BillEase Review

Pros and Cons of BillEase

Pros:

- Compared to other online lending services in the Philippines, Billease has lower monthly installments

- It has a preventative and responsive app

- Registration and loan approval processes are prompt

Cons:

- Some features might not be accessible to newly registered users

- The amount of loan notifications is extensive

- Convenience fees may not be useful at all

Key Points

BillEase is a convenient loan app that greatly addresses one’s fiscal gaps. It allows customers to receive needed funds and use them for a variety of purposes. Both web and mobile interfaces are easy to navigate, with several options for contacting customer support. Additionally, BillEase offers the best interest rate and loan terms in the Philippines. You’ll never regret choosing BillEase for your financial support!

| Features | Details |

| Interest rate | 3,49% per month |

| Loan amount | ₱2000 – ₱40,000 |

| Loan Tenure | 30 – 90 days |

| Approval time | 1 business day |

| Processing fee | 1,5% |

Full Review

BillEase Philippines is a great solution to your fiscal hardness and payment gaps. However, before borrowing a cash loan, you need to get acquainted with the product. That’s why we’ve created this revision — to enlighten you about all the essential aspects and go through a step-to-step signing-up process together.

After reading this loan review, you’ll know how BillEase works, what offers it provides, and what you need to qualify for an advance. We’ll also discuss loan terms and other vital conditions. Stay attentive to acquire more user tips!

What is BillEase?

BillEase is an online loan that you can use on different purchases and return later. The product was launched long ago in 2017, and quickly gained momentum. It’s governed by FDFC — First Digital Finance Corporation — a fiscal technology corporation that enforces the trade credit market within Southeast Asia.

The product provides flexible and convenient payment plans. Moreover, it has the lowest interest rates in the Philippines’ commerce. Large borrowing limits are also applicable. Apart from its main feature, BillEase PH operates as a one-off store for gaming advances, e-wallet replenishments, and prepaid mobile refills.

Registered members of BillEase PH can receive exclusive propositions — the longer you’re using the loan services, the more you get. For instance, your initial credit limit may increase the longer you utilize a BillEase loan. The best thing is — the product is genuinely easy to navigate, so you won’t have any complications in managing it.

| Company Name | First Digital Finance Corporation |

| Founder | Georg Steiger, Huyen Nguyen, Ritche Weekun |

| Official Launch | 2017 |

| License Number | CS201516347 |

Loans Provided by BillEase

Just like a reputable financial provider, BillEase offers a couple of loan products to borrow money. They are both convenient and suit customers’ needs. So, depending on your urge, you can:

- Apply to Buy Now, Pay Later (BNPL) product. It’s an online loan that you can use for shopping across stores of a large variety of BillEase partner merchants — Lazada, Samsung, Shopee, etc. Although you’ll still have to pay a monthly interest rate and extra charges, it functions as a convenient payment method. BillEase can efficiently bridge your budget shortage if you don’t have a credit card yet.

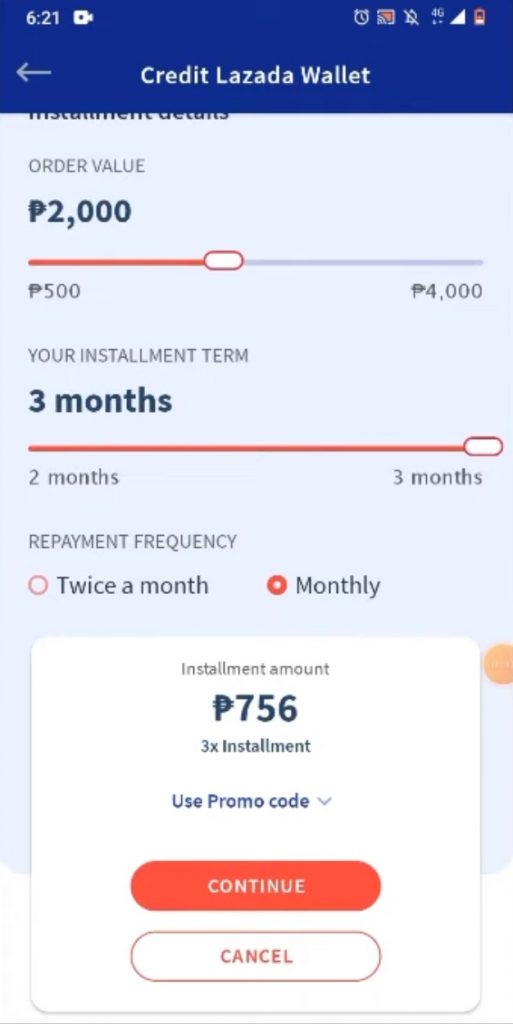

- Take out a BillEase Philippines cash loan. All you need is to set up your banking in the loan app — add an e-wallet or a bank account to claim the funds. Once done, you can avail of needed loan amounts with convenient terms. Your loan information will be displayed in your account, including ordered value, installment term, and repayment frequency.

Interest Rate for BillEase

BillEase offers the lowest loan interest rate among its competitors. It makes the usage of the loan more efficient and useful. The BillEase charges only 3.49% per month. Additionally, customers can avail of an extra perk — 0% APRs on the proposed merchant’s services.

BillEase Cash Loan Requirements

Another favorable feature of BillEase PH is that it doesn’t have an extensive list of loan requirements. If you’re over 18 years old and have a job with stable earnings, here’s a list of records you need to provide within your loan application:

- Valid state ID. The list of required verification documents is wide. Besides, you need to provide only one identification paper of your choice, which is allowed by BillEase loan services.

- Latest income check. You can attach your certificate of employment, PayPal paying history, receipts of bank transfers, payslips, etc.

- Proof of billing. You can include any postpaid invoice, for instance, water or TV bills. If the invoices aren’t under your name, it’s not an obstacle. Make sure you’ve stated your current mailing address.

ID’s Accepted by BillEase

| ID Type | Name |

| Government Insurance Card | Government Service Insurance System (GSIS) Card |

| Driver’s License | Land Transportation Office (LTO) Driver’s License |

| Passport | Passport of a citizen of the Philippines |

| Unified ID Card | Unified Multi-Purpose Identification (UMID) Card |

| Social Security Card | Social Security System (SSS) Card |

| Student Permit Card | Land Transportation Office (LTO) Student Permit (card format) |

| Firearms Permit | Philippine National Police (PP) Permit to Carry Firearms

Outside Residence |

| Worker’s Welfare ID | Overseas Workers Welfare Administration (OWWA) E-Card |

| Professional ID | Professional Regulatory Commission (PRC) ID |

| Seafarer’s Record | Seafarer’s Record Book |

| Postal ID | Philippine Postal ID |

| Airman License | Airman License |

How Can You Repay a Loan in BillEase?

To repay a BillEase cash loan, you’ll be offered a large list of options. These are all useful and efficient, so you’re free to use any of them up to your choice:

- Bank transfer. The BillEase has several bank accounts where you can deposit the reimbursement. All the details are stated and described at the end of your online loan application. Once you’ve made a deposit, you need to send a receipt to [email protected] to prove the transaction. Note that this method may show up on your payroll only 2 days after.

- E-wallets. There is a wide range of online payment options you can choose from — GCash, GrabPay, Maya, etc. Although a little transaction fee applies, this option is prompt and convenient.

- Linked online bank account. Connect your bank account to BillEase Philippines and pay directly from it without mandatory payment proofs.

- Coins.ph. It suits those customers who prefer to pay with cryptocurrency. After you click on the loan reimbursement request, you’ll be redirected to a list of available options where you need to select Coins.ph. A step-to-step instruction will be provided.

Exclusive Features of BillEase

The exclusive features are one of the main attractions of the BillEase app. As a newly registered member, you’ll be able to grab an alluring 0% APR with opted vendors once you open an account. BillEase sticks to a responsive and adapted approach, which excellently addresses customers’ needs. Moreover, if you take out advances and return them in a timely manner, you’ll get access to exclusive offers.

For instance, BillEase will grant you an opportunity to load your phone balance, top-up e-wallets, and pay for cable, gaming, and other bills. What’s more exciting, all these features will be available on your mobile and always at your disposal.

BillEase Customer Support

To ensure that clients have all the answers, BillEase provides several communication options. You can contact customer support via e-mail at [email protected], online form, or live chat. There’s also a large frequently asked questions section you can turn to beforehand.

The managers are dedicated and always find an efficient solution to your requests. Otherwise, you can leave a message on the website indicating your name, email address, and concerns. Using this option, you must also consent to the Terms & Conditions and Privacy Policy.

We recommend you follow BillEase Philippines on social media. The company has official pages on Facebook, Instagram, and TikTok.

BillEase Mobile Loan App Review

The BillEase loan app is a flexible way of managing your budget — whether you’re at home or meeting with friends, — you can always access your account. Additionally, the loan product is compatible both with Android and iOS. Many Philippines customers enjoy the offered loan services and promote the BillEase loan app online.

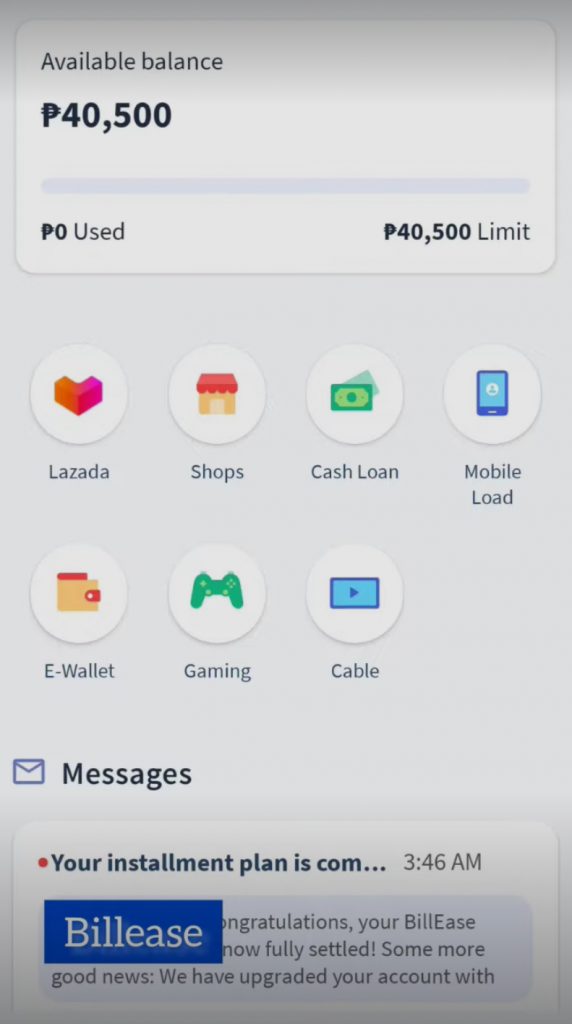

One of the most prominent features of the loan app is its convenient interface. It’s clear and easy to navigate. On the main page, customers see their BillEase account. It includes available balance, including used sum and credit limit. You can also click on the “pay now” button to make a deposit.

The home page also represents several categories where you’re able to utilize the received loan funds. For example, partner shops, gaming, mobile load, cable, cash advance, etc. The pending period is specified at the bottom of the page — it allows clients to see the remaining loan payments.

To see the loan details, you should click on the corresponding area. You’ll be redirected to another page that represents the ordered loan value, installment terms, repayment frequency, and applicable fee. Clients are offered two options: you can either return funds once or twice per month. Beneath, you’ll also see the number of monthly installments you need to pay and the number of remaining loan repayments.

How Does the BillEase Loan App Work?

The developers of BillEase PH made their loan app extremely responsive and clear in navigation. Each step is accompanied by instructions and related details to help customers use the interface.

Firstly, go through the registration process, filling up all the required information. Once you’re done with all the verification procedures, you can start borrowing funds. On the main page, you’ll see your credit details and current loan balance. To request a loan, you’ll need to click on the “Cash Loan” button with the corresponding picture on it.

Afterward, you’ll be redirected to the loan application, where you can specify the cost you need, the amount of monthly installments you can reimburse, and the loan repayment frequency. Once you’ve finished filling up the details, you can send your form for approval. The process is usually fast and takes up only 1 banking day.

Finally, when you obtain the loan funds, you’re free to use them whenever you want. The BillEase loan app allows clients to pay in a variety of shops, top-up e-wallets, proceed with mobile load and pay for TV, gaming, etc.

How do I Create a BillEase Account?

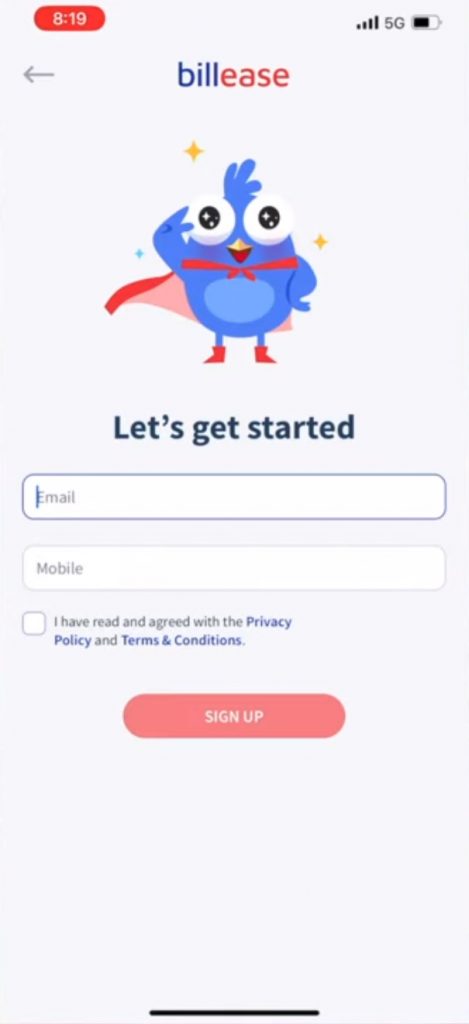

Although many might think the signing up process is complicated, you’ll be surprised how easy and prompt it is:

- Firstly, you need to download the loan app and register an account, providing an email and phone number. You also have to comply with the Terms & Conditions and Privacy Policy of the BillEase. The next step is creating a strong password.

- Once you’re done with the basic registration processes, you’ll have to fill up a personal information form. To be eligible to receive BillEase loan services, one needs to specify gender, full name, date of birth, marital status, and nationality.

- The next step would be providing residential address details — street name and house number, province, city, and postal code. You can also optionally specify the barangay and landline. Lastly, you’ll be asked whether you work from home or not.

- BillEase Philippines will ask you to ensure the character reference — family, friends, or colleagues. You’ll need to indicate their name, relation, and phone number. Make sure to negotiate and inform your reference character about such a procedure.

- You’ll have to attach your ID information. You can choose from a wide list of options and specify the number of the selected document. About 5 minutes later, BillEase will ask you to take a selfie to verify your identity. Lastly, you’ll need to add information about your income — job title, the amount of your earnings, and the frequency of payouts.

Whom BillEase Suits Better?

When it comes to the question of whom BillEase Philippines suits better, it’s hard to give a precise answer. The loan services are highly adaptive and useful for borrowers from a variety of areas. For instance, college students, business owners, individuals with low income, or those who require emergency funds.

Yet, you need to take some details into account. If you’re a student, you must have a stable job or a responsible co-signer to ensure the reimbursement of a loan. If you’re a small business owner, make sure you actually benefit from a loan and won’t go negative. Mainly, keep an eye on your financial situation to avoid debt traps.

FAQ

Is BillEase Legal in the Philippines?

Yes, BillEase is a legit Buy Now, Pay Later online service running in the Philippines since 2017. It’s also certified as a reliable Operative System and regulated by the Securities and Exchange Commission. If you search BillEase revision on the Internet, you’ll find only positive feedback from PH customers.

Is It Okay to Pay in Advance in BillEase?

Yes, this loan procedure is possible. You need to generate a Loan Payment Request through the website or a BillEase loan app just by clicking on the “Pay Now” button. Customers are also free to make a direct loan request by emailing [email protected].

How Do I Edit Information on BillEase?

Firstly, you need to log in to your account and go to the “Settings” section. There, you select the information you would like to edit. For example, if it’s a contact number, you must add a new one or delete the old one. However, if you’re changing your living address, you’ll have to send proof of residence.

How Do You Get Approved for BillEase?

The process is straightforward — just fill out and submit a loan application and wait until it’s approved. Once you receive a positive decision, the credit total will be sent to your account. You can use this money for different purposes, including partner merchants.

What Is the Highest Credit Limit in BillEase?

As a new customer who meets minimum credit requirements, you’ll be eligible to receive loan funds between ₱2000 and ₱10,000. Besides, by active usage and paying on time, you’ll be able to increase your credit limit up to ₱40,000.