borrowers to make repayments through the app. Users can set up automatic payments or manually initiate repayments as per the agreed terms. The loan app provides a clear overview of the loan balance, repayment schedule, and transaction history.

- Additional Features: Apart from a loan, the UnaCash app may offer features like bill payments, fund transfers, and other services to enhance the user experience and provide a comprehensive digital financial platform.

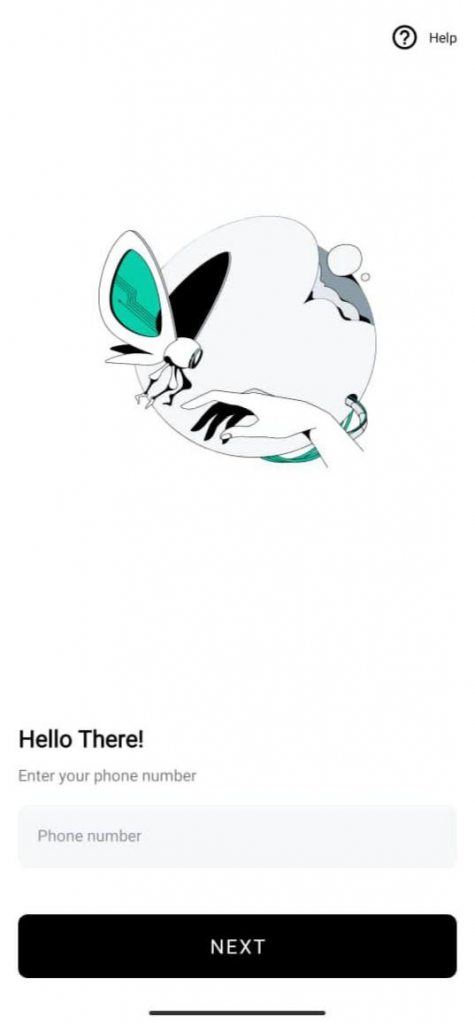

How Do I Create a UnaCash Account?

To create a UnaCash account and start applying for loans, follow the step-by-step instructions we’ve compiled below:

- Download the UnaCash mobile app from your smartphone’s app store (available for both Android and iOS).

- Open the app and tap on the “Sign Up” or “Register” button to begin the registration process.

- Enter your mobile phone number in the designated field and tap “Next.”

- Verify your phone number by entering the verification code sent to you via SMS.

- Provide your personal information, such as your full name, email address, and date of birth. Tap “Next” to proceed.

- Create a secure password for your UnaCash Philippines account and confirm it.

- Set up a 6-digit PIN code to enhance the security of your account. Confirm the PIN code.

- Review and agree to UnaCash’s terms and conditions, privacy policy, and other relevant agreements.

- Optionally, you may be asked to take a selfie or upload a photo of yourself for identity verification purposes.

- Once all the required information is provided, tap “Finish” or “Create Account” to complete the registration process.

Whom UnaCash Loan Suits Better?

UnaCash Loan is well-suited for Filipino users who require quick and hassle-free access to funds. It is an ideal choice for individuals facing urgent financial needs, such as unexpected medical expenses or emergency repairs.

Its app has a streamlined loan application process coupled with fast approval and disbursement. So it’s appealing to those seeking immediate financial assistance. UnaCash Loan is also a beneficial option for anyone who prefers to enjoy the convenience of a digital platform. That’s because it allows you to avoid filing paperwork or making stressful visits to walk-in lending institutions.

FAQ

Is UnaCash Loan legal in the Philippines?

UnaCash Loan is a legal online lending service in the Philippines. It is registered and regulated by the appropriate government authorities like the SEC, ensuring compliance with local laws and regulations.

Is it okay to pay in advance in UnaCash Loan?

Yes, it’s permissible to make advance payments on UnaCash Loan. Paying in advance can be beneficial as it allows borrowers to reduce their outstanding balance and potentially minimize interest charges

How do I edit information on UnaCash?

To edit information on UnaCash, log in to your account on the UnaCash app or website. Navigate to your profile or account settings, where you will find options to update and modify your details, contact number, and other relevant data.

How do you get approved for UnaCash Loan?

To get approved for UnaCash Loan, applicants need to provide basic documents like IDs, proof of income, and other necessary information during the process. Meeting the eligibility criteria and providing accurate information increases the chances of approval

What is the highest credit limit for UnaCash Loan?

The highest credit limit offered by UnaCash is PHP 50,000. But it varies for individuals and is based on factors like creditworthiness and repayment history. The initial credit limit will be determined during the online loan application process based on the borrower’s profile and financial assessment.